Tag Archive: coronavirus

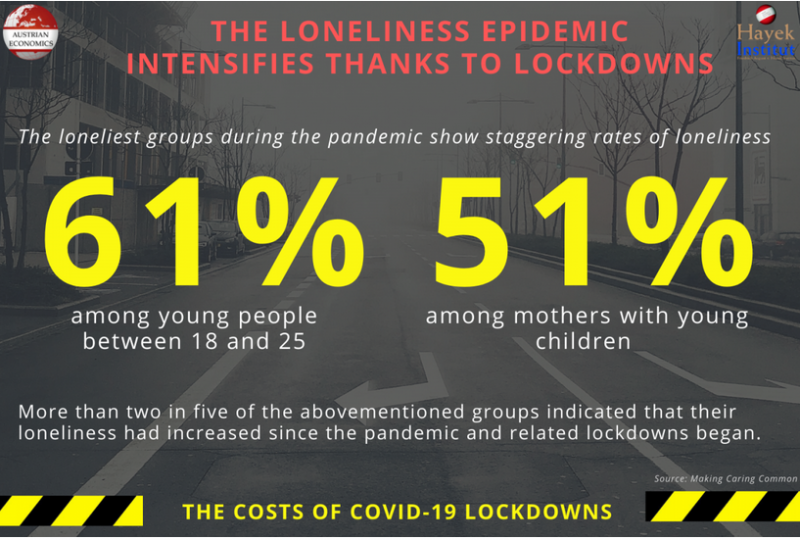

The Loneliness Epidemic intensifies Thanks to Lockdowns

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

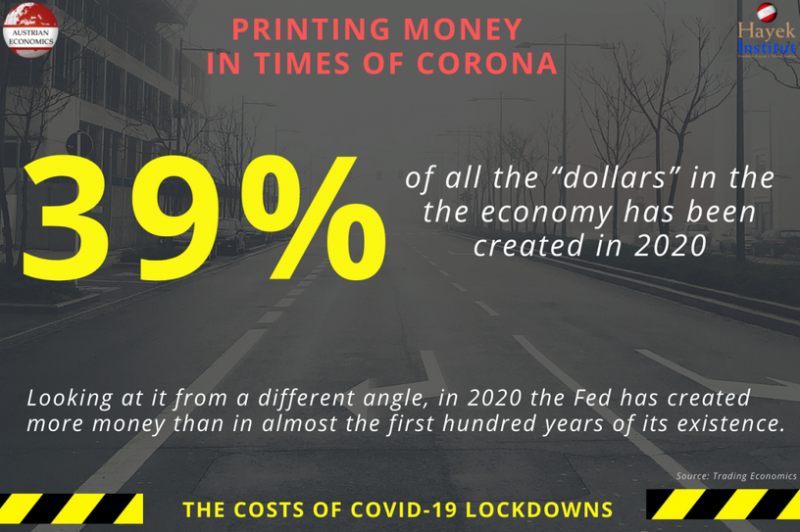

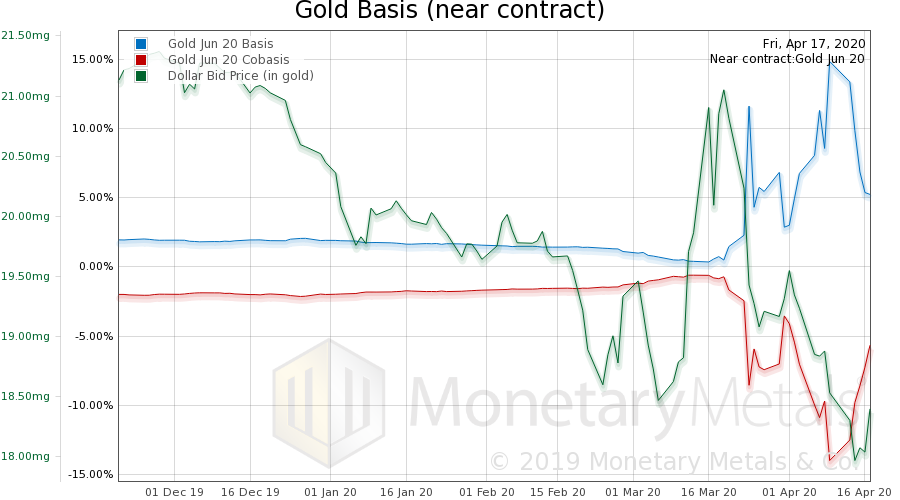

Printing Money in Times of Corona

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

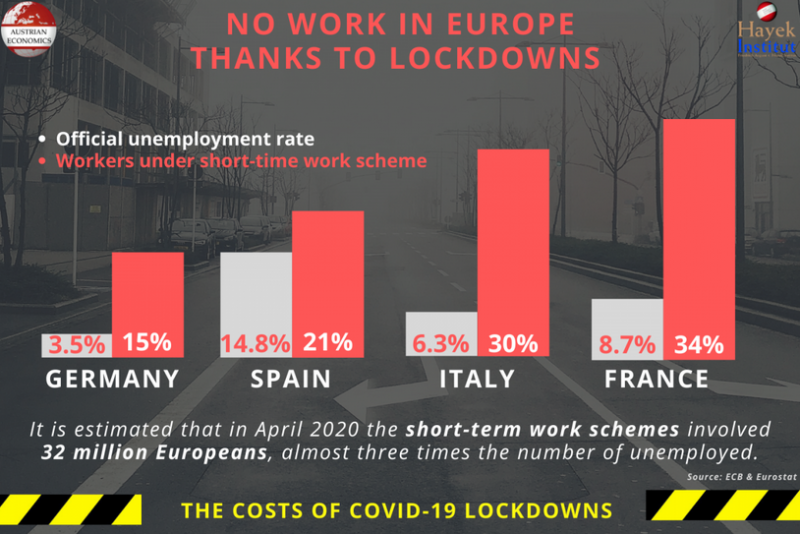

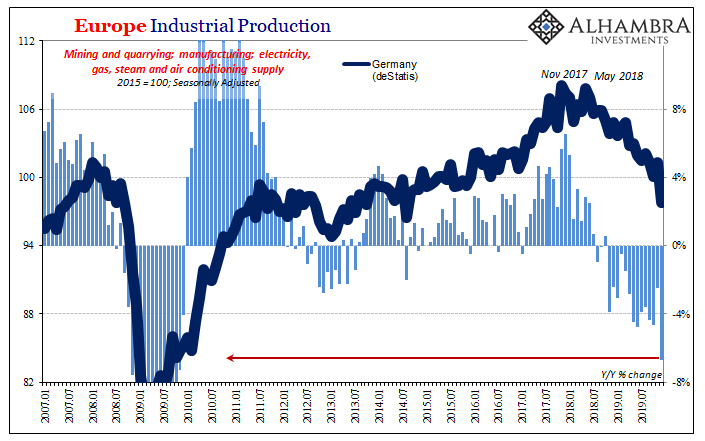

No Work in Europe Thanks to Lockdowns

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

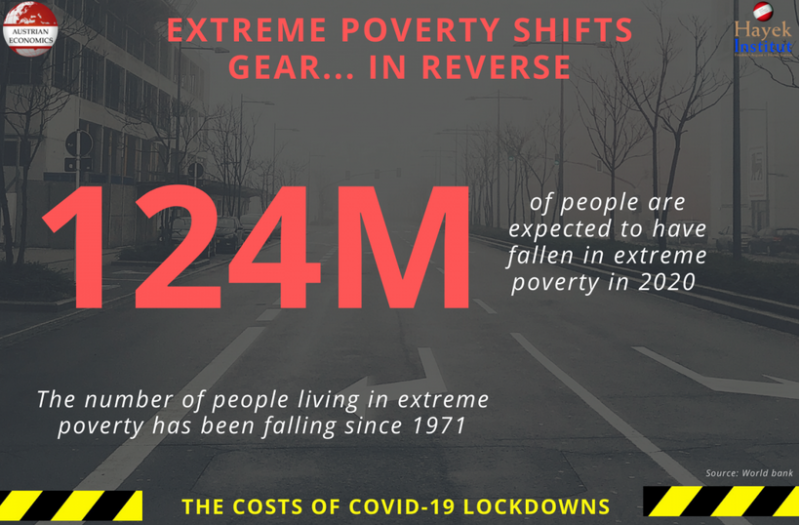

