Tag Archive: default

Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm.

Read More »

Read More »

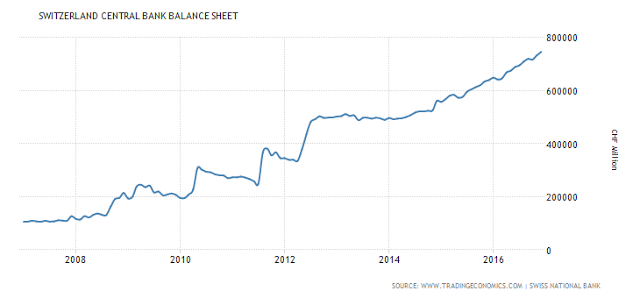

SNB: It’s A Bonfire Of The Absurdities

This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my head now and then to “WTF” moments several times a week.

Read More »

Read More »

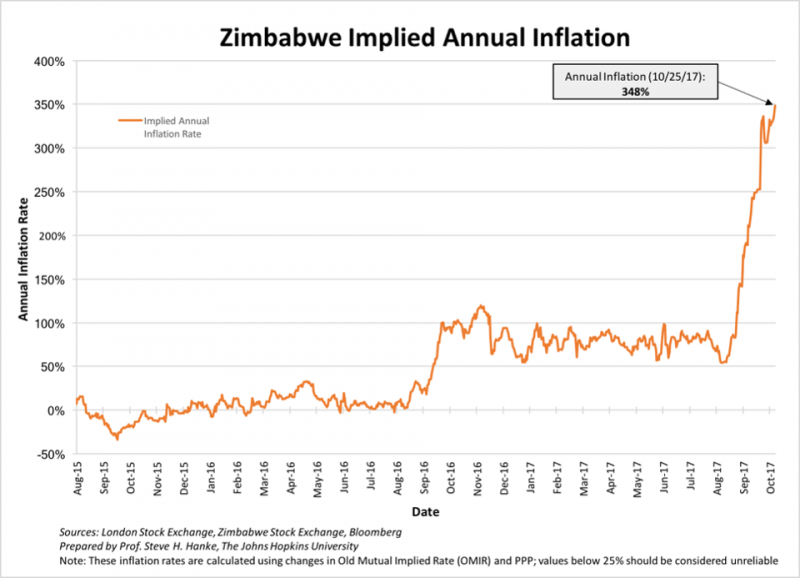

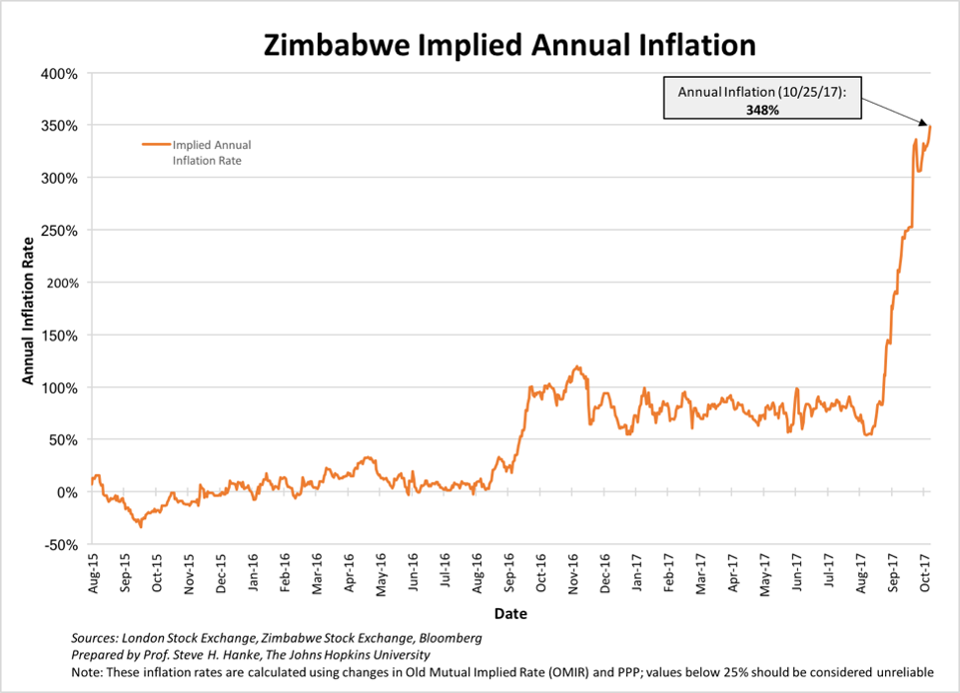

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe. Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis. Venezuela's new 100,000-bolivar note is worth less oday thehan USD 2.50. Maduro announces plans to eliminate all physical cash. Gold rises in response to ongoing crises.

Read More »

Read More »

Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Authored by Kevin Muir via The Macro Tourist blog, Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility.

Read More »

Read More »

100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world's largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump.

Read More »

Read More »

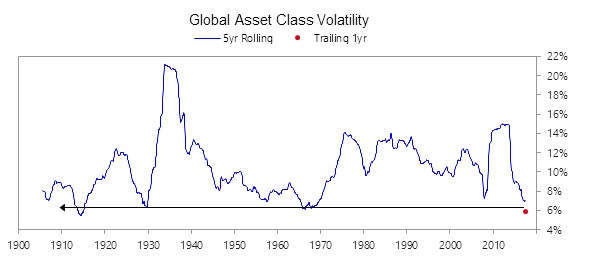

The VIX Will Be Over 100 due to Central Bank Created Tail Risk

We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory!

Read More »

Read More »

Destroying The “Wind & Solar Will Save Us” Delusion

