Tag Archive: Emerging Markets

Emerging Markets: Preview of the Week Ahead

EM FX continues to rally as the dollar remains on its back foot. With no obvious drivers this week that might help the dollar, we believe EM FX can extend the recent gains. Still, we continue to advise caution when investing in EM, as differentiation should again become evident as idiosyncratic risks remain in play.

Read More »

Read More »

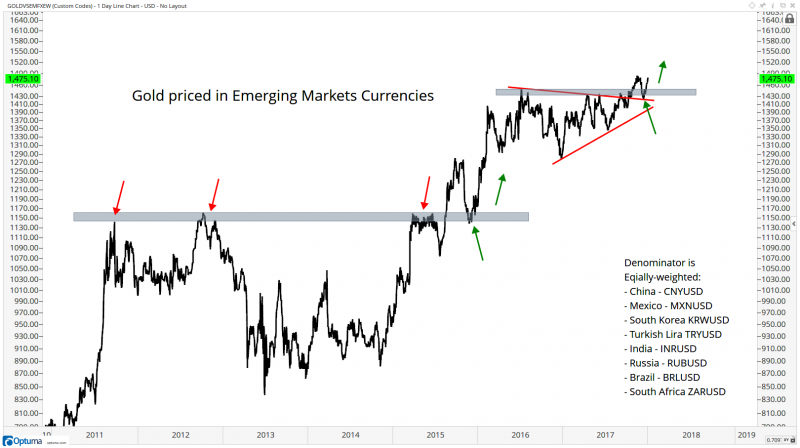

Gold Hits All-Time Highs Priced In Emerging Market Currencies

Gold Hits All-Time Highs Priced In Emerging Market Currencies. Gold at all time in eight major emerging market currencies. A stronger performance than seen when priced in USD, EUR or GBP. As world steps away from US dollar hegemony expect new gold highs in $, € and £. Gold is a hedge against currency debasement and depreciation of fiat currencies.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX was mostly firmer last week, but ended on a mixed note Friday. Best performers on the week for COP, MXN, and BRL while the worst were ARS, PHP, and CNY. We continue to warn investors against blindly buying into this broad-based EM rally, as we believe divergences will once again assert themselves in the coming weeks.

Read More »

Read More »

Emerging Markets: What Changed

Tensions on the Korean peninsula appear to be easing. Relations between Pakistan and the US have worsened. The Philippine central bank is tilting more hawkish. The ANC may consider removing Zuma from the presidency at the January 10 meeting of its National Executive Committee. Turkish banker Atilla was convicted of helping Iran evade US financial sanctions.

Read More »

Read More »

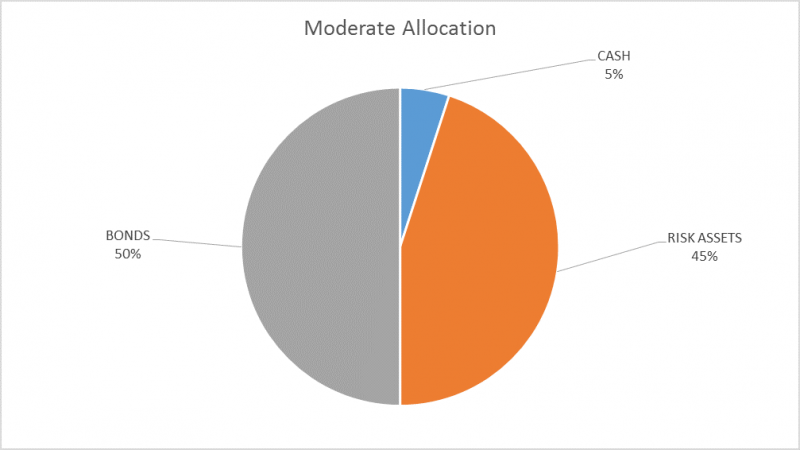

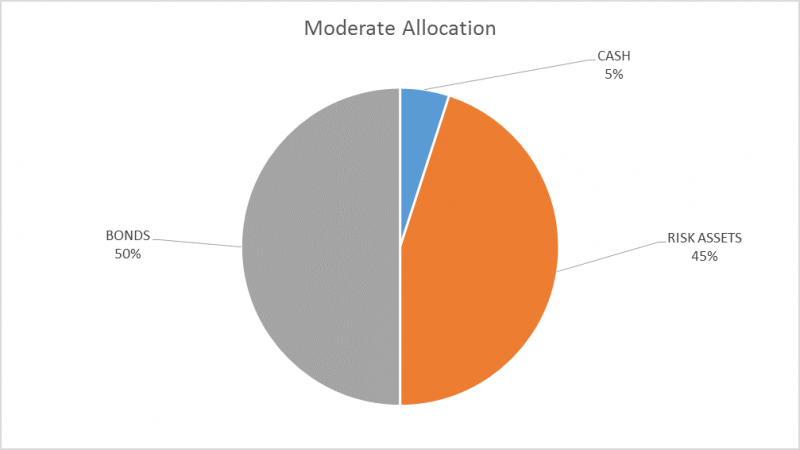

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged.

