Tag Archive: CPI

Update The Conflict of Interest Rate(s)

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data.

Read More »

Read More »

Can’t Blame COVID For This One

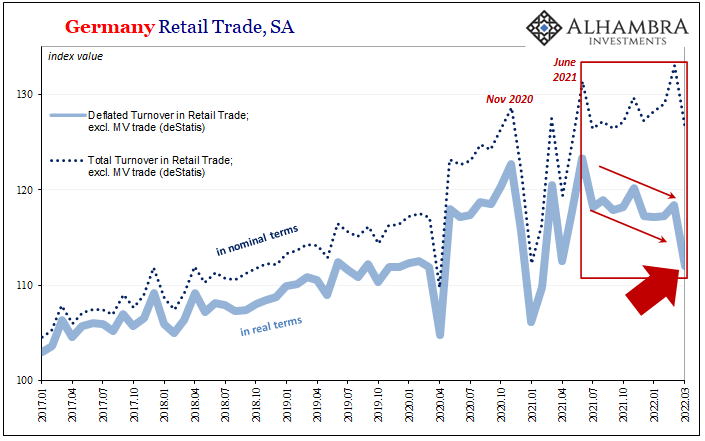

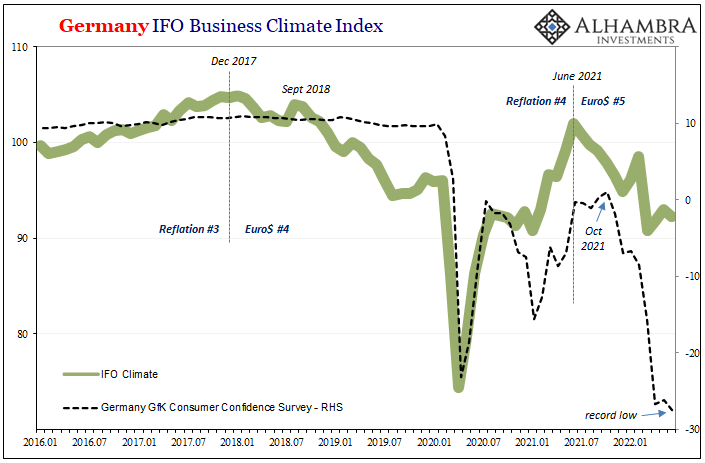

Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal.

Read More »

Read More »

Peak Inflation (not what you think)

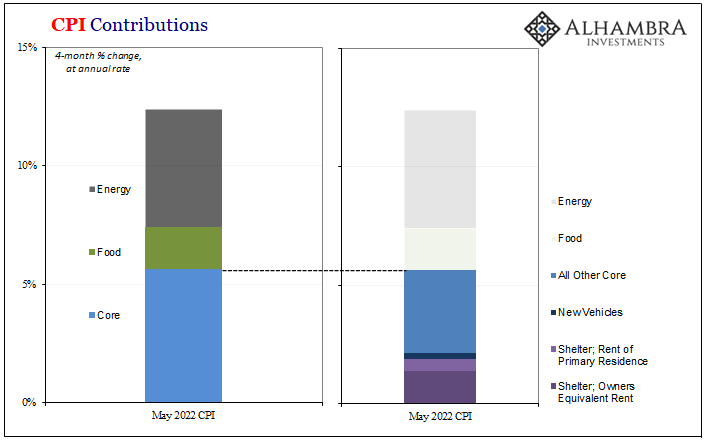

For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him?

Read More »

Read More »

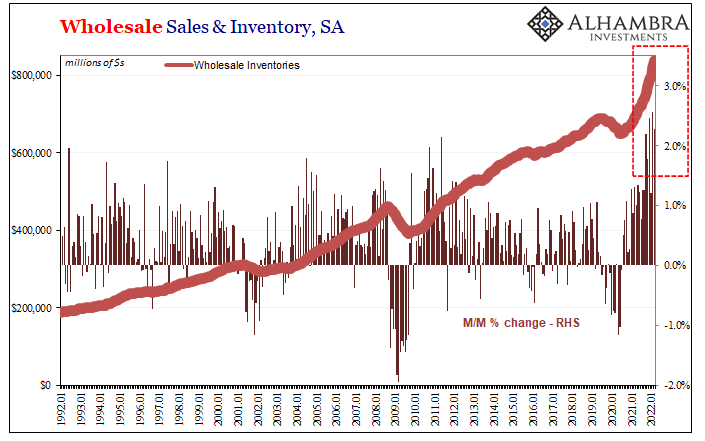

Historic Inventory Continued In March, But Is It All Price Illusion, Too?

