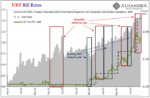

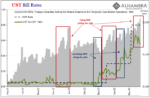

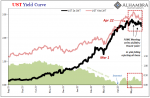

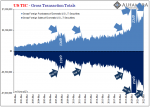

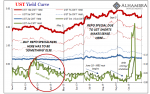

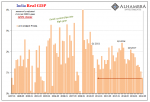

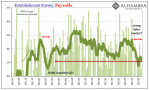

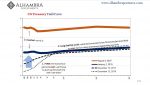

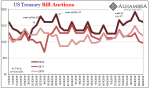

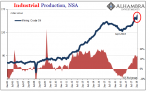

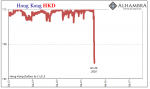

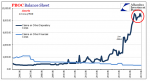

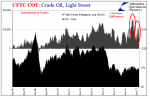

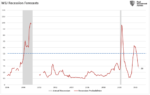

Yesterday’s market “volatility” spilled (way) over into this morning’s trading. It ended up being a very striking example, perhaps the clearest and most alarming yet, of a scramble for collateral. The 4-week T-bill, well, the chart speaks for itself:During past scrambles, such as those last year, they didn’t look like this. They would hit, stick around for an hour, maybe a bit longer, and then clear up as collateral books get balanced in repo like derivatives, the system sorting out, and handing out, any short run consequences.This time, this morning, it was sustained bids all the way from Asia through Europe into the US open. It shouldn’t have been surprising given the strains of illiquid-ness all over global markets yesterday. To give you a sense of the difference, I’ll include a chart

Read More »