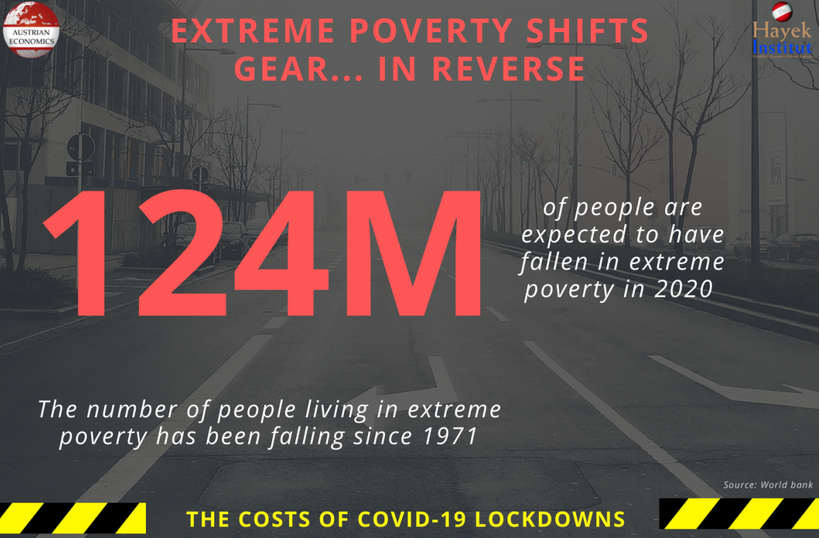

Extreme Poverty Shifts Gear… in Reverse

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

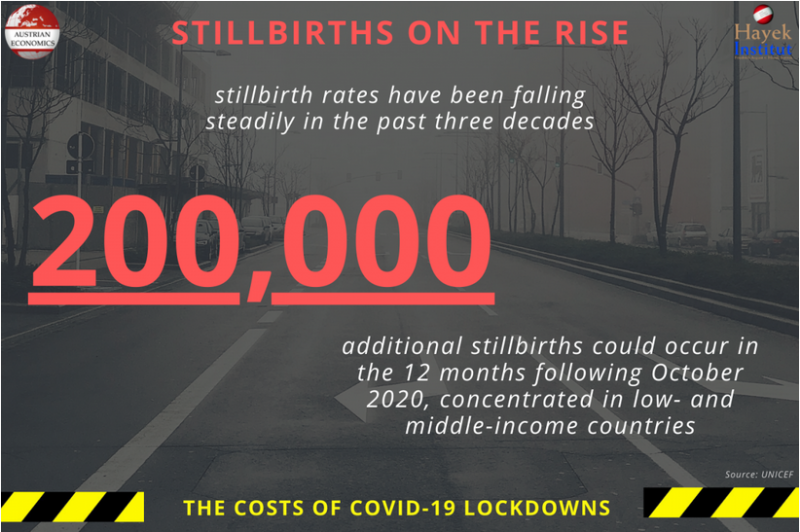

Stillbirths on the Rise

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

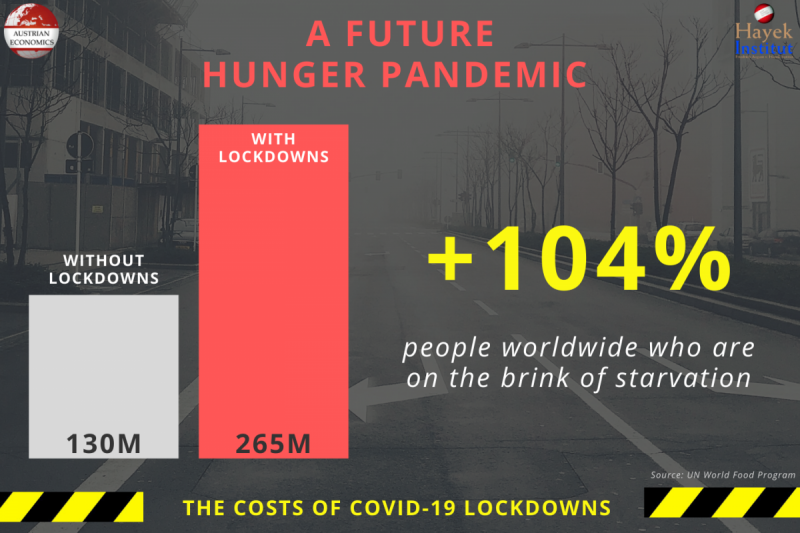

A Future Hunger Pandemic

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

The Costs of Coronavirus Lockdowns

Throughout the next weeks, we will regularly feature statistics showing some of the costs of the prevailing lockdown politics. This article is an introduction to this new series. All over Europe, life has come to a halt again. As a second wave of Coronavirus infections has arrived, social and economic life has largely once more, as was already the case in spring when COVID-19 first spread across the world.

Read More »

Read More »

Government urged to do more to help companies

The Swiss government should scale up its efforts to help businesses overcome the coronavirus crisis, according to the director of the KOF Swiss Economic Institute. Transport companies are also calling for more assistance.

