Tag Archive: central planning

Is the West repeating India’s mistakes?

Following the publication of our last conversation with Jayant Bhandari, I received a lot of interesting feedback and remarks. The common denominator of all those comments was the astonishment of many Western readers at the real conditions and dynamics on the ground in India.

Read More »

Read More »

Reject the “Next Generation EU Plan”

The Václav Klaus Institute urging the Czech Government to reject the dangerous Ursula von der Leyen´s plan. It is rather rare that I share articles on my channel that are not from my own pen. The following article is therefore an exception and for good reason. It is written by none other than the former President of the Czech Republic Václav Klaus, with whom I have a long-standing relationship, based on great respect and many shared values.

Read More »

Read More »

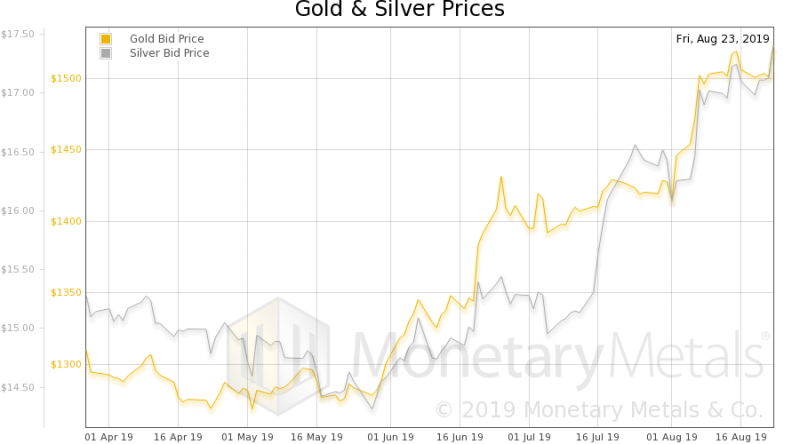

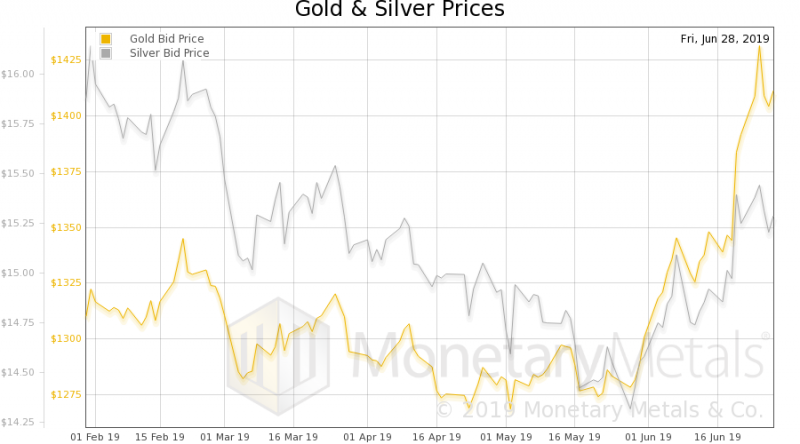

Directive 10-289, Report 25 Aug

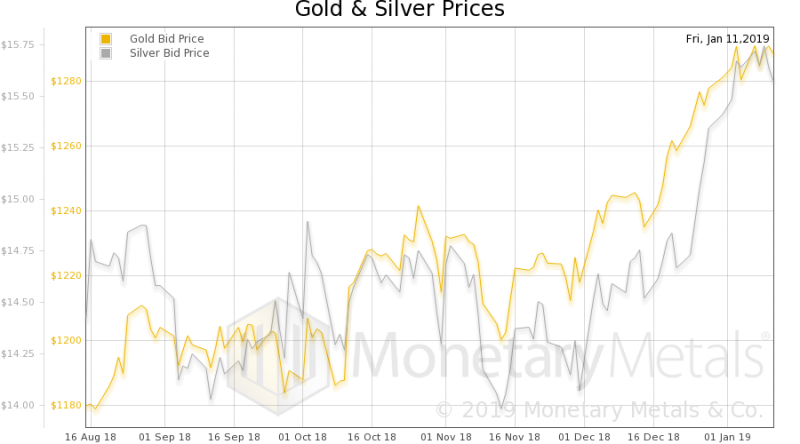

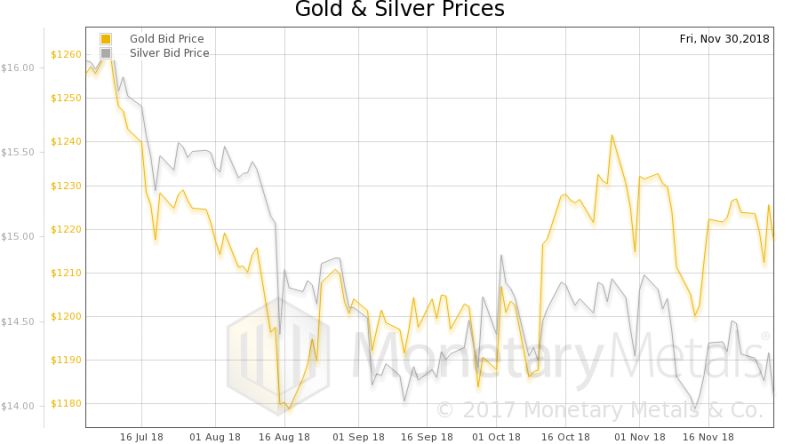

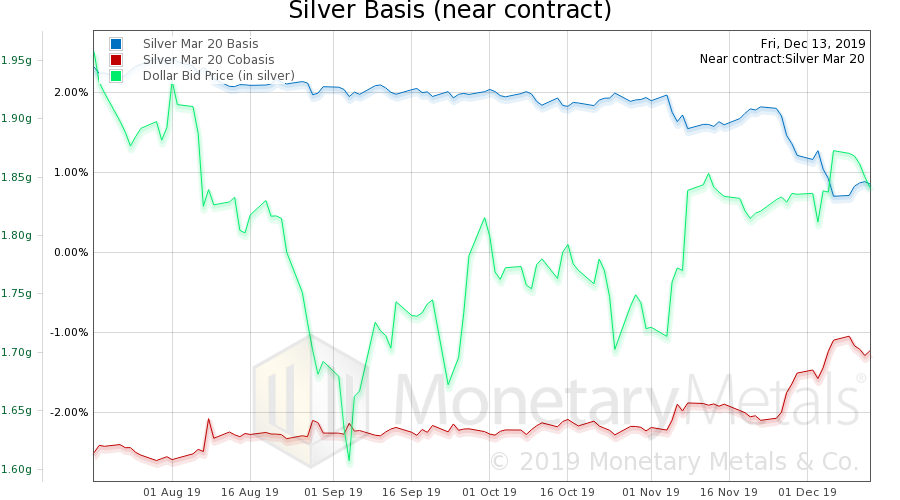

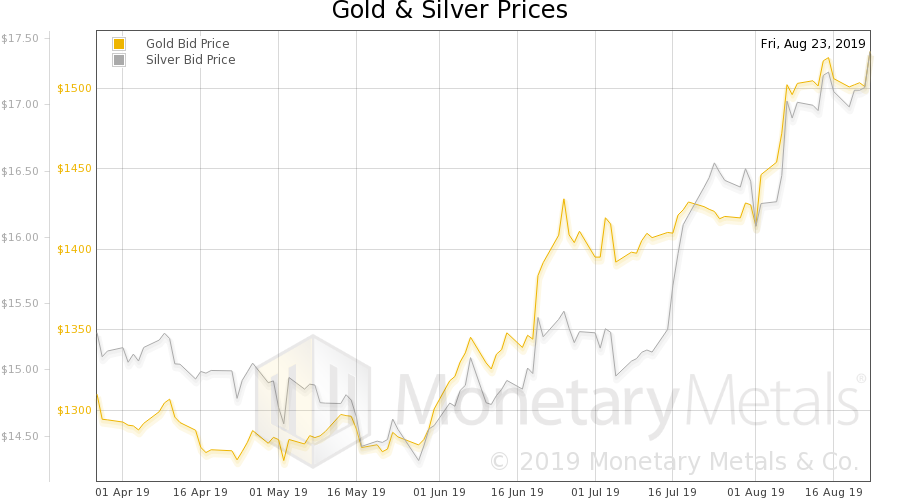

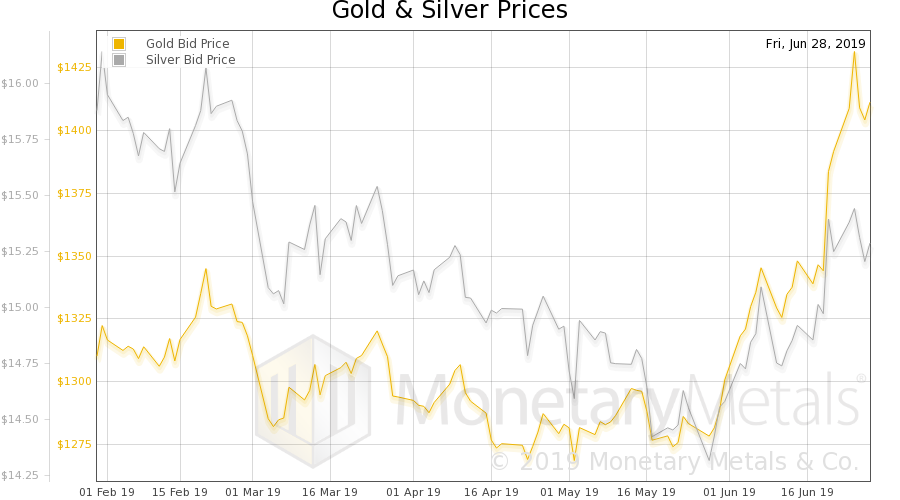

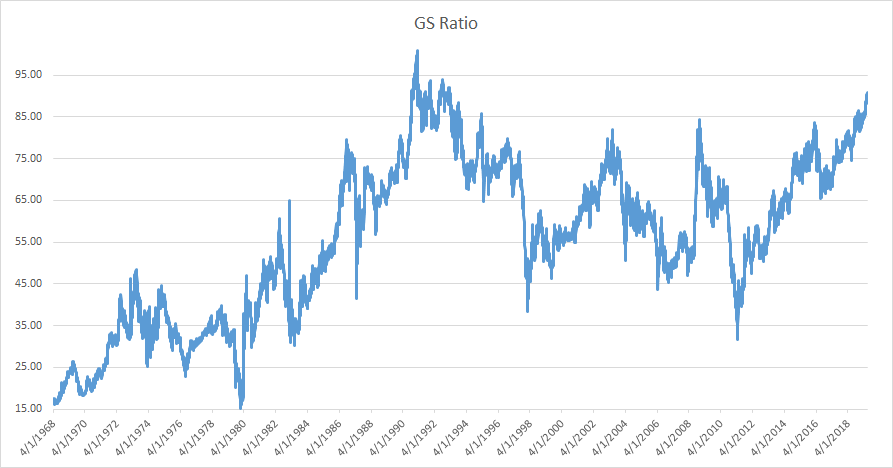

