There are several important differences between the global financial crisis of 2007–08 (GFC) and the coronavirus crisis (CC).

Origin and Nature of the Crisis

The GFC resulted from financial imbalances, primarily the housing bubble, while the CC was triggered by the external negative shock (the pandemic and the following economic shutdown) that dramatically reduced the labor supply. In other words, the GFC was a financial crisis, a bust phase of the business cycle triggered by a misallocation of resources toward housing and construction sectors, while the CC is a shock to the real economy triggered by the health crisis and the containment measures.

Importantly, the exogenous nature of the CC does not imply that we will see a V-shaped recession (even the central banks do not expect it). There are three reasons for this.

- First, the fear of coronavirus and social distancing will not disappear overnight, but will stay with us for a certain period, perhaps until an effective medical treatment is developed.

- Second, there will be a hysteresis effect. It is easy to become unemployed or to go bankrupt, but finding a job or starting a new company might be more difficult (especially given the high ratio between the unemployment benefit and median salary in many states).

- Third, the monetary and fiscal policies being pursued can hamper the pace of recovery, just as they did in the aftermath of the Great Recession.

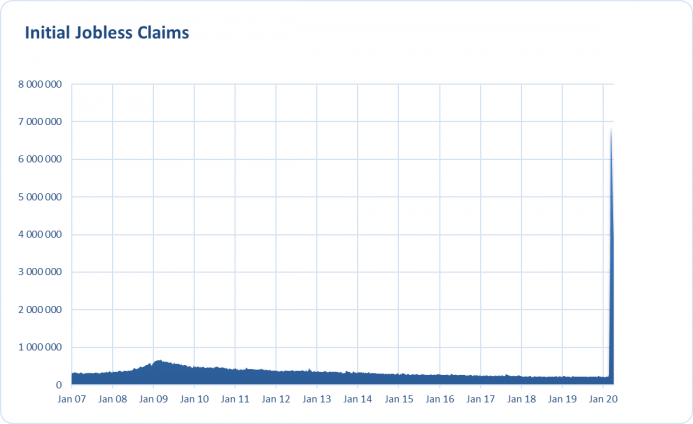

Depth, Scope, and Pace of the CrisisThe first economic reports (on initial jobless claims, retail sales, or industrial production) suggest that the CC will be deeper than the GFC. According to the International Monetary Fund’s (IMF) recent World Economic Outlook report, “the global economy is projected to contract sharply by 3 percent in 2020,” much worse than during the GFC — when the global economy shrank by 0.1 percent in 2009. And since the COVID-19 pandemic is an international phenomenon, the crisis is truly global. According to the IMF, a much larger fraction of countries is expected to experience negative per capita income growth than during the GFC. But what is really striking is the pace of the crisis. In just a few weeks, the CC’s economic losses will likely surpass those related to the Great Recession, which lasted an entire year and a half. For example, more than 30 million Americans have applied for the unemployment benefit in just six weeks compared to the 37 million jobless claims filed during the whole GFC, as Figure 1 shows. |

US Initial Jobless Claims from January 2007 to April 2020 |

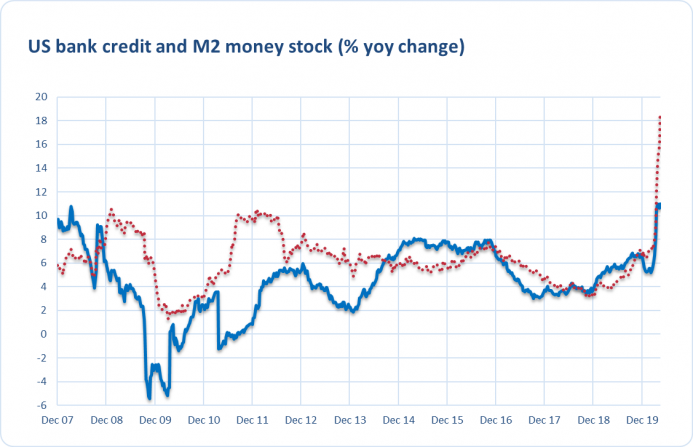

ImplicationsThe differences listed above have serious economic and political implications. The standard measures to stimulate aggregate demand, such as interest rate cuts, will not help during the CC, in which people are being encouraged to stay home and social distance. Neither will investors be encouraged by lower interest rates in times of disrupted supply chains and significant economic uncertainty. Interest rate cuts cannot solve the health crisis or end social distancing and official lockdowns. Because the CC is not a financial crisis and the overindebted corporate sector constitutes a greater threat than the financial sector today, the monetary policy aimed at adding liquidity to financial markets will be even less useful than it was during the GFC. Because the US financial institutions have more capital than they did before the GFC, and because the CC has affected them less than it has the nonfinancial sector, they are more inclined to grant new loans, especially since central banks’ actions, aimed at supporting the flow of credit in the economy, are encouraging them to do so. Moreover, reserve and capital requirements have been loosened, while entrepreneurs eagerly clamor for new loans to stay afloat. All this means that the credit supply can increase more than it could during the GFC. As new money is created when banks grant new loans, the money supply will also be able to rise faster than during the GFC. As Figure 2 shows, in late March, the growth rate of bank credit and M2 money stock started to expand above 10 percent year over year, much faster than in the aftermath of the GFC. Please note that the Figure 2 displays the broad money supply, not the monetary base — the increase of the latter does not automatically translate into higher price inflation rates, as bank reserves do not enter the wide circulation within the real economy. |

Annual Percentage Change in US Bank Credit and M2 from December 2007 to April 2020 |

| It might be too early to draw authoritative conclusions, but if the current trend in the broad money supply continues, the CC could be more inflationary than the GFC, especially since it is both a negative demand and supply shock. Indeed, as Figure 3 shows, the market expects a higher inflation rate five years from now than it did during the GFC. |

US Five-Year Breakeven Inflation Rate (Derived from Five-Year Inflation Indexed Treasurys) from December 3, 2007, to April 30, 2020 |

This does not, of course, mean that a high US inflation rate in the near future is a sure thing. The CC is also a negative demand shock, and the recent declines in oil prices will create downward pressure on the Consumer Price Index (CPI) inflation rates.

Therefore, although in the short term the disinflation scenario seems more likely, in the long run the risk of stagflation increases, especially with too-fast credit growth and excessive debt monetization (the government may be tempted to get out of its large public debt through high inflation, which lowers real interest rates). The possibility that the CC will be more inflationary than the GFC should be acknowledged by economists, policymakers, and investors.

Full story here Are you the author? Previous post See more for Next postTags: newsletter