Tag Archive: Emerging Markets

Global Asset Allocation Update: Not Yet

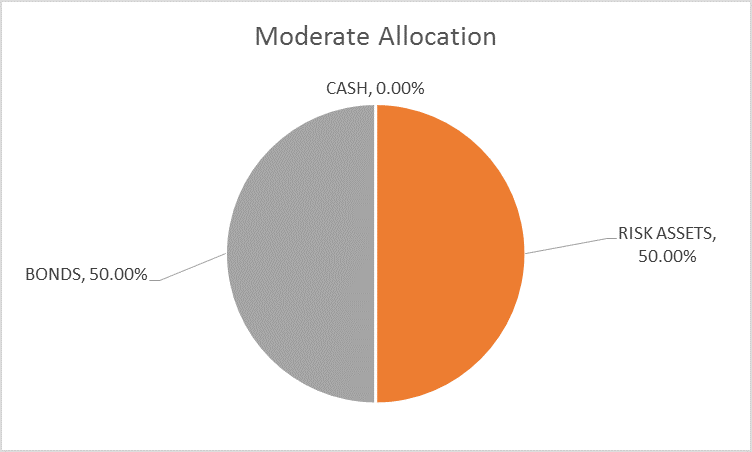

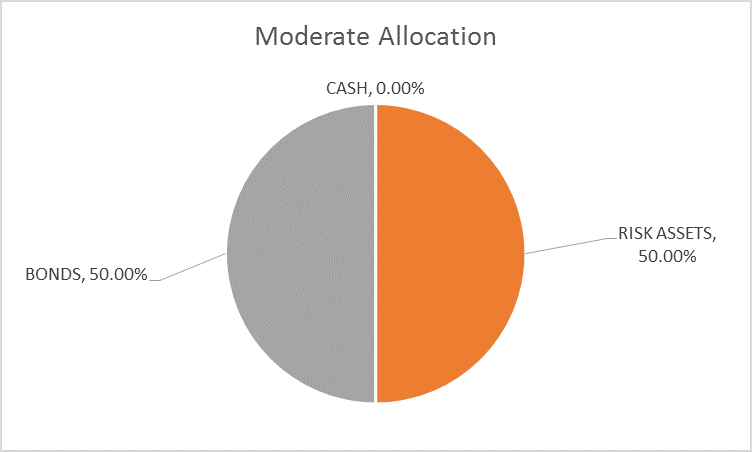

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

Emerging Markets FX ended the week on a firm note, helped by softer than expected US data. Indeed, EM FX was up across the board for the entire week and was led by BRL, MXN, and ZAR. The ECB meeting this week will draw some interest, especially after the BOC last week became the second major central bank to hike rates.

Read More »

Read More »

Emerging Markets: What has Changed

Pakistani Prime Minister Nawaz Sharif may face trial on corruption charges. Turkey will reportedly pay $2.5 bln for a Russian missile defense system. Nigeria said it was willing to cap its oil production to support OPEC efforts to cut global supply. Former Brazilian President Lula was sentenced to nine and half years in prison on corruption charges. S&P downgraded Chile one notch to A+ with a stable outlook.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed last week on a firm note, as the stronger than expected US jobs gain was mitigated by lower than expected average hourly earnings. Still, we believe that global liquidity conditions will continue to move against EM, as the Fed continues tightening and others join in.

Read More »

Read More »

Emerging Markets: What has Changed

The US confirmed North Korea's claims that it tested an intercontinental ballistic missile. The Pakistani rupee was devalued, prompting a new central bank governor to be named. Vietnam’s central bank cut interest rates for the first time since March 2014. Egypt’s central bank surprised markets with a 200 bp hike to 18.75%. South Africa's ruling ANC reportedly proposed that SARB be state-owned. Petrobras announced two separate cuts to fuel prices.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended the week on a mixed note, as investors await fresh drivers. US jobs data on Friday could provide more clarity on Fed policy and the US economy. Within EM, many countries are expected to report lower inflation readings for June that support the view that most EM central banks will remain in dovish mode for now. We remain cautious on the EM asset class near-term.