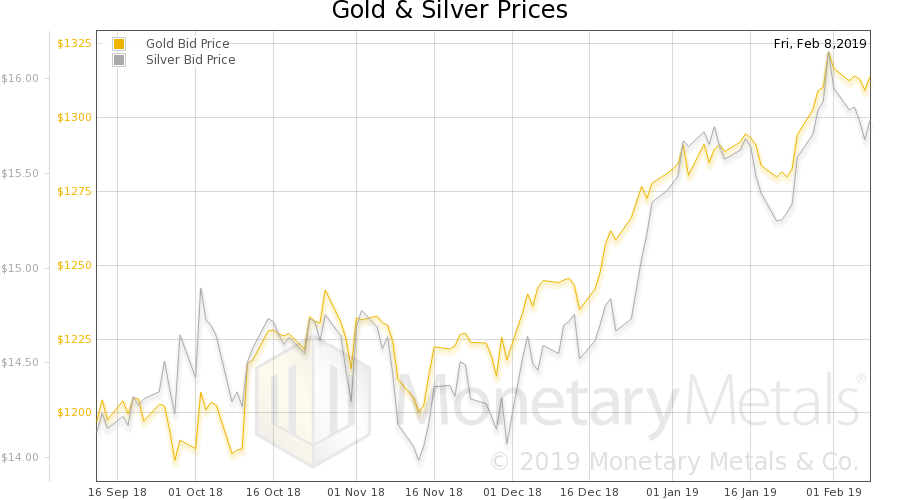

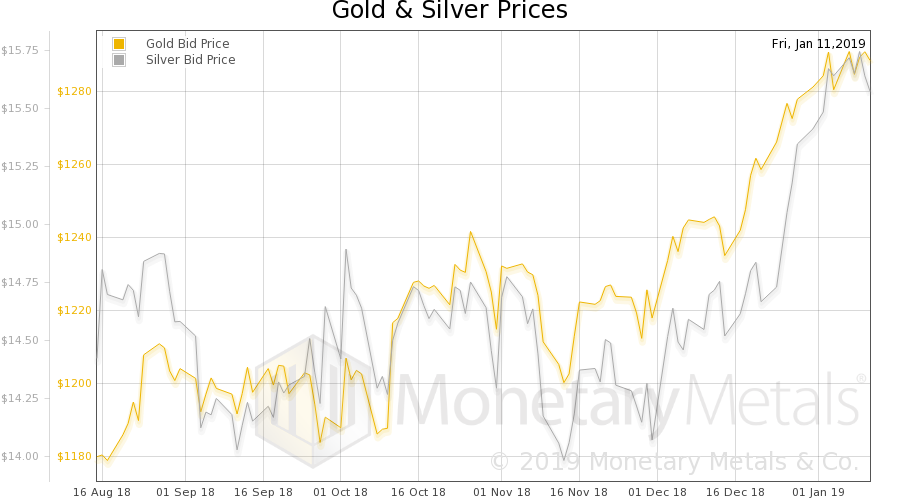

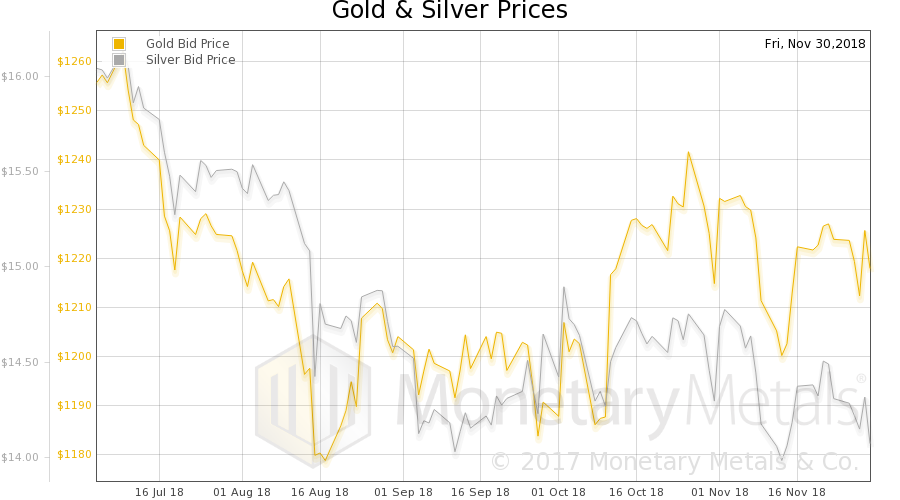

Everyone must ask himself the question. Do you want the world to move to an honest money system, or do you just want gold to go up (we italicize discussion of apparent moves in gold, because it’s the dollar that’s moving down—not gold going up—but we sometimes frame it in mainstream terms).

