Tag Archive: currencies

If the Fed’s Not In Consumer Prices, Then How About Producer Prices?

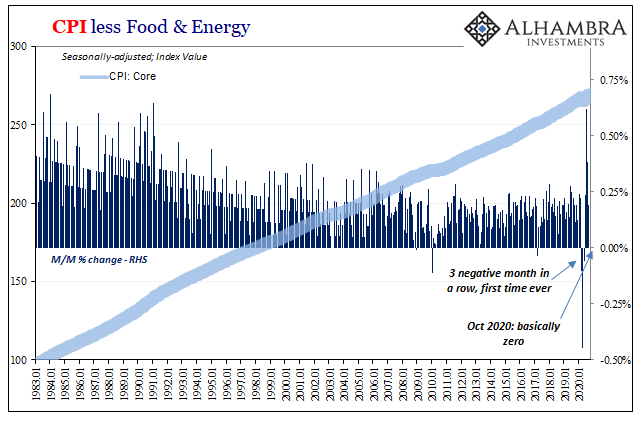

It’s not just that there isn’t much inflation evident in consumer prices. Rather, it’s a pretty big deal given the deluge of so much “money printing” this year, begun three-quarters of a year before, that consumer prices are increasing at some of the slowest rates in the data.

Read More »

Read More »

They’ve Gone Too Far (or have they?)

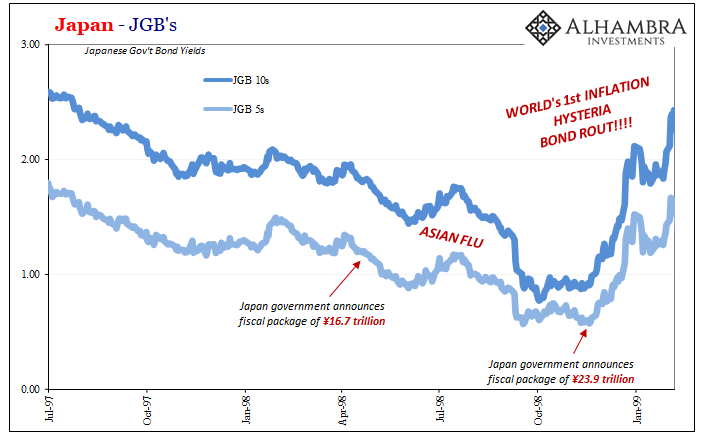

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

There’s Always A First Time

Is it a race against time? Or is it trying to set aside today so as to focus entirely on a specific kind of tomorrow? It’s easy to do the latter especially when today is what it is; you can’t change what’s already gone on.

Read More »

Read More »

Seizing The Dirt Shirt Title

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn.

Read More »

Read More »

Consumers, Too; (Un)Confident To Re-engage

There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend).

Read More »

Read More »

What Did Hamper Growth ‘In A Few Months’