Submitted by Gail Tverberg via Our Finite World blog, The “Wind and Solar Will Save Us” story is based on a long list of misunderstandings and apples to oranges comparisons. Somehow, people seem to believe that our economy of 7.5 billion people can get along with a very short list of energy supplies. This short … Continue reading »

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

Will The ECB Buy Stocks?

Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility. We think the ECB could legally buy ETFs that fit its requirements… but it would be controversial and we question the benefits. An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme.

Read More »

Read More »

Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today's uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of "helicopter money" is about to be unveiled in Japan by the world's most experimental central bank. However, as Nomura's Richard Koo warns, central banks may get much more than they bargained for, because helicopter money "probably marks the end of the road for believers in the omnipotence of monetary policy who have continued to press for further...

Read More »

Read More »

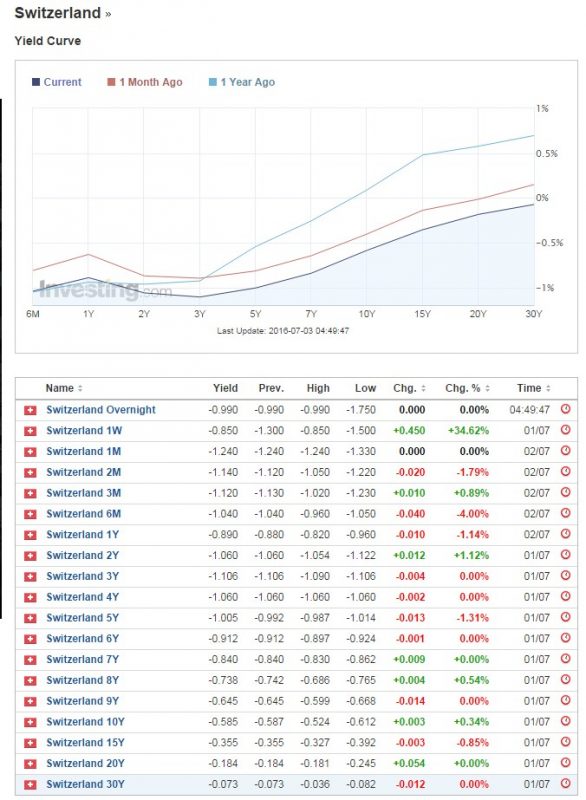

Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are "more negative than others", because investors expect a slow appreciation of the Swiss franc.