Read More »

Read More »

Emerging Markets: What has Changed

Chinese President Xi visited Hong Kong for the first time. The US has proposed $1.3 bln of arms sales to Taiwan. The Egyptian government raised fuel and cooking gas prices. significantly as part of the IMF program. South Africa’s parliament has scheduled the no confidence vote on President Zuma. Brazil’s central bank lowered its inflation target. Brazil after President Temer was charged with corruption.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended last week on a firm note, though most were still down for the week as a whole. Commodity prices stabilized, but the balance remains fragile, in our view. We remain cautious, especially with regards to the high beta currencies such as BRL, MXN, TRY, and ZAR.

Read More »

Read More »

Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month.

Read More »

Read More »

Emerging Markets: What’s Changed

MSCI announced it will include 222 China Large Cap A-shares in its Emerging Markets Index. Czech central bank is pushing out rate hike expectations. Hungary central bank eased again using unconventional measures. MSCI announced that it has launched a consultation on reclassification of Saudi Arabia from Standalone to Emerging Market status.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mixed Friday to cap off a mostly lower week. Obviously, we're seeing a bit of a washout in EM after the hawkish FOMC. Market was overly complacent and very long EM going into the FOMC meeting. The big question is how deep this selloff gets. For the better part of this year, EM dips have been met with renewed buying. We remain cautious on EM and think that investors should avoid the high beta currencies like ZAR, TRY, BRL, MXN.

Read More »

Read More »

Emerging Markets: What has Changed

Philippines central bank forecast a current account deficit this year, the first one in fifteen years. Kuwait refrained from matching the Fed’s 25 bp hike. The US Senate voted overwhelmingly to step up sanctions against Iran and Russia. Moody’s downgraded South Africa by a notch to Baa3 with negative outlook. South Africa plans to require that all local mines be 30% black-owned.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mixed last week but in general held up well in the aftermath of Super Thursday. The global backdrop seems relatively benign right now despite the FOMC meeting this week. We still think investors have to be picky. TRY, ZAR, and BRL at current levels seem too rich given the underlying risks in all three.

Read More »

Read More »

Emerging Markets: What has Changed

The Reserve Bank of India cut its inflation forecast for FY2017/18. South Korean President Moon suspended the installation of the remaining components of the THAAD missile shield. S&P cut Qatar one notch to AA-. Turkey looks likely to get caught up in yet another regional conflict. Brazil’s structural reform agenda has been delayed as President Temer remains on the ropes.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed last week on a firm note as weak US jobs data supported the notion that the Fed will find it hard to tighten in H2. No major US data will be reported this week and the FOMC embargo for the June 14will be in effect. As such, there is little on the near-term horizon that might help the dollar, so it’s likely to remain on the defensive this week.

Read More »

Read More »

Emerging Markets: What has Changed

The Indonesian cabinet is discussing revisions to the 2017 state budget. The Thai central bank plans to reform some FX rules. South African President Zuma survived the no confidence vote within his own ANC. Brazil’s central bank signaled a slower pace of easing ahead after it cut 100 bp again. Moody’s cut the outlook on Brazil’s Ba2 rating from stable to negative.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX closed last week on a mixed note, with markets struggling to find a compelling investment theme. The US jobs data this week could provide some more clarity on Fed policy. We still think markets are still underestimating political risk in the big EM countries, including Brazil (Moody’s outlook moved to negative), Mexico (election in state of Mexico), South Africa (ANC debates Zuma’s fate), and Turkey (ongoing crackdown on opposition).

Read More »

Read More »

Emerging Markets: What has Changed

Moody's downgraded China's rating from Aa3 to A1 with stable outlook. Reports suggest that the PBOC has informed local banks that it is changing the way it sets the daily fix. Moody's downgraded Hong Kong’s rating to Aa2 from Aa1 with stable outlook. Philippine President Duterte declared martial law on Mindanao island. Egypt's central bank unexpectedly hiked rates by 200 bp. S&P moved the outlook on Bolivia’s BB rating from stable to negative....

Read More »

Read More »

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended last week on a firmer note, helped by lower US rates and softer than expected CPI and retail sales data. Stabilizing commodity prices also helped EM. Yet these supportive conditions seem unlikely to persist, and we remain defensive on EM.

Read More »

Read More »