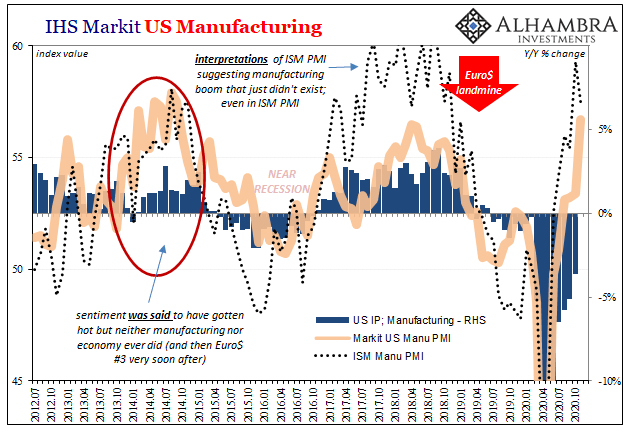

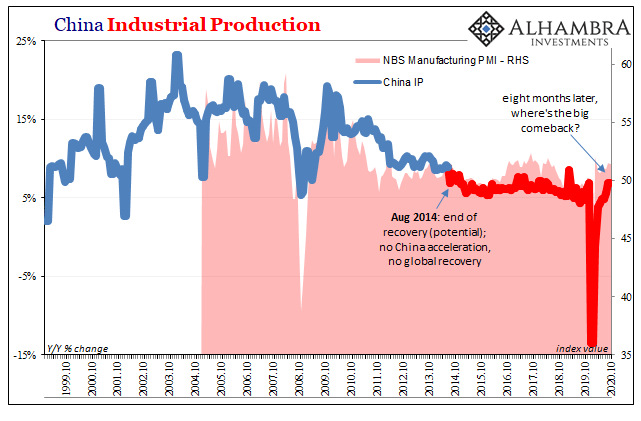

Over here, on the other side of that ocean, the US economy can only dream of the low levels Chinese industry has been putting up this late into 2020. At least those in the East are back positive year-over-year. Here in America, manufacturing and industry can’t even manage anything like a plus sign.

Read More »

Read More »

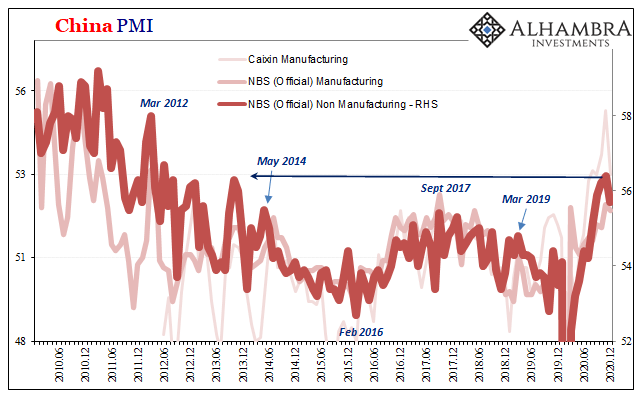

This Global Growth Stuff, China Still Wants A Word

Before there could be “globally synchronized growth”, it had been plain old “global growth.” The former from 2017 appended the term “synchronized” to its latter 2014 forerunner in order to jazz it up. And it needed the additional rhetorical flourish due to the simple fact that in 2015 for all the stated promise of “global growth” it ended up meaning next to nothing in reality.Oddly the same for 2017’s update heading into 2018 and...

Read More »

Read More »

Inflation Hysteria #2 (Slack-edotes)

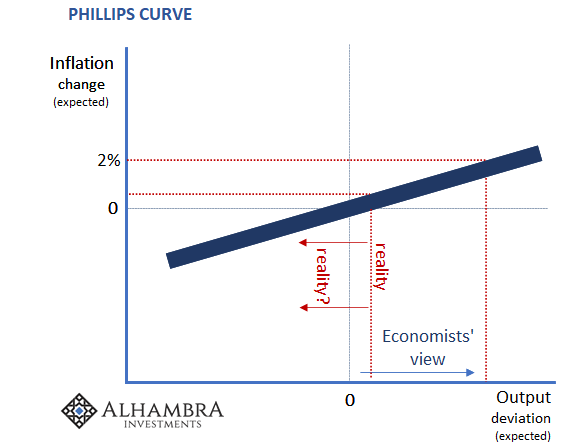

Macroeconomic slack is such an easy, intuitive concept that only Economists and central bankers (same thing) could possibly mess it up. But mess it up they have. Spending years talking about a labor shortage, and getting the financial media to report this as fact, those at the Federal Reserve, in particular, pointed to this as proof QE and ZIRP had fulfilled the monetary policy mandates – both of them.

Read More »

Read More »

Inflation Hysteria #2 (WTI)

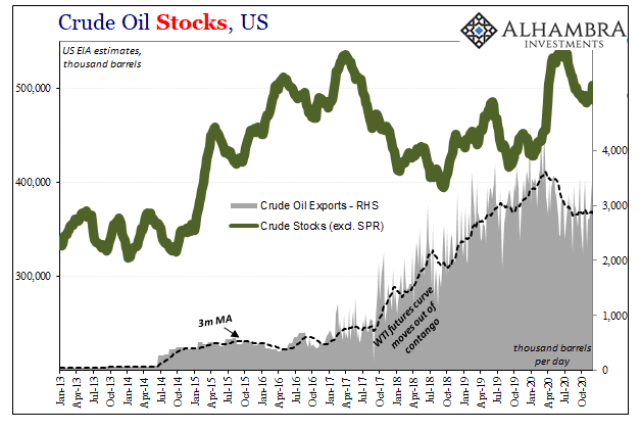

Sticking with our recent theme, a big part of what Inflation Hysteria #1 (2017-18) also had going for it was loosened restrictions for US oil producers. Seriously.

