Tag Archive: Emerging Markets

Emerging Markets: Preview of the Week Ahead

EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM.

Read More »

Read More »

Emerging Markets: What Changed

Hong Kong may impose a tax on unsold apartments as an effort to increase supply and cool off the housing market. Bank of Israel’s MPC had a split vote last month for the first time in three years. South Africa President Ramaphosa said the ANC wants Julius Malema of the opposition EFF to rejoin the party. Former South Africa President Zuma will face trial on 16 criminal charges.

Read More »

Read More »

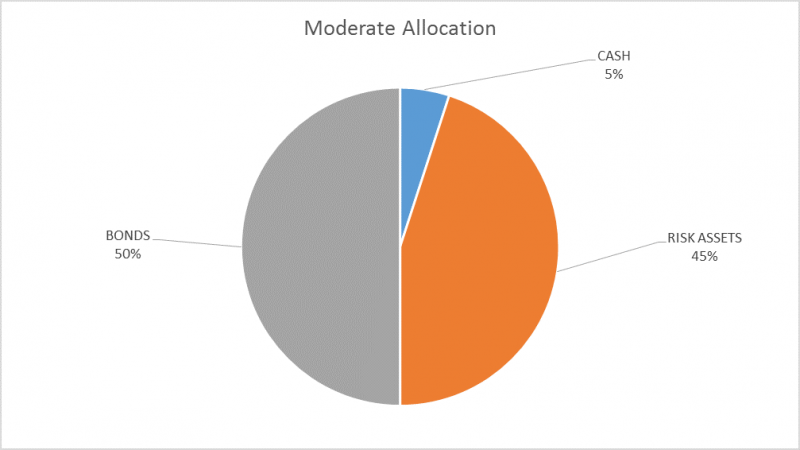

Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

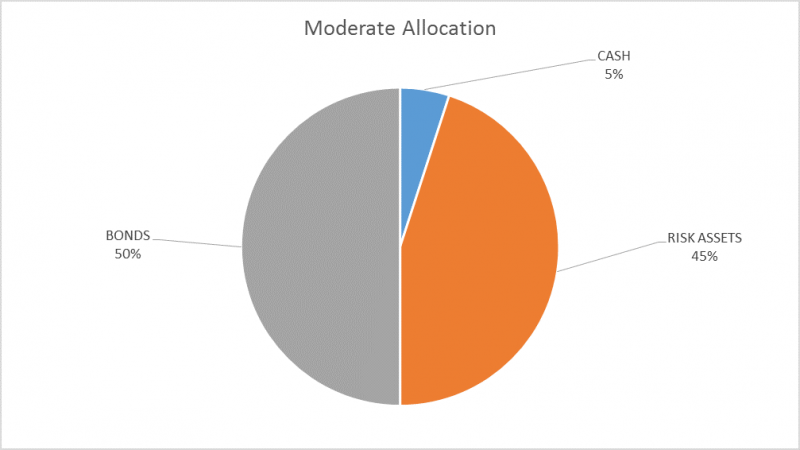

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average.

Read More »

Read More »

Emerging Markets: Preview Week Ahead

EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month.

Read More »

Read More »

Emerging Markets: What Changed

Indonesia will freeze prices for electricity, gasoline, and diesel fuel until next year. US President Trump and North Korean President Kim Jong Un will hold a summit meeting this spring. National Bank of Poland has tilted even more dovish. Moody’s downgraded Turkey a notch to Ba2 with a stable outlook. Saudi Arabian Energy Minister hinted that the Aramco IPO could be delayed until 2019. Tanzania finally obtained a sovereign rating after years of...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely.

Read More »

Read More »

Emerging Markets: What Changed

China plans to change its constitution to eliminate term limits for President Xi Jinping. Bank Indonesia Deputy Governor Perry Warjiyo was nominated by President Widodo to be the next Governor. Bank of Korea Governor Lee was reappointed by President Moon for a second term. Hungary ruling party candidate lost the mayoral vote in Hodmezovasarhely. S&P upgraded Russia to BBB- with stable outlook.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note and capped off a soft week overall. Best performers last week were ZAR, CLP, and PHP while the worst were TRY, ARS, and IDR. Fed Chief Powell’s testimony to Congress will likely draw market attention back to Fed policy.

