Federal Reserve Balance Sheet, Excess Reserves and Fed Fund Rate

Bar a disastrous NFP print this coming Friday the US Federal Reserve will change the target range for the Federal Reserve (Fed) Bank’s Funds rate from the current level of zero – 25bp to 25 – 50bp on December 16th. The Fed will effectively raise the overnight interbank rate of interest to around 30bp from an average of only 12bp in 2015. Ironically, that will be seven years, to the day, when the Fed first lowered rates to the current band. During the period of ZIRP madness, the Fed’s balance sheet ballooned 6.2 times its pre-Lehman size to allow the central bank to add monetary “stimuli” even at the zero lower bound. Consequently the financial system got stuffed with more cash than they knew what to do with; commercial banks thus ended up funding the very same assets they sold to the central bank through excess reserves held as deposits with the Federal Reserve bank itself |

Historically the Fed would meet their targeted interest rate in the interbank market by conducting open market operations, id est buying and selling securities on the margin from designated primary dealer banks to affect available reserves and hence the rate of interest. As a side note, in this ˈmarketˈ demand will indeed create its own supply. ˈMarket signalsˈ emanating from banks eager to expand their balance sheet will put pressure on interest rates, and hence prompt the Fed to buy securities in order to add reserves in order for them to maintain rates at their ˈappropriateˈ level. This Keynesian creation is thus the only ˈmarketˈ that actually operates according to Keynesian principles; whereby demand dictates the level of supply.

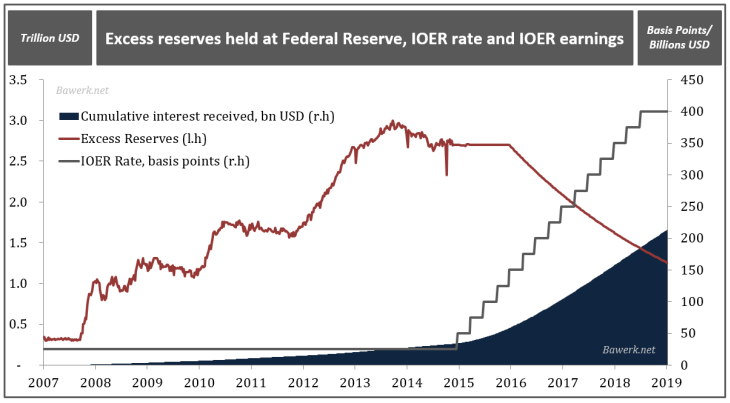

We digress. In a new world where reserve supply is already excessive as witnessed by the 2.5 trillion dollar in the chart above, conventional tools to manage interest rates are no longer applicable.

The Fed has thus come up with new ways to lift rates in a world of reserve oversupply. According to “Policy Normalization Principles and Plans” dated September 2014 the main conduit that will be used by the Fed to transmit their target range of interest rates to financial markets will be the interest paid on excessive reserves (IOER). In this respect it is worth noting that through the Financial Services Regulatory Relief Act of 2006 (Section 201) the Fed was granted the right to pay interest on bank reserves; long before QE policies had created unprecedented amounts of excessive reserves. While the Fed’s newfound authority did not take effect until October 2011 (section 203), the Emergency Economic Stabilization Act of 2008 section 128 effectively brought that forward to October 1st 2008. Never let a good crisis go to waste.

The idea behind the IOER is simple; if the Fed pay banks a rate equal to their target rate for the Fed Funds on their excessive reserves there is no incentive to take risk in short dated money markets so long as the Fed can match the going market rate. Reserves will thus stay put and the Fed can lift rates without unleashing a tsunami of liquidity into already frothy markets; or so the theory goes.

In practice, it is much more complicated. The scope of Fed’s policy interventions over the last eight years has been so extensive and spread far beyond the Primary Dealer nexus. Money funds in particular sits on piles of liquidity and these cannot access the IOER as only FDIC-insured depository institutions have direct recourse to the Fed and hence IOER only applies to a small group of financial institutions.

It is therefore highly unlikely that market rates will respond as the Fed moves its target rate upwards; in this case, the FOMC will have lost all control.