Read More »

Read More »

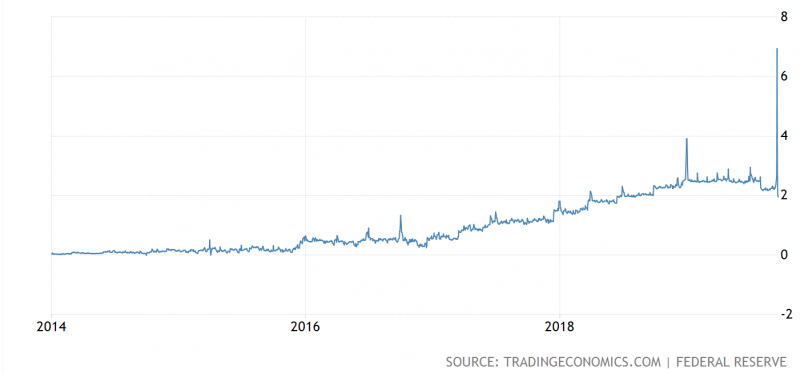

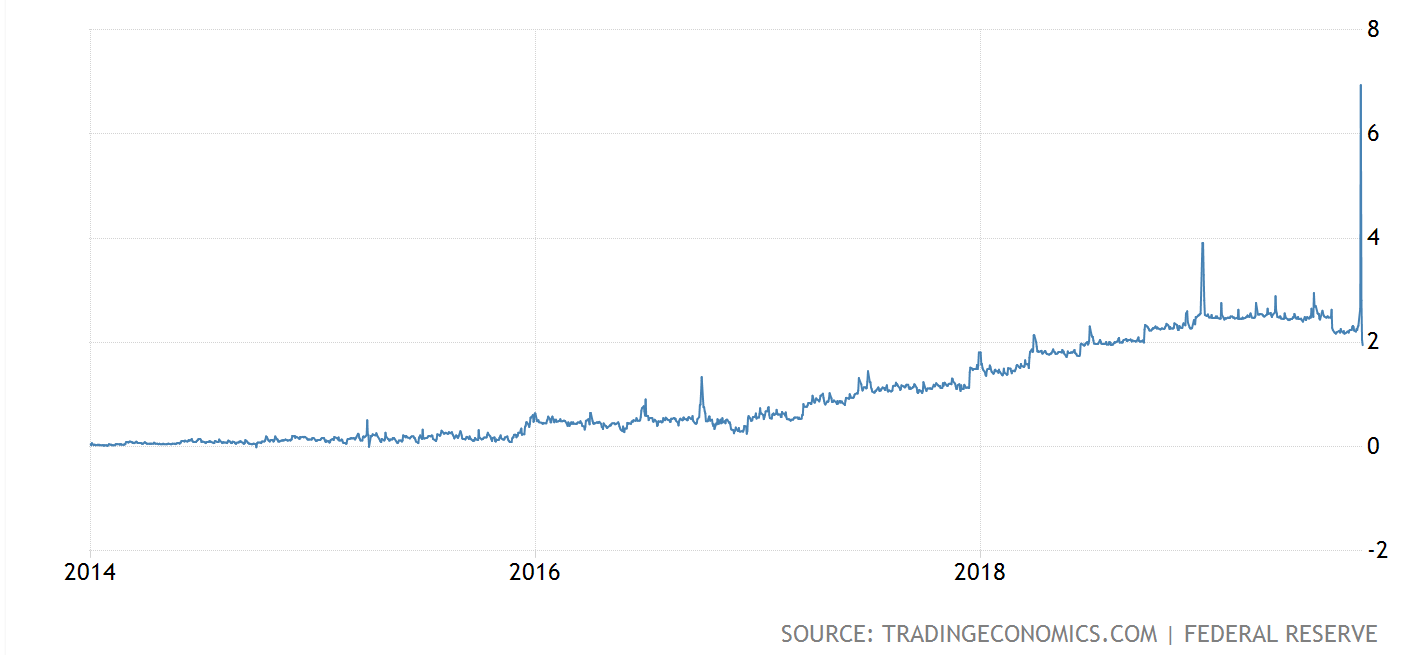

Janet Yellen Fights the Tide of Falling Interest

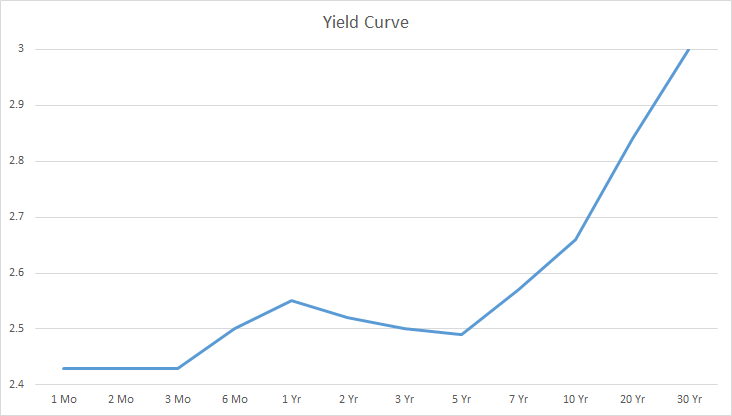

The Fed is going to have to take back this interest rate hike (Dec 16). The process that sets the interest rate is complex. I have written many words on its terminal decline. However, there are two simple reasons why the trend remains downward.

Read More »

Read More »

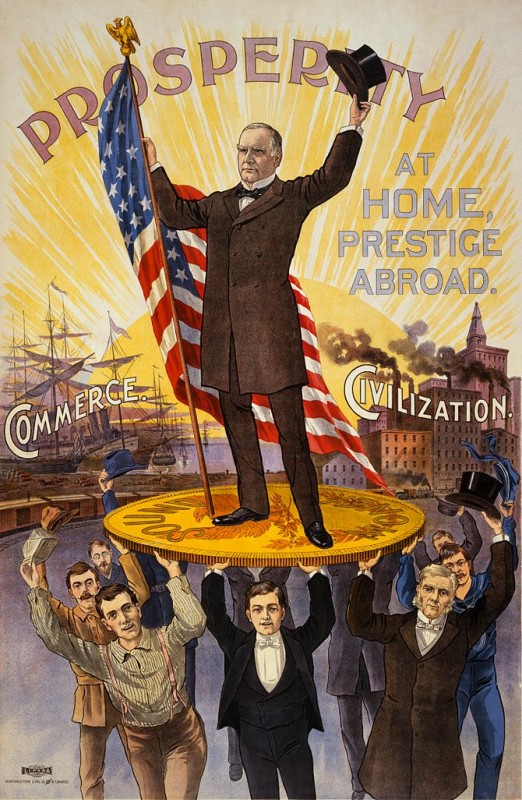

America Needs The Gold Standard More Than Ever

The United States needs the gold standard more than ever. The gold standard is neither barbaric nor impractical, and it is more urgently needed every day. This is because the standard of paper money is failing. It has set in motion an accelerating series of crises, each worse than the previous. The nation cannot continue to borrow to infinity, nor can the U.S. endure zero interest much longer.

Read More »

Read More »

Janet Yellen’s Fed Has The Makings Of A Potential Disaster

In 2013, President Obama nominated Janet Yellen to be the next Federal Reserve Chairman. We need to know what she stands for if we want to predict what the central bank will do to us next. Clearly, Yellen will continue Bernanke’s Quantitative Easing, but her papers and speeches show that she is quite different from her predecessor.

Read More »

Read More »