Read More »

Read More »

Emerging Markets: What has Changed

Fitch upgraded Indonesia by a notch to BBB with stable outlook. EU-Poland tensions entered a new phase. Cyril Ramaphosa was elected as the new ANC President over opponent Nkosazana Dlamini-Zuma. Argentina’s lower house approved President Macri’s pension reform bill. Sebastian Pinera won the Chilean presidency in the second round vote.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX was mixed last week, with political optimism driving the big winners ZAR and CLP. We remain cautious, as the Fed has signaled its intent to continue tightening in 2018.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed on a firm note, though most currencies were down for the entire week. TRY and ZAR outperformed, but we do not think that will be sustained. FOMC meeting this week will provide some event risk for EM.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended the week on a mixed note. US jobs data may refocus market attention on Fed tightening. Most EM inflation readings this week are expected to show easing price pressures, supporting a dovish EM central bank outlook. The major exceptions are Mexico and Turkey, whose central banks may be forced to tighten policy in the coming weeks.

Read More »

Read More »

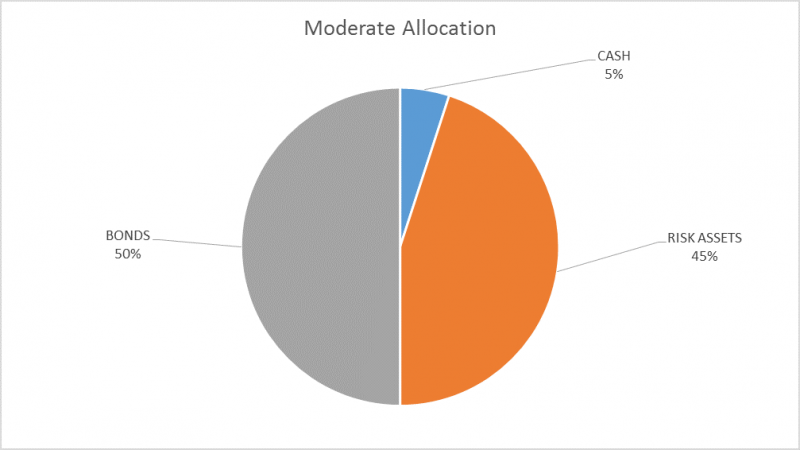

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash.

Read More »

Read More »

Emerging Markets: What Changed

Bank of Korea hiked rates by 25 bp to 1.50%, the first hike in six years. Egypt central bank lifted the last remaining currency controls. S&P cut South Africa’s foreign currency rating one notch to BB with stable outlook. Turkey President Erdogan was implicated in an alleged plot to help Iran evade US sanctions. Moody’s upgraded Argentina one notch to B2 with stable outlook.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended the holiday-shortened week on a soft note. While most were up on the entire week, notable laggards were TRY, CLP, and ZAR. All three currencies underperformed due to rising political risks, and we suspect that will continue. We believe MXN and BRL are likely to rejoin the laggards in the coming days.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended the week firm, and capped off a good week overall. Best performers last week for ZAR and KRW, while the worst were TRY and IDR. Until we get higher US rates, the dollar may remain under modest pressure. This would help EM maintain some traction, though we remain cautious.

Read More »

Read More »

Emerging Markets: What has Changed

Moody's raised India's sovereign debt rating for the first time since 2004 by a notch to Baa2. Nigerian officials are on a global roadshow to support plans to issue its longest-dated Eurobonds ever. The head of South Africa’s budget office resigned.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX closed the week on a soft note. For the week as a whole, best performers were MYR, PLN, and COP, while the worst were BRL, ZAR, and INR. US inflation and retail sales data will likely set the tone for EM. Also, the US fiscal debate is set to continue this week, so expect lots of choppy trading across many markets.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week under pressure. News of the Venezuela debt restructuring was digested well, but sentiment went south as the day wore on. Weakness was concentrated in the weakest links TRY, BRL, RUB, and ZAR, while MXN and COP were dragged along for the ride. We see EM selling pressures persisting into 2018.

Read More »

Read More »

Global Asset Allocation Update

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise.

Read More »

Read More »

Emerging Markets: What has Changed

EM FX gained some limited traction Friday but still capped off another awful week. So far this quarter, the worst EM performers are TRY (-6%), MXN (-5%), ZAR (-4%), COP, and BRL (both -2.5%). We expect these currencies to remain under pressure as political concerns are unlikely to dissipate anytime soon.

Read More »

Read More »

Emerging Markets: What has Changed

President Xi Jinping’s concepts of socialist thinking were written into China’s constitution. Malaysia Prime Minister Najib presented an expansionary budget for 2018 ahead of elections. Czech billionaire Andrej Babis’ ANO party won the elections. South Africa's mid-term budget statement acknowledged the deteriorating outlook but offered little in the way of solutions. Press reports suggest Germany is working to cut funding for Turkish banks.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week on a soft note. Indeed, nearly every EM currency was down for the entire week, led by ZAR, BRL, and TRY. While higher US rates will pressure EM FX as a whole, we think heightend political risk will continue to hit these three currencies particularly hard, plus perhaps MXN too.

Read More »

Read More »