Read More »

Read More »

Switzerland Peps Up SMEs

How Switzerland peps up SMEs: Banks are encouraged to extend credit (at 0%). The treasury guarantees the loans. The SNB refinances banks and accepts the guaranteed loans as collateral. Fast and efficient. Eventually, some of these loans will turn into grants of course. But that’s ok; the first-best response to a shock with asymmetric effects does involve transfers if markets are incomplete.

Read More »

Read More »

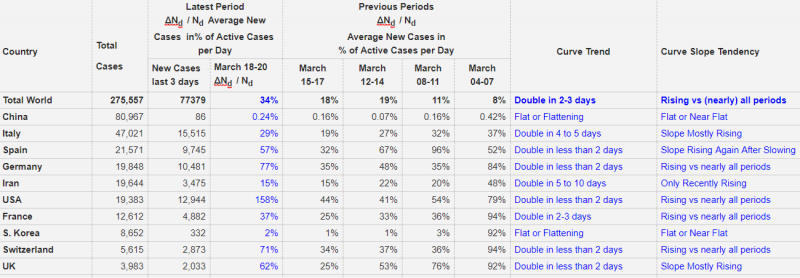

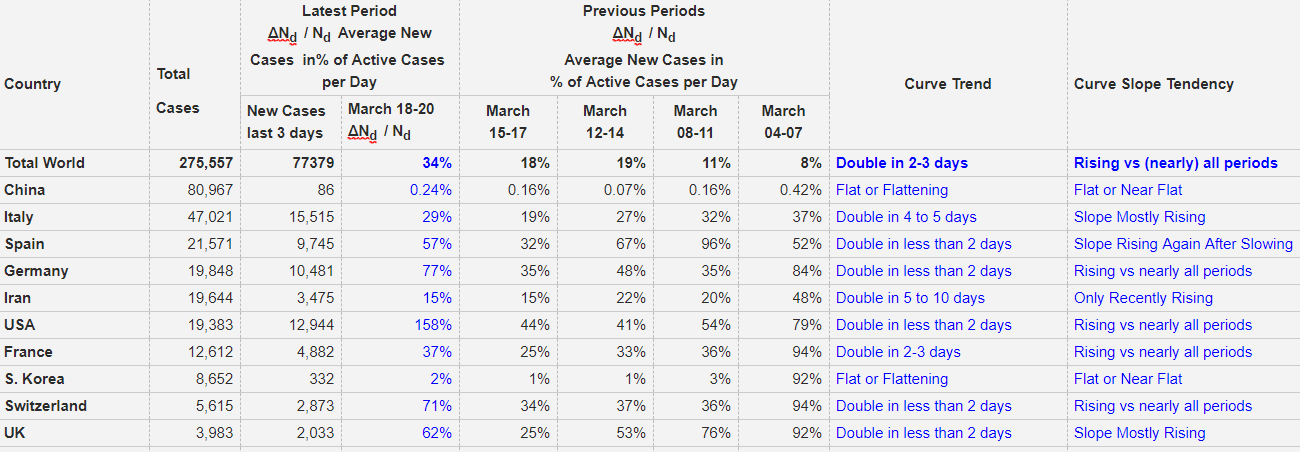

Corona’s Exponential Curve Slope Tracking, March 20

Key for understanding the expansion of the Coronavirus, is the slope (or steepness / derivation) of the curve.

This post compares the slope values of different countries.

Read More »

Read More »

FX Daily, February 25: Capital Markets Remain Fragile after Yesterday’s Bloodletting

Overview: Yesterday's bloodletting in global equities has calmed, but investors remain on edge. Despite all the concerns that the markets were under-appreciating the implications of the new coronavirus, there is a sense that yesterday's moves were in excess. Japanese markets, which were closed on Monday, played catch-up today, and the Nikkei shed 3.3%.

Read More »

Read More »

As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be...

Read More »

Read More »

FX Daily, February 7: Dollar Rides High as Eurozone Disappoints, and Caution Sets In

Overview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the markets in the region slipping.

Read More »

Read More »

FX Daily, January 30: Contagion Impact not Peaked, Weighs on Risk Appetites

Overview: The ongoing concerns about the geometric progression of the new coronavirus continues to swamp other considerations for investors. Risk continues to be unwound, as the World Health Organization meets to decide if this is indeed a global health emergency. Several large equity markets in Asia were hit particularly hard.

Read More »

Read More »