We have recently seen an increase in social media posts about the big increase in short positions by the bullion banks. What would motivate them to short a commodity during this period of inflation, much less a monetary metal when central banks are printing money with reckless abandon? And doesn’t their shorting of silver push down the price?

The retail trader is thinking about what price to bet on, in either direction (usually up), or perhaps how to preserve or increase his purchasing power.

Either way, it is a quest for an asset that will go up, with the only difference perhaps being the time frame of the expected gain.

But banks do not typically bet on the price (in either direction). They do not think and act like retail traders. They don’t trade price. They trade spread. They are not betting. They are arbitraging.

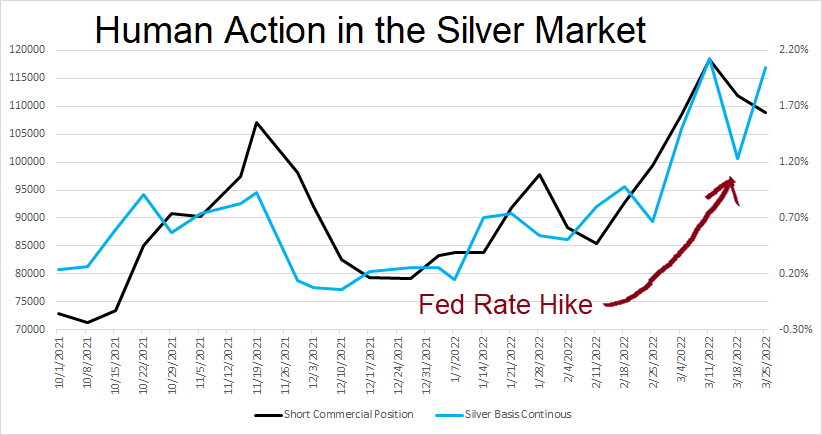

How the Banks Short Arbitrage the Silver MarketThere is an important arbitrage offered in the gold and silver markets: buy metal at the spot price and simultaneously sell short a futures contract at the futures price. This is called carrying metal. Regardless of what the price is, and regardless of where anyone thinks the price will go, this is a trade that makes a small profit. And they know how much profit they will make, up-front. Profit = future price – spot price If we quote this as an annualized rate, this is the gold or silver basis. If the basis is greater than the bank’s cost of funding—banks borrow to finance their positions—then the bank may consider putting on a carry trade. If the basis is rising, then the market is offering an increased profit today compared to yesterday. The increased profit is an increased incentive. All else being equal, the banks will increase their positions. If this theory is true, then we would expect to see a correlation between basis and aggregate bank position size. So, we put together a chart showing 6 months of basis overlaid with the total short position (commercial traders). There is a strong correlation between the basis and the short futures position. This confirms our theory that the incentive to put on a long metal / short futures position is the basis. |

The Fed’s Rate Hike and the Silver Market

When the Fed hiked the Fed Funds Rate, this affected the banks in two different ways.

It raises both their hurdle rate of return, and their cost of funding. The hurdle rate is the rate that they seek on all positions. An increase in hurdle or cost may not cause them to reduce their silver carry position size immediately, but it can cause them to stop adding to it.

A few notes:

- Most of the silver mined over 5,000 years of human history is still in human hands

- This total amount, not just what was mined this year, is the potential supply

- There is no data on positions in physical metal, only in futures

We discuss all the dynamics of gold and silver markets, including the right and wrong ways to analyze precious metals in our Gold Outlook Report 2022. (Free to Download)

Carrying silver is a hedged position. That is, the trade is to both buy and sell silver in two different markets. This does not affect the headline price on your screen. It affects the spread (futures – spot), which you don’t see (unless you’re a subscriber to our charts at Monetary Metals).

Why Are We Writing About This?

What happens if you make a decision for the wrong reason?

For example, suppose you date someone. Your parents tell you that the person is great, because marrying that person would be good for your finances. Your friends push you too, “Tie the knot already!” They’re married, and they just want to do things together with other couples.

Now, maybe you’re really in love. And perhaps this person will be a true life-partner. There are certainly good reasons to get married. But if you get married for the reasons that your parents see $$$, and your friends want you to fill in the last slot for gourmet couples on Friday nights, you may end up included in the divorce statistics.

If this happened to you, you would hope you had a friend who would take you aside and discuss.

It is in this spirit that we write about the gold- and silver-price suppression conspiracy theory. This conspiracy theory holds that the prices of gold and silver would be $50,000 and $1,000 (or more), but for a long-term conspiracy to suppress it.

Proponents are telling you not to get married to make a buck, but to buy gold or silver to make a buck. There are certainly good reasons to buy gold and silver. But if you buy with the expectation that some kind of catastrophic failure of the banks will send the price to the moon soon, you may end up included in the trading-losses statistic.

The Motte and Bailey Metals Fallacy

Several times recently, we have been confronted with alleged proof of a long-term conspiracy to suppress the price. JP Morgan was ordered to pay a $920 million fine “in connection with schemes to defraud precious metals markets”. However, according to the Department of Justice, the actual criminal act was that they “placed orders to buy and sell precious metals futures contracts with the intent to cancel those orders before execution.”

We have here an instance of the Motte and Bailey Fallacy, which is:

“an informal fallacy where an arguer conflates two positions that share similarities, one modest and easy to defend (the “motte”) and one much more controversial (the “bailey”). The arguer advances the controversial position, but when challenged, they insist that they are only advancing the more modest position. Upon retreating to the motte, the arguer can claim that the bailey has not been refuted (because the critic refused to attack the motte) or that the critic is unreasonable (by equating an attack on the bailey with an attack on the motte).”

The controversial position is that gold should be $50,000, but for a long-term conspiracy between the central banks and the commercial banks to sell massive amounts of paper gold (i.e. futures) short. Whenever we have challenged this (see our Thoughtful Disagreement with Ted Butler), then conspiracy theory proponents retreat to the Motte. “JP Morgan was convicted of the very thing you deny!” But, as the Justice Department press release explains, that is not at all what the bank was convicted of. The bank placed and cancelled orders to buy and sell.

Note that they were buy orders as well as sell. In other words, it was a scheme to scalp pennies from other traders, not to push the price downward. There is no plausible mechanism that placing and cancelling orders could cause the price to be massively dislocated from what it should be, and stay dislocated for decades.

Why the Truth Matters

We obviously love gold and silver. We named our company after them! We think that everyone should own some gold and many people should own silver. We do not write this to discourage buying or holding gold and silver. We write because we think there are few things worse than a bad argument offered in favor of a good thing.

We are not dissatisfied to see a court-economist committing logical fallacies in his desperate attempt to sell people on irredeemable currency. We are OK when we see MMTers flailing around, trying not to acknowledge the inconvenient facts.

But nothing makes us blow a gasket than to see bad arguments used to sell gold and silver. No bad arguments are needed! The truth works just fine. Indeed, the truth is more than fine.

The truth is sufficient.

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

For more truth bombs make sure to subscribe to our YouTube Channel to check out all our Media Appearances, Podcast Episodes and more!

Full story here Are you the author? Previous post See more for Next post

Tags: Basic Reports,Blog,Featured,Gold Exchange Report,newsletter