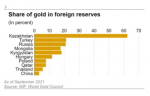

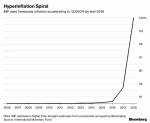

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions solely based on the current price of any asset without considering its underlying value or future potential can be prove to be a very costly mistake.For one thing, it is obvious that there is a reason why gold has skyrocketed to these new levels. Actually, there are many reasons, and all of them are bound to become increasingly important and clear to more and more people in

Read More »2024-04-09