The Census Bureau today released its advanced estimates for March trade. These include, among other accounts like imports and exports, preliminary results reported by retailers and wholesalers. That means, for our purposes, inventories. Oh my, was there ever more inventory. It was, apparently, widely expected that following an avalanche of goods building up over the previous five months the situation might calm down a touch.

Read More »

Read More »

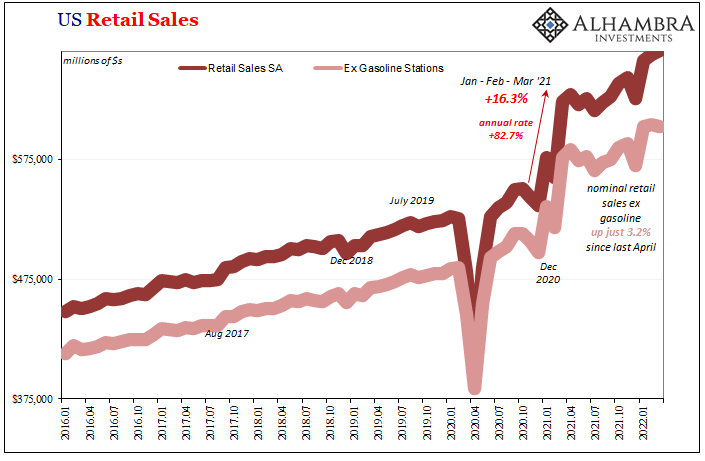

Not Good Goods

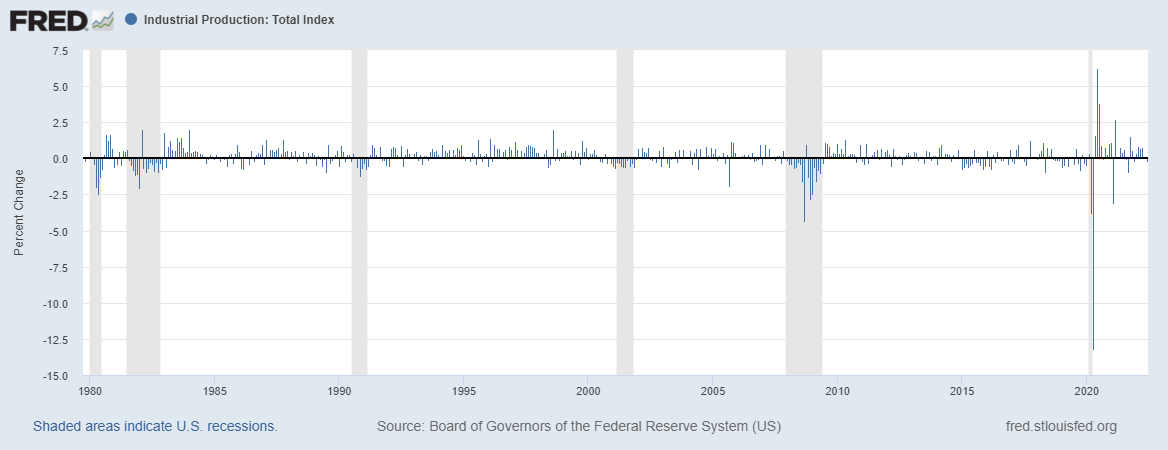

The goods economy in the United States is – maybe was – the lone economic bright spot. That in and of itself should’ve provoked more caution, instead there was the red-hot recovery to sell under the cover of supply shock pricing changes. The sheer spending on goods, and how they arrived, each unabashedly artificial from the get-go.

Read More »

Read More »

China More and More Beyond ‘Inflation’

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%.

Read More »

Read More »

