Inflation is typically defined as a general increase in the prices of goods and services—described by changes in the Consumer Price Index (CPI) or other price indexes.

Inflation is typically defined as a general increase in the prices of goods and services—described by changes in the Consumer Price Index (CPI) or other price indexes.

If inflation is a general rise in measured prices, then why is it regarded as bad news? What kind of damage can it inflict? Mainstream economists maintain that inflation causes speculative buying, which generates waste. Inflation, it is maintained, also erodes the real incomes of pensioners and low-income earners and causes a misallocation of resources.

Despite all of these assertions regarding inflation’s side effects, mainstream economics doesn’t tell us how all of these bad effects are caused. Why should a general rise in prices hurt some groups of people and not others? Why should a general rise in prices weaken real economic growth? How does inflation lead to the misallocation of resources? Moreover, if inflation is just a rise in prices, surely these effects can be offset by adjusting everyone’s incomes in accordance with this general price increase.

The Problem with Price Indices

Despite its popularity, the whole idea of a consumer price index is flawed. It is based on the idea that it is possible to establish an average price of goods and services.

Suppose two transactions are conducted. In the first transaction, one loaf of bread is exchanged for $2. In the second transaction, one liter of milk is exchanged for $1. The price, or exchange rate, in the first transaction is $2/one loaf of bread. In the second transaction the price is $1/one liter of milk. In order to calculate the average price, we must add these two ratios and divide them by two; however, it is conceptually meaningless to add $2/one loaf of bread to $1/one liter of milk.

On this Rothbard wrote, “Thus, any concept of average price level involves adding or multiplying quantities of completely different units of goods, such as butter, hats, sugar, etc., and is therefore meaningless and illegitimate. Even pounds of sugar and pounds of butter cannot be added together, because they are two different goods and their valuation is completely different” (Man, Economy, and State, p. 734).

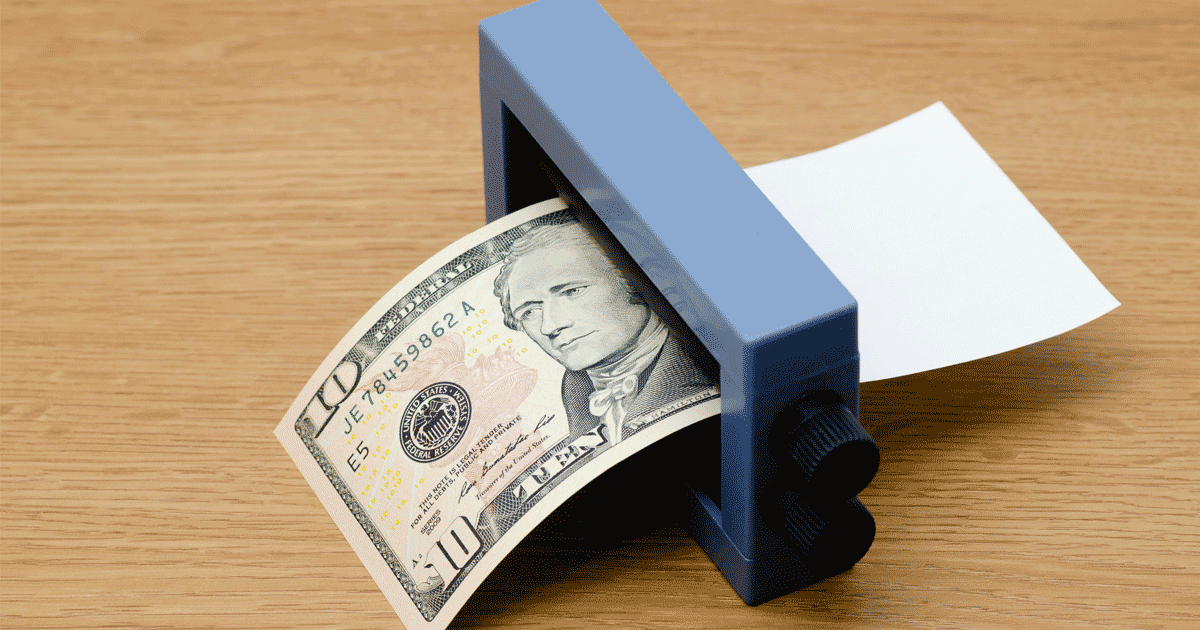

The Proper Definition of Inflation: It’s a Wealth Transfer

The reality of inflation is its association with the diversion of real wealth from one individual to another by means of an expansion in the money supply.

