| How is private equity loading companies up with debt as a means of paying outlandish dividends to themselves not commoditized fraud? How is paying dividends with debt rather than earnings not fraud? The net result of this fraud is the debt-burdened company eventually defaults on its debt, defrauding the investors who were suckered into the scam.

But once again, the instigators of the fraud–private equity–have escaped with billions in gains and zero liability. How is understating inflation so Social Security retirees get near-zero cost of living adjustments as real-world inflation pushes 7% not normalized, institutionalized fraud? We all understand the motivation for this institutionalized fraud: to limit the increasing cost of Social Security and mask the erosion of household income’s purchasing power. |

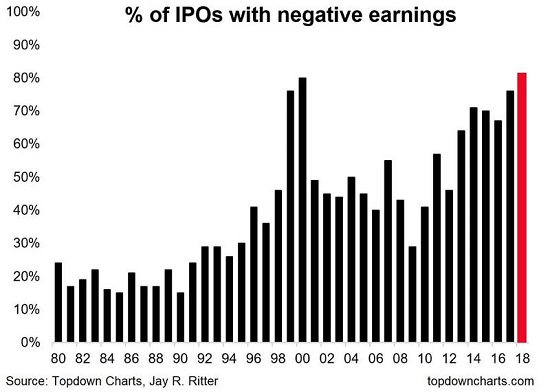

% of IPOs with negative earnings, 1980-2018 |

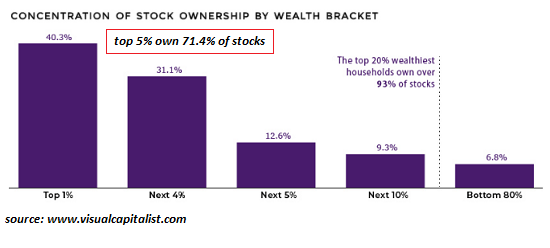

| While the Social Security recipient and the minimum wage worker are getting squeezed, those getting nearly free money from the Federal Reserve to plow into stocks are piling up trillions of dollars in gains. How is the Fed’s fee money for financiers not commoditized, institutionalized fraud? Those who can borrow outlandishly large sums at a discount are in effect being given the tools to defraud the financial system and all the other players who aren’t as close to the money spigot of the central bank.

How is charging 20% interest on a credit card balance while financiers pay 2% not commoditized, institutionalized fraud? The cover for this fraud is particularly rich: the high credit risk of the credit card holder demands a high rate of return, while the “low-risk” financier gets 2% financing to blow up the entire financial system and get bailed out by the taxpayer. |

Concentration of stock ownership by wealth bracket |

| Normalizing and institutionalizing fraud undermines the foundations of the economy and the financial system. Calling these commoditized frauds business as usual doesn’t mean they won’t destroy the system from the inside. |

SPX everything bubble, 2000-2015 |

Tags: newsletter