You Know What They Say About The Light At The End Of The Tunnel

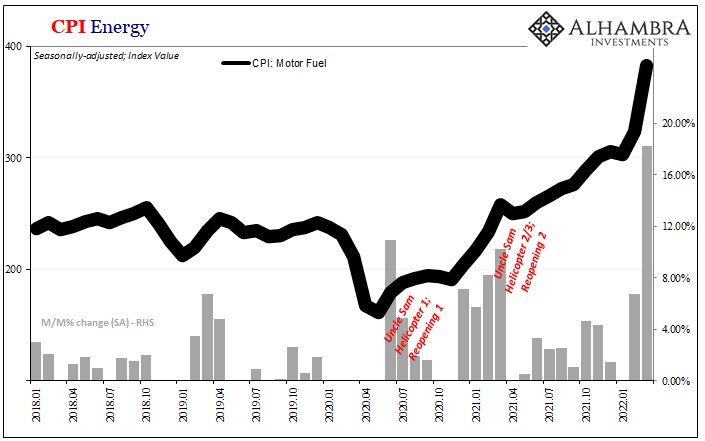

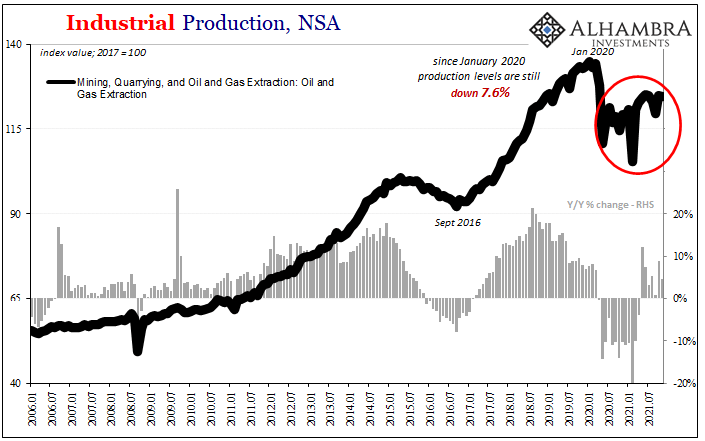

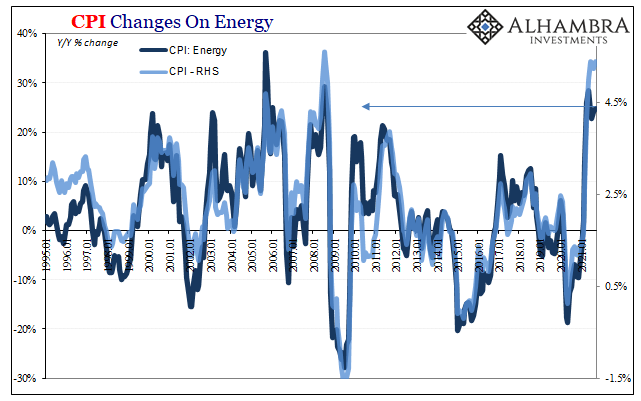

In any year when gasoline prices rise 18%, that’s not going to be good for anyone except maybe oil companies who extract its key ingredient from out of the ground (or don’t, as the case can be). Yet, annual rates of increase that size do happen.

Read More »

Read More »

US Jobs, EMU CPI, Japan’s Tankan, and China’s PMI Highlight the Week Ahead

This year was supposed to be about the easing of the pandemic and the normalization of policy. Instead, Russia's invasion of Ukraine threw a wrench in the macroeconomic forecasts as St. Peter’s victories broke the brackets of the NCAA basketball championship pools.

Read More »

Read More »

Consumer Prices And The Historical Pain(s)

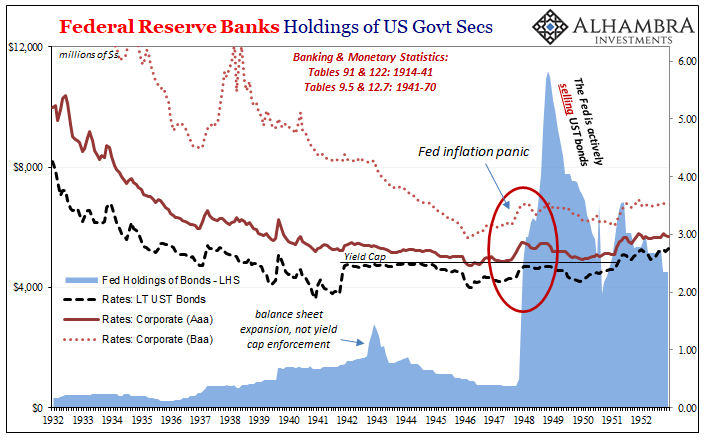

The 1947-48 experience was truly painful, maybe even terrifying. The US and Europe had just come out of a decade when the worst deflationary consequences were so widespread that the period immediately following quickly erupted into the worst conflagration in human history.

Read More »

Read More »

ECB Meeting and US and China’s CPI are the Macro Highlights in the Week Ahead

One of the most significant market responses to Russia's attack on Ukraine is in the expectations for the trajectory of monetary policy in many of the high-income countries, including the US, eurozone, UK and Canada. The market has abandoned speculation of a 50 bp hike in mid-March by the FOMC and the Bank of England. It has also scaled back the ECB's move to 20 bp this year from 50 bp.

Read More »

Read More »

US CPI Reaches Seven On US Goods Prices, With Disinflation Setting In Everywhere Else (incl. US Services)

How is that US Treasury rates out in the independent longer end of the yield curve have now “suffered” a seven percent CPI to go along with double taper and triple maybe quadruple (if the whispers are to be believed) rate hikes this year, yet have weathered all of that allegedly bond-busting brutality with barely a market fluctuation?

Read More »

Read More »

One Shock Case For ‘Irrational Exuberance’ Reaching A Quarter-Century

Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts.