Historically, inflation occurred when a country’s ruler, such as a king, would force his citizens to give him all of their gold coins under the pretext that a new gold coin was going to replace the old one. In the process, the king would falsify the content of the gold coins by mixing it with some other metal and return impure gold coins to the citizens. On this Rothbard wrote,

More characteristically, the mint melted and recoined all the coins of the realm, giving the subjects back the same number of “pounds” or “marks”, but of a lighter weight. The leftover ounces of gold or silver were pocketed by the King and used to pay his expenses.1

Because of the dilution of the gold coins, the ruler could now mint a greater amount of them and pocket the extra coins minted for his own use. What was now passing as a pure gold coin was in fact a gold alloy coin.

The increase in the number of coins brought about by this debasement of gold coins is what inflation is all about.

If we were to accept that inflation is in effect an increase in the money supply, then we would likely reach the conclusion that inflation results in the diversion of real wealth from wealth generators toward the holders of newly printed (or coined) money. We are also likely to conclude that monetary pumping, i.e., inflation, is bad news for the wealth generating process.

Note that what we have is an inflation of coins, i.e., an expansion in the number of coins. As a result of inflation, the ruler can engage in an exchange of nothing for something (an act that diverts resources from citizens to himself).

The technique of abusing the medium of the exchange under the gold standard became much more advanced with the issuance of paper money unbacked by gold. Inflation therefore became an increase in the amount of receipts for gold—that is, of receipts not backed by gold yet masquerading as the true representatives of money proper, gold.

The holder of an unbacked receipt could buy goods, engaging in an exchange of nothing for something. This produced a situation where the issuers of the unbacked paper receipts diverted real goods to themselves without making any contribution to the production of those goods.

In the modern world, money proper is no longer gold, but rather paper money. Hence, inflation in this case is an increase in the stock of paper money. (This includes an increase in demand deposits because of fractional reserve bank lending.)

Increasing the Supply of Goods Does Not “Fix” Inflation

For most economists, if an increase in the money supply is fine if it is matched by an increase in the production of goods, since no increase in general prices (as measured by indices) has taken place and therefore no inflation has emerged. But this way of thinking is erroneous—inflation has very much taken place, i.e., the money supply has increased. This increase cannot be undone by a corresponding increase in the production of goods and services.

To continue the king example, once a king has created more gold alloy coins that masquerade as pure gold coins, he is now able to exchange nothing for something irrespective of the rate of growth in the production of goods. Regardless of how many goods are being produced, the king is getting something for nothing, i.e., diverting resources to himself and paying nothing in return.

The same logic can be applied to paper money inflation. The exchange of nothing for something that the expansion of money sets in motion cannot be undone by an increase in the production of goods. The increase in money supply—i.e., in inflation—is going to set in motion all of the negative side effects of money printing, including the menace of the boom-bust cycle, regardless of increases in production.

Why an Increase in Economic Activity Does Not Cause Inflation

Mainstream economists almost always see an increase in economic activity as a trigger for a general price increase, which they erroneously label inflation. But why should an increase in production lead to a general increase in prices? If the money stock stays constant, then we will have a situation of less money per unit of a good—a fall in prices. This conclusion stands even if the so-called economy operates very close to “potential output” (another dubious term mainstream economists use).

Only if the pace of money expansion surpasses the pace of increase in the production of goods will we have a general increase in prices. And this increase will be only on account of the inflation of money and not due to the increase in the production of goods.

Another popular explanation for a general rise in prices is the increase in wages once the economy is close to the potential output. If the amount of money remains unchanged, it is not possible to raise all the prices of goods and wages. So again, the trigger for a general price increase has to be monetary expansion.

