As credit-asset bubbles pop, the dominoes start falling.

The economy is far more precarious than the surface boom/bubble suggests. A great many households, enterprises and municipalities are in overloaded boats whose gunwales are just a few inches above the water; the slightest wave will swamp and sink them.

The cost structure of the economy is completely out of whack with what households and enterprises can afford. There are several dynamics in play:

1. Enterprises have already stripped out all the expenses they can: head count has been cut, quality has been gutted, quantity has been reduced, supply chains have been squeezed, inventory controls trimmed to just-in-time and so on. There are no easy, quick cost reductions available except laying off employees. Every other cost-cutting strategy has been milked dry.

2. Costs are soaring despite the low rate of officially measured inflation. I recently found some notes from 1995–a long time ago, 24 years. The dot-com bubble–the first of this era’s three great asset bubbles–was inflating rapidly but official inflation was low, around 2.5% to 3% annually.

A slice of pizza was $1.50, a main dish in a Chinese restaurant was $4.50 and rent for a one-bedroom apartment in the S.F. Bay Area was $650/month. Now the pizza slice is $4.25 plus 9.25% tax, $4.65; the main dish is $11.95 plus 9.25% tax, $13.05, and rents for one-bedroom apartments far exceed $2,000/month in desirable neighborhoods.

Official inflation is $1 in 1995 equals $1.67 today. So a $1.50 slice of pizza in 1995 should cost $2.50 today, the $4.50 main dish should cost $7.50, and the $650 monthly rent should be $1,085. Real-world inflation has outstripped the bogus official rate in sector after sector. So TVs have dropped in price; big deal. How often do you buy a TV?

| Costs have tripled in 24 years, but have wages tripled? No. In many cases, they haven’t even kept pace with official inflation, much less real-world inflation. How many people earning $40,000 in 1995 are now earning $67,000, the minimum increase needed to match the rise in official inflation? Nobody I know. How many positions paying $40,000 in 1995 are now paying $120,000 for the same job? I think we can safely say none.

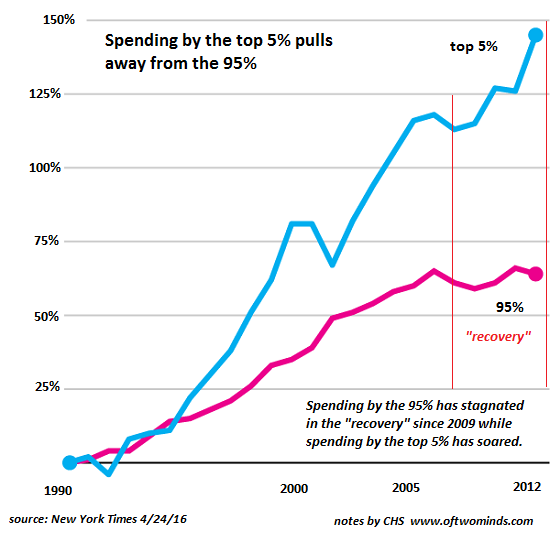

3. The majority of gains in income and wealth have flowed to the top 5%, and most of the gains in the top 5% have flowed to the apex of that income bracket. So when we read that average household wealth has increased or median wages have increased, the reality is these statistics mask the actual distribution of income and wealth gains, which are skewed heavily to the top 5% income/wealth brackets.

This chart is a few years old but the trend hasn’t changed. |

Spending by the top 5% pulls away from the 95% - Click to enlarge |

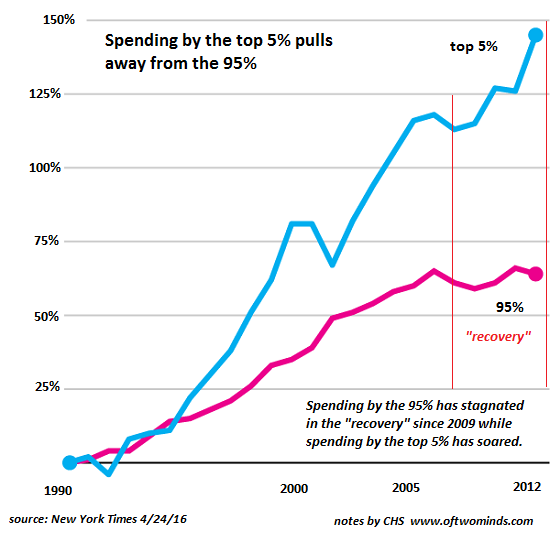

| Long-term distribution of gains continues to favor the top 1%.

Enterprises are precarious because their costs are high and there’s nothing left to cut. A relatively modest decline in revenues will cut profits / owners’ incomes to less than zero.

Households in high-cost regions are barely above water. Any reduction in household income will push these households into insolvency.

As credit-asset bubbles pop, the dominoes start falling. As real estate rolls over, lending and construction activity decline, triggering layoffs. As household income takes a hit, the days of spending $15 for lunch every day plus a $5 coffee and $4 bagel go away. The only way for enterprises absorbing revenue declines to survive is to lay off employees, which reduces the pool of consumers with disposable income. |

Wealth Inequality 1962-2014 - Click to enlarge |

Relying on the free-spending top 5% is also a recipe for fragility. The highest paid employees are the last plum target left for corporate cost-cutters, and the biggest targets for software/AI/automation. The janitors making minimum wage ($15/hour now in many locales) are not that exposed to automation, and the gains would be modest any way. But reducing the head count of employees earning $120,000 and up makes a significant positive impact on the bottom line as revenues stagnate or plummet.

Sorry, boom-time America: the lifestyle you ordered in now out of stock and we have no indication it will be in stock again within the foreseeable future.

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the

book's website.

Full story here

Are you the author?

At readers' request, I've prepared a biography. I am not confident this is the right length or has the desired information; the whole project veers uncomfortably close to PR. On the other hand, who wants to read a boring bio? I am reminded of the "Peanuts" comic character Lucy, who once issued this terse biographical summary: "A man was born, he lived, he died." All undoubtedly true, but somewhat lacking in narrative.

Previous post

See more for 5.) Charles Hugh Smith

Next post

Tags:

newsletter