Read More »

Read More »

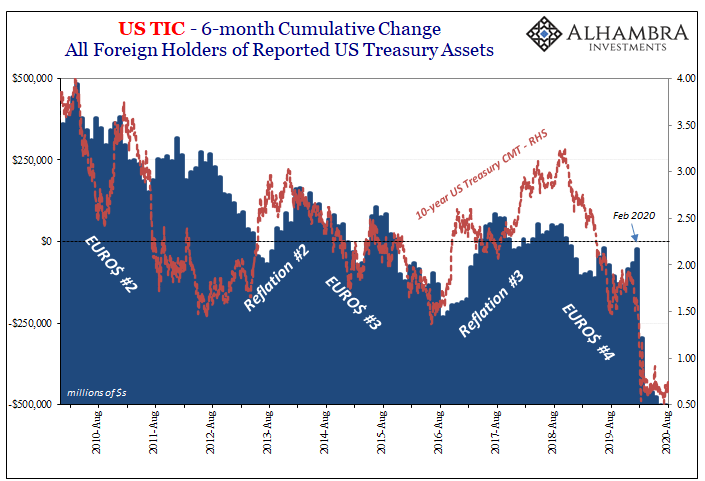

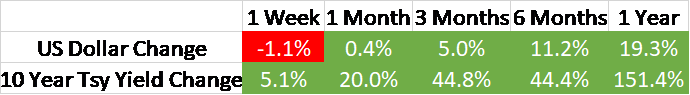

Inflation Hysteria #2 (Nominal UST)

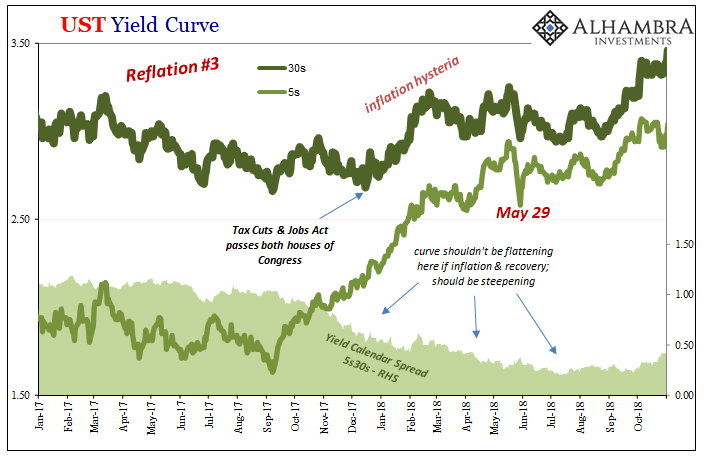

What had given Inflation Hysteria #1 its real punch had been the benchmark 10-year Treasury note. Throughout 2017, despite the unemployment rate in the US, globally synchronized growth being declared around the world (and being declared as some momentously significant development), and whatever other tiny factors acceding to the narrative, longer-term Treasury rates just weren’t buying it.

Read More »

Read More »

Polar Opposite Sides of Consumer Credit End Up in the Same Place: Jobs

If anything is going to be charged off, it might be student loans. All the rage nowadays, the government, approximately half of it, is busily working out how it “should” be done and by just how much. A matter of economic stimulus, loan cancellation proponents are correct that students have burdened themselves with unprofitable college “education” investments.

Read More »

Read More »

Don’t Really Need ‘Em, Few More Nails Anyway

The ISM’s Non-manufacturing PMI continued to decelerate from its high registered all the way back in July 2020. In that month, the headline index reached 58.1, the best since early 2019, and for many signaling that everything was coming up “V.”

Read More »

Read More »

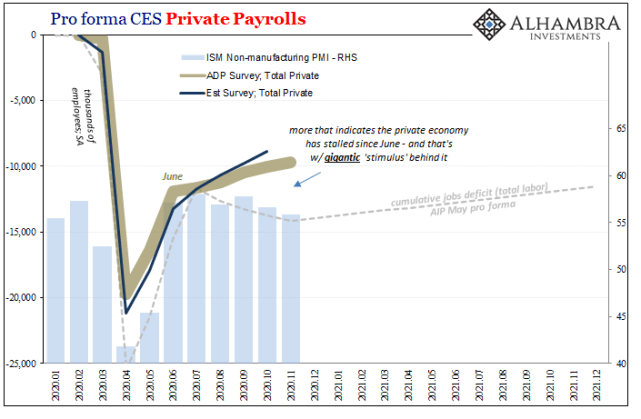

There Have Actually Been Some Jobs Saved, Only In Place of Recovery

The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5.