Read More »

Read More »

Venezuela’s Gold Reserves Plunge To Lowest Ever As Maduro Repays Debt With Gold

Several months ago, as Venezuela's hyperinflating, imploding economy was spinning in freefall, leading to the dramatic episodes of total social collapse such as those profiled in "Scenes From The Venezuela Apocalypse: "Countless Wounded" After 5,000 ...

Read More »

Read More »

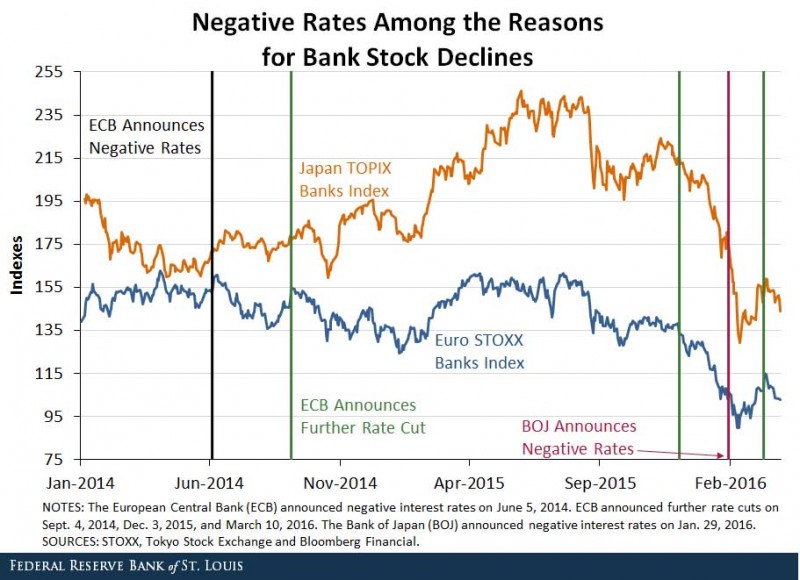

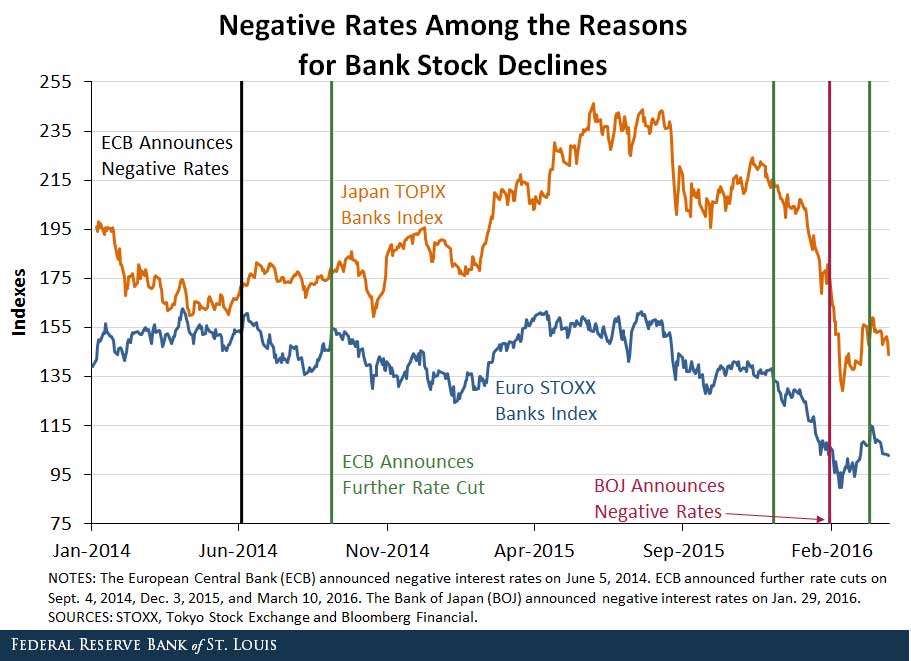

St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

"At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?" Those are the shocking wor...

Read More »

Read More »