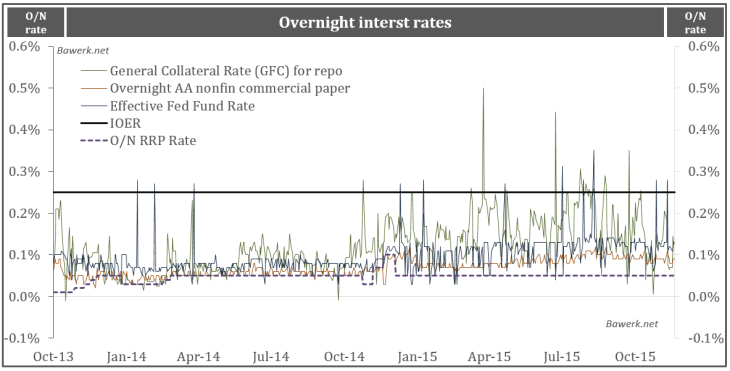

Overnight interest ratesThe solution is obvious as the Fed could simply reduce its balance sheet back to pre-crisis levels and remove all excess reserves thereby reestablishing the old practice of managing short term rates through open market operations. With the US Government running a deficit, Fed drawdowns would constitute net supply in the treasury market as the US Treasury would have to issue bonds to repay the Fed. All new issuance would have to be carried by the private market. In addition, most reserve managers are currently selling treasuries, not buying. A dramatic re-pricing of US bonds would occur, flows would move rapidly out of equities and high yield corporates to take advantage of the relative favorable pricing of US treasuries. In addition, by ceasing to reinvest the excess reserve problem would compound several time over; see Why the Fed will change its exit strategy…again for more details. This is clearly not a viable strategy for a bankrupt government so the only option for the Fed is to find ways to lift rates with excess reserves still in the system. The proposed solution is to broaden the Fed’s reach by also including non-bank entities. A move that essentially turns the Fed into an all-encompassing market maker. Technical speaking they will offer a fixed rate, full allotment overnight reverse repurchase (RRP) agreements with a range of financial institutions, such as money market funds (MMF), government sponsored enterprises (GSEs) and banks. The Fed started testing the RRP scheme in September 2013 to make sure they are able to control rates within a relatively narrow band. Results so far indicate that the Fed is able to move the band as they want to. During the period of testing we see market rates react to changes in the O/N RRP rate; suggesting rates can be moved up despite excess reserves. |

|

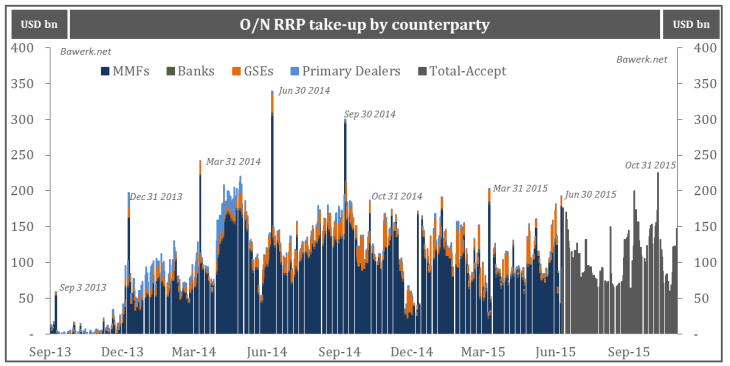

O/N RRP take-up by counterpartyHowever, this does not mean the strategy is risk-free. On the contrary, we could see dramatic financial flows when the current cap of $300bn turns into full allotment. Unsurprisingly large money market funds are the main beneficiaries of the RRP and as can be seen from the next chart, they are by far the largest user of the Fed’s new tool. Also note that at quarter end, when banks window dress their balance sheets for regulatory purposes, money market funds need to park more money in the RRP, periodically exceeding the statutory limit set by the Fed. |