Read More »

Read More »

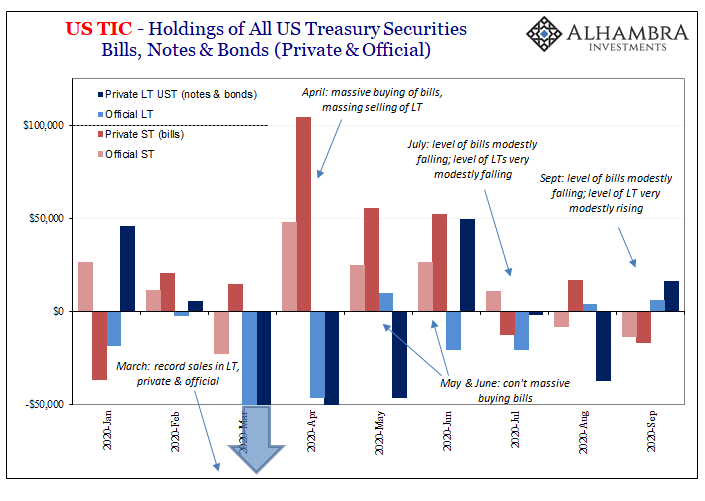

Just Who Is, And Who Is Not, Selling T-Bills

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral.

Read More »

Read More »

Treasury Auctions Are Anything But Sorry Because They’ve Never Been Sorry About Solly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on...

Read More »

Read More »

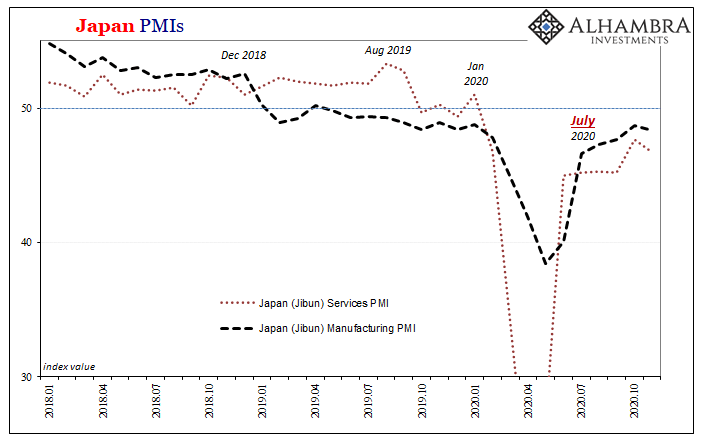

Deflation Returns To Japan, Part 2

Japan Finance Minister Taro Aso, who is also Deputy Prime Minister, caused a global stir of sorts back in early June when he appeared to express something like Japanese racial superiority at least with respect to how that country was handling the COVID pandemic.

Read More »

Read More »

Extending the Summer Slowdown

A big splurge in September, and then not much more in October. While it would be consistent for many to focus on the former, instead there is much about the latter which, for once, is feeding growing concerns. Retail sales, American consumer spending on goods, has been the one (outside of economically insignificant housing) bright spot since summer

Read More »

Read More »

Six Point Nine Times Two Equals What It Had In Twenty Fourteen

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.”

Read More »

Read More »

Where Is It, Chairman Powell?

Where is it, Chairman Powell? After spending months deliberately hyping a “flood” of digital money printing, and then unleashing average inflation targeting making Americans believe the central bank will be wickedly irresponsible when it comes to consumer prices, the evidence portrays a very different set of circumstance.

Read More »

Read More »

The Prices And Costs Of What Xi Believes He’s Got To Do

It does seem, at first, a huge contradiction. On the one hand, what we know so far of China’s 14th 5-year plan apparently will lean heavily on new technologies not-yet invented to rescue the country’s economy from the pit of de-globalization the eurodollar system had thrown it into years ago.

Read More »

Read More »