Read More »

Read More »

Short Run TIPS, LT Flat, Basically Awful Real(ity)

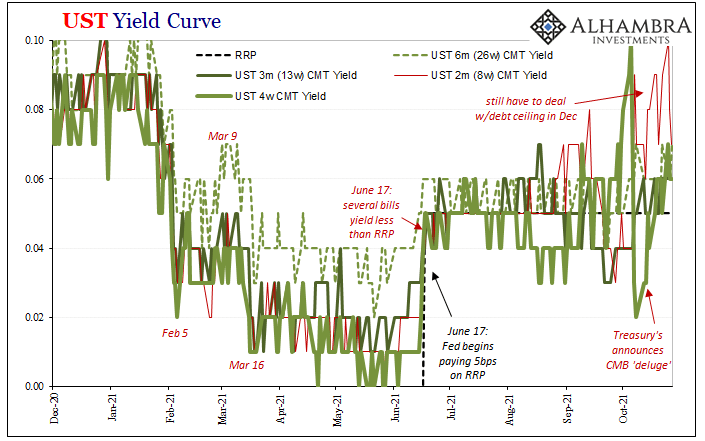

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday.

Read More »

Read More »

Perfect Time To Review What Is, And What Is Not, Inflation (and why it matters so much)

It is costing more to live and be, so naturally people are looking for who it is they need to blame. Maybe figure out some way to stop it. You know and feel for the basics since everyone’s perceptions begin with costs of just living. This is what makes the subject of inflation so difficult, even more so in the era of QE.

Read More »

Read More »

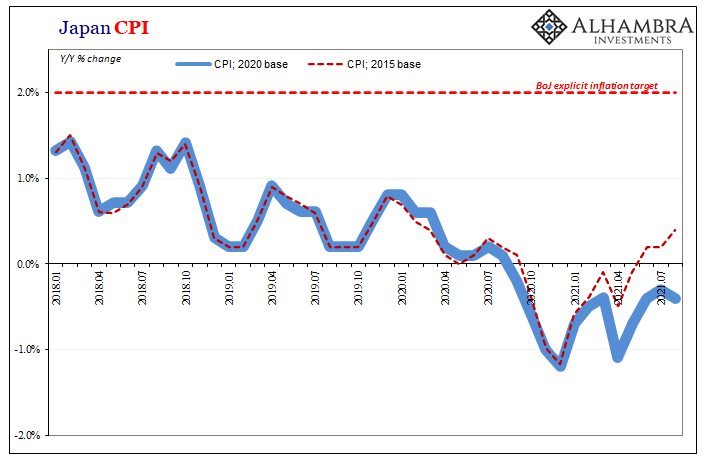

August Avoids Zero In JGB’s

Central banks and their staffs have long been accused of trying to hide inflation. This allegation had been a staple of their critics, those charging reckless monetary policies for creating “too much” money that had allegedly been causing price imbalances all over the financial map.

Read More »

Read More »

Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time.

Read More »

Read More »

Weekly Market Pulse: As Clear As Mud

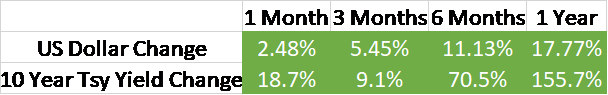

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs.

Read More »

Read More »

And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene.

Read More »

Read More »

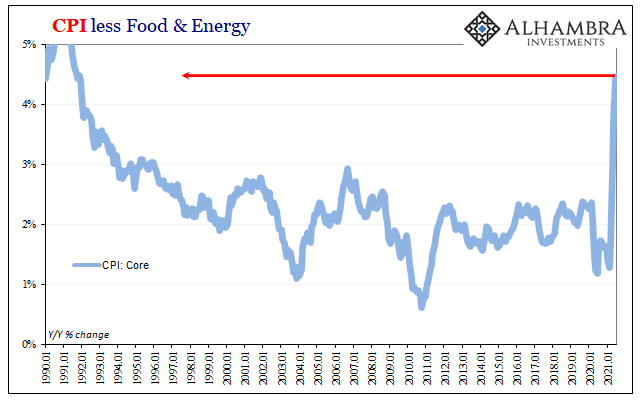

Third CPI In A Row, Yet All Eyes On That 30s Auction

Three in a row, huge CPI gains. According to the BLS, headline consumer price inflation surged 5.39% (unadjusted) year-over-year during June 2021. This was another month at the highest since July 2008 (the last transitory inflationary episode). The core CPI rate gained 4.47% last month over June last year, the biggest since November 1991.

Read More »

Read More »

Weekly Market Pulse: Is It Time To Panic Yet?

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range.

Read More »

Read More »