Milton Friedman and Expected Inflation

Some economists such as Milton Friedman maintain that if inflation is “expected” by producers and consumers, it produces very little damage (see Friedman’s Dollars and Deficits [Upper Saddle River, NJ: Prentice Hall, 1968], pp. 47–48).

The problem, according to Friedman, is with “unexpected” inflation, which causes a misallocation of resources and weakens the economy. According to Friedman, if a general rise in prices can be stabilized by means of a fixed rate of monetary injections, people will then adjust their conduct accordingly. Consequently, Friedman says, expected general price increases, which he calls expected inflation, will be harmless, with no real effect.

Observe that Friedman sees the bad side effects as being caused not by money supply increases but by their outcome—price increases. Friedman regards money supply increases as a tool that can stabilize general rises in prices and thereby promote real economic growth; all that is required is to fix the rate of money supply growth and the rest will follow suit.

What is overlooked is that “fixing the money supply’s rate of growth” does not alter the fact that it continues to expand. This, in turn, means that it will continue the diversion of resources from wealth producers to non–wealth producers even if goods prices remain stable. This policy of attempting to stabilize prices is, instead, likely to generate more instability.

Observe that we do not say, as the monetarists postulate, that the increase in the money supply causes inflation. What we are saying is that inflation is the increase in the money supply.

Monetary Pumping and Moderate Price Increases

Given that, for us, inflation is in fact an increase in the money supply, how can we reconcile strong monetary pumping with moderate increases in prices, conventionally labeled “low inflation”?

The price of a good is the amount of money paid for the good. If the growth rate of money is 5 percent and the growth rate of the supply of goods is 1 percent, then prices will increase by 4 percent. If, however, the growth rate in goods supply is also 5 percent, then no increase in prices will take place, all other things being equal.

If one were to hold that inflation is the increase in the CPI then one would conclude that despite this money supply increase of 5 percent inflation is 0 percent.

However, if we were to adopt the definition of inflation as an increase in the money supply, then we would conclude that inflation is 5 percent regardless of any changes in a price index or in output.

Prices are determined by both real and monetary factors. Consequently, the real factors can pull things in a direction opposite to monetary factors, causing no visible change in prices. Thus, if money increases by 5 percent while the supply of goods also increases by 5 percent no change in the prices of goods will emerge.

While the money supply growth, i.e., inflation, is buoyant, prices might show no increases. And when the pool of real savings (the total consumer goods in the economy) is expanding, the increase in money supply appears to provide support to both wealth generating and nonproductive activities.

But once the pool becomes stagnant or starts to decline, increases in the growth rate of money supply can no longer create the illusion of creating real economic growth. (Money is just a medium of exchange and cannot grow an economy; it can only facilitate the transfer of goods from one individual to another individual).

The pool of real savings, which supports various economic activities, determines the overall “economic pie” at any point in time. Obviously, then, if the pool of real savings is stagnant or declining, the “economic pie” must also follow suit. In this setup, competition among companies to protect their market share is likely to force reductions in the prices of goods and services.

In addition, various companies’ attempts to secure profits and stay solvent might force them to lower prices in order to increase sales. This of course also means that various activities that the previous expanding pool of real savings made possible will now have to shrink or disappear altogether.

Once a general decline in goods prices emerges because of a stagnant or declining pool of real savings, any attempt by the central bank to reverse this general price decline will only weaken the pool of real savings further, prolonging the economic hardship.

A better way out of these difficulties is to allow businesses to get along with the buildup of real wealth while at the same time curtailing the central bank’s involvement in the economy through its monetary pumping and lowering of interest rates. As the buildup of real wealth gains momentum, it will enable various activities to reemerge. These emerging activities are likely to be of a wealth generating nature—to be self-supporting and not require the central bank to engage in monetary pumping and interest rate reduction.

- 1. Murray N. Rothbard, What Has Government Done to Our Money? (N.P.: Libertarian Publishers,1964), p. 32.

Tags: newsletter