Read More »

Read More »

Emerging Markets: What Changed

China regulators have taken over Anbang Insurance. Group for at least one year. RBI minutes from this month’s meeting were more hawkish than expected. The RBI is reportedly reviewing its process for allowing local companies to issue debt overseas. Effective June 1, IDR-denominated debt becomes eligible for the Barclays Global Aggregate Index.Israeli Prime Minister Netanyahu is coming under increasing pressure.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended on a mixed note Friday, but capped off a very strong week overall. Best performers over the past week were RUB, ZAR, and COP, while the worst were PHP, CNY, and TWD. There is not much happening this week that could disrupt the weak dollar narrative, and so EM FX should continue to rally.

Read More »

Read More »

Emerging Markets: What Changed

The National Stock Exchange of India will end all licensing agreements and stop offering live prices overseas. Philippine central bank cut reserve requirements for commercial banks. Egypt cut rates for the first time since 2015. Israeli police recommended that Prime Minister Netanyahu be charged. South Africa President Zuma resigned before a no confidence vote was held.

Read More »

Read More »

Emerging Markets: The Week Ahead, February 12

EM FX ended Friday on a mixed note, as risk assets recovered a bit from broad-based selling pressures. Best EM performers on the week were ZAR, PHP, and CNY while the worst were COP, RUB, and ARS. Besides the risk-off impulses still reverberating through global markets, we think lower commodity prices are another headwind on EM.

Read More »

Read More »

Emerging Markets: What has Changed

Reuters reported that China may loosen controls on outbound capital flows (QDLP). Samsung chief Lee was set free in an unexpected court reversal. Romania central bank hiked rates by 25 bp and raised its inflation forecasts for the next two years. South Africa President Zuma appears to be on the way out. Ecuador voters approved a referendum that reinstates term limits for the president. Venezuela central bank restarted FX auctions for the first time...

Read More »

Read More »

Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in correction territory, down 10% from the...

Read More »

Read More »

Great Graphic: European Equities Lead Move

European equities peaked earlier and have fallen the furthest. MSCI EM equities faring the best, and as of now, they are still up on the year. MSCI Asia Pacific fell 3.4% today and is now down 0.33% for the year.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a weak note and capped off a week of softness. We felt that more and more EM policymakers were getting uncomfortable with FX strength and are likely welcome this recent weakening. However, that's only if their stock and bond markets hold up, which they are (for now).

Read More »

Read More »

Emerging Markets: What Changed

India plans to increase spending and widen its budget deficit targets ahead of key elections. India appears to be cracking down on cryptocurrencies. South Africa’s parliament has scheduled a no- confidence vote for Zuma on February 22. Turkish central bank raised its end-2018 inflation forecast in its quarterly inflation report. Peru’s Popular Force party expelled Kenji Fujimori and several of his allies.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX closed Friday on a mixed note, but still posted solid gains for the week as a whole. Best performers last week were ZAR, PLN, and CZK while the worst were ARS, PHP, and IDR. The bearish dollar environment remains intact and so we see further gains for EM FX this week. However, we continue to warn that divergences within EM are likely to assert themselves.

Read More »

Read More »

Emerging Markets: What Changed

Korea policymakers have asked state-owned banks and companies to limit the issuance of global bonds. Malaysia's central bank hiked rates for the first time in four years. Pakistan’s central bank unexpectedly hiked rates for the first time in over four years. Moody’s raised its outlook on Russia’s Ba1 rating from stable to positive. Argentina’s central bank surprised markets with its second straight 75 bp rate cut.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended last week on a soft note, but still enjoyed a relatively positive tone for the week as a whole. Best performers last week were MXN, ZAR, and CNY while the worst were ARS, TRY, and CLP. With little on the horizon to give the dollar some traction, we think EM FX will likely continue to firm this week. However, we again urge caution and look for divergences within EM.

Read More »

Read More »