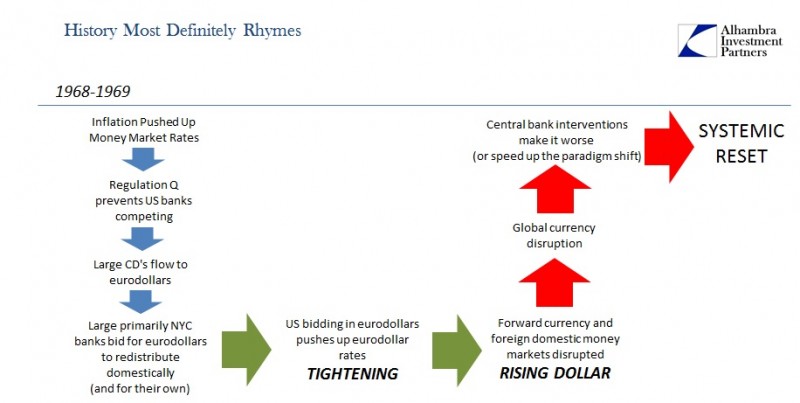

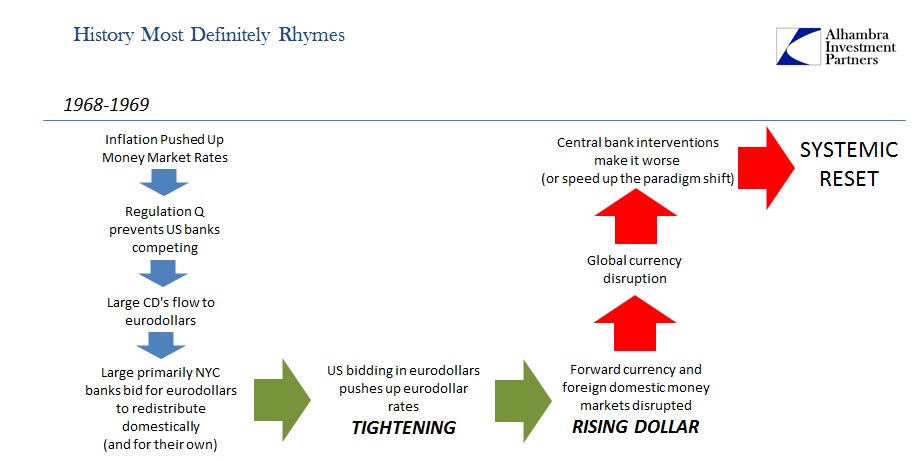

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Tag Archive: excess reserves

Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »

Read More »

Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today's uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of "helicopter money" is about to be unveiled in Japan by the world's most experimental central bank. However, as Nomura's Richard Koo warns, central banks may get much more than they bargained for, because helicopter money "probably marks the end of the road for believers in the omnipotence of monetary policy who have continued to press for further...

Read More »

Read More »

HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth.

For whatever reason, Haruhiko Kuroda’s move into NI...

Read More »

Read More »

BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is...

Read More »

Read More »

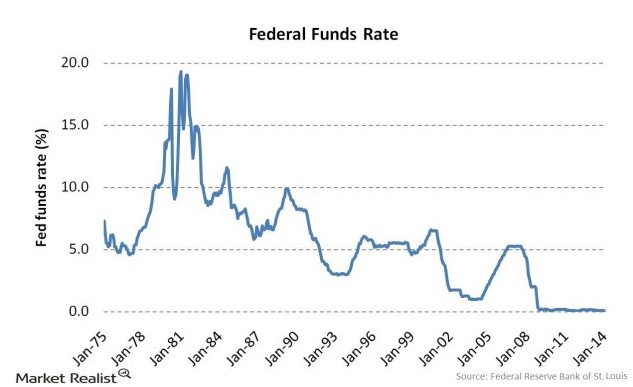