|

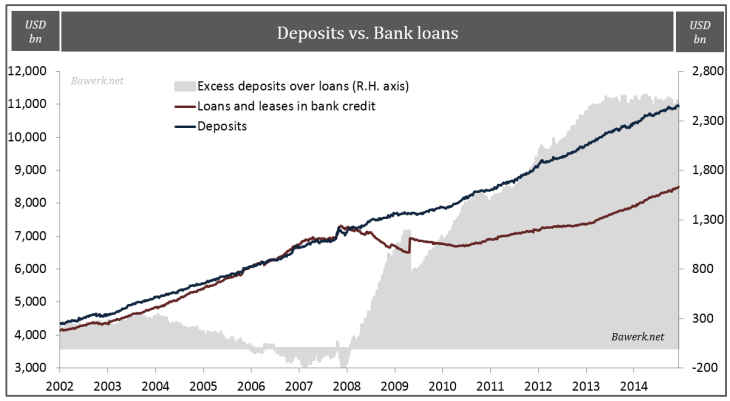

Deposits vs. Bank IoansSince the system is flooded with excess cash, money market funds probably hold large deposits with major banks, which in turn funds the Fed’s large holdings of bonds. In other words, banks are arbitraging the fact that MMFs can only get the going market rate for their investments, while banks receive the higher 25BP IOER rate. Banks thus hold a massive deposit base far exceeding the loan and leases provided to the mainstream economy as shown in the chart below. The imbalance between deposits and loans is essentially the excess reserves problem. |

|

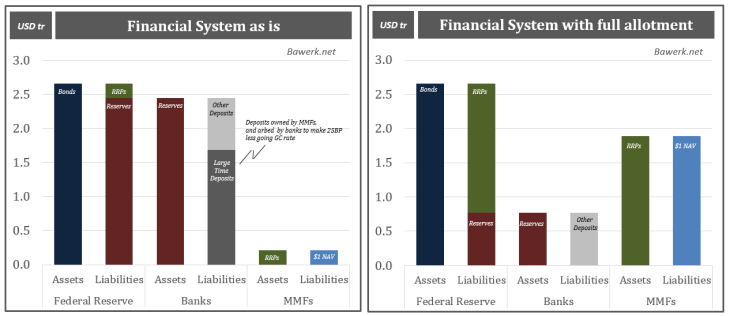

Financial SystemBefore we move on it is important to note that banks, which cannot use their excess reserves outside the banking system itself, probably collateralizes it to fund their own positions vis-a-vis non-bank entities. To what extent excess reserve collateral are then re-hypothecated is unknown to us, but we would not be surprised if they were significant. What we do know is that sudden changes in these flows could have unknown, and probably large, implications for the way the financial system is currently funded. When money market funds get the chance to move all their deposits with banks into the RRP they will obviously take it, or at a minimum bargain banks for higher rates on deposits, which in turn depresses banks’ IOER / RRP arbitrage. Assuming banks outstanding $1.6 trillion liability of large time deposits are susceptible to relatively sudden move into the RRP by MMFs, we get the following before/after picture of how the Fed funds its bond portfolio. |

|

Excess reserves held at Federal Reserve, IOER rate and IOER earnings.Today the Fed funds its bond portfolio with excess reserves held by banks. The banks fund these by deposits, of which money market funds probably hold the largest single part. If the RRP goes into full allotment money market funds will be eager to move money into it. In other words, the money market funds could relatively quickly withdraw their deposits and move them into RRPs. This will neither change the amount of reserves nor the overall size of the Fed’s balance sheet, but it will change the composition. From being funded by banks excess reserves prior to full allotment, it will be funded by RRPs, predominantly through the money market funds after full allotment. Banks would then need to reduce their market exposure to the extent they post excess reserves as collateral with unknown, but potential significant effect on collateral chains and by extension financial markets. With RRP pledged bonds barred from re-hypothecation, collateral chains will not be equally lengthened on the money market side of the equation. We are therefore looking at a net reduction in collateral availability for repo markets. In the short run this will probably lead to dramatic and unexpected change in financial flows. Over the longer run, a much-overlooked problem emerges. Assuming Fed balance sheet drawdown will be around half the pace of natural redemptions through maturity the excess reserve problem will persist for many years to come. Further assuming they will raise rates, very slowly to around 400 basis points, then more than $200bn of ˈcapitalˈ will have entered the financial system. This can be leveraged around 10 times in a fully loaned banking system, which equates to a massive $2 trillion dollars. In other words, the excess reserve problem will be impossible to correct without causing a major financial upheaval at some level. Note that it does not matter who the ultimate holder of reserves are. If they move over to the money market funds, the interest will be paid through the RRP which will have to move in tandem (albeit with a small discount) to the IOER. |

Tags: Economics,Finance,money-market funds,Regulation,US Federal Reserve