Tag Archive: Currency Wars

Parity hysterics: What it means and what it doesn’t – Part II

Part II of II, by Claudio Grass, Hünenberg See, Switzerland

“Reverse currency wars”?

Although the parity event may have captured the attention of the mainstream financial press and most western citizens, there’s a much bigger shift that has been going on in the background, which received much less coverage.

Read More »

Read More »

The Dollar’s Evolving Outlook

The foreign exchange market sees an average daily turnover of something on the magnitude of $6.6 trillion a day. In a week, the turnover is sufficient to more than cover world trade for a year. It is the largest of the capital markets. Trends in the currency market can last for years.

Read More »

Read More »

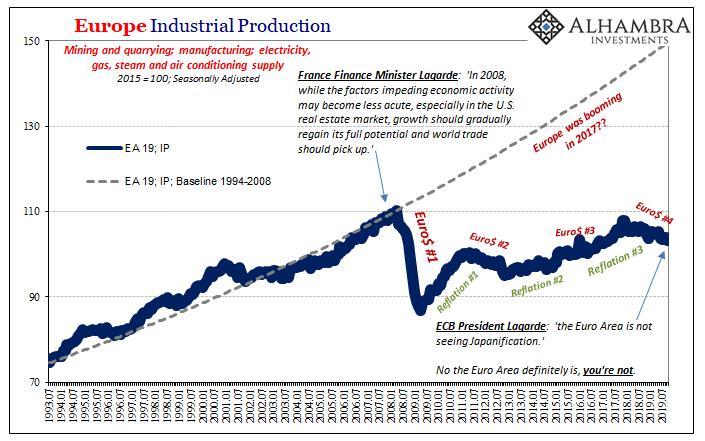

Lagarde Channels Past Self As To Japan Going Global

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar.

Read More »

Read More »

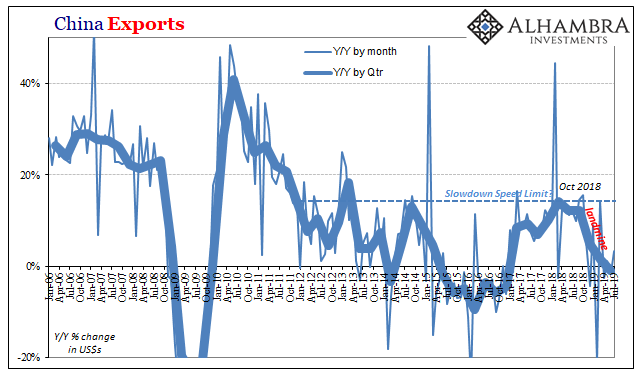

The Myth of CNY DOWN = STIMULUS Won’t Die

On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out.

Read More »

Read More »

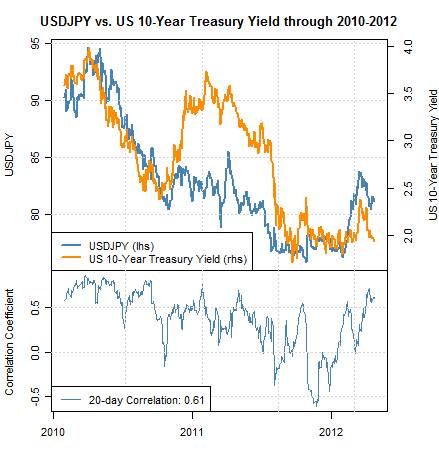

(7) FX Theory: The Asset Market Model

The Asset Market Model implies that a currency will be in higher demand and should appreciate in value, if the flow of funds into financial market of the country such as equity and bonds markets increase.

Read More »

Read More »

Who Has Got the Problem? Europe or Japan?

A couple of months ago the euro traded close to EUR/USD 1.20 and the whole world was betting on its breakdown. Once the euro downtrend ended thanks to QE3, OMT and euro zone current account surpluses, the common currency did not stop to appreciate against the yen and reached levels of EUR/JPY 104 and above. … Continue reading...

Read More »

Read More »

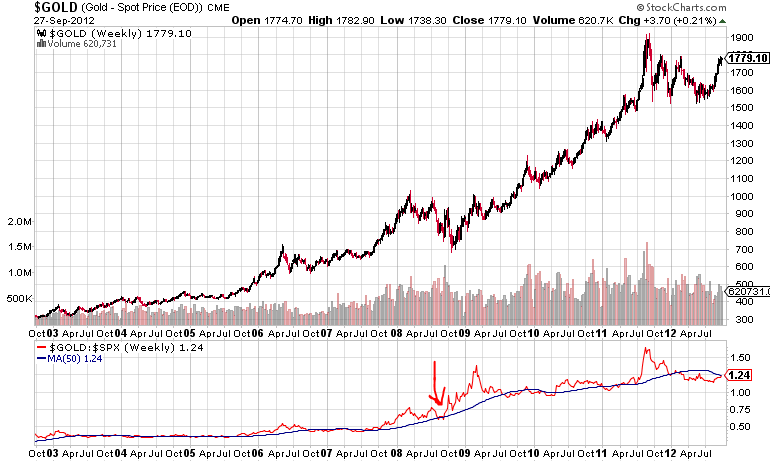

Marc Faber: Assets are overpriced, we short metals and Brent now

As we predicted on October 5 or one day later on DailyFX, metals have started their descent, silver lost one dollar, from levels around 35$ last week to 34$ now. Marc Faber joins our view and says that asset prices are quite vulnerable. “I’m not 100% in cash, for the simple reason that I could … Continue reading »

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): November 2010

EUR/CHF Continues Lower Presently down at 1.3055 from early 1.3090, having been as low as 1.3037 so far. Earlier I was reading comments made by UBS economist Huenerwadel, who said “At least from a fundamental point of view and aware of the increased long CHF positioning, very little speaks in favour of a materially higher EUR/CHF … Continue reading...

Read More »

Read More »

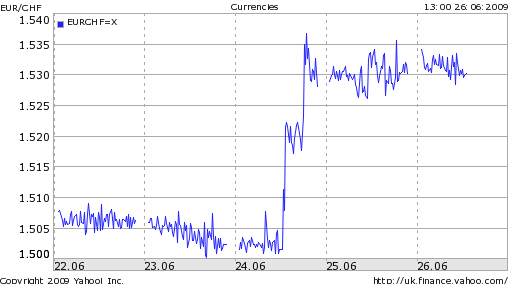

SNB Intervenes on Behalf of Franc (June 2009)

Jun. 26th 2009 Extracts from the history of the Swiss franc (June 2009) Back on March 12, the Swiss National Bank issued a stern promise that it would actively seek to hold down the value of the Swiss Franc (CHF) as a means of forestalling deflation. The currency immediately plummeted 5%, as traders made … Continue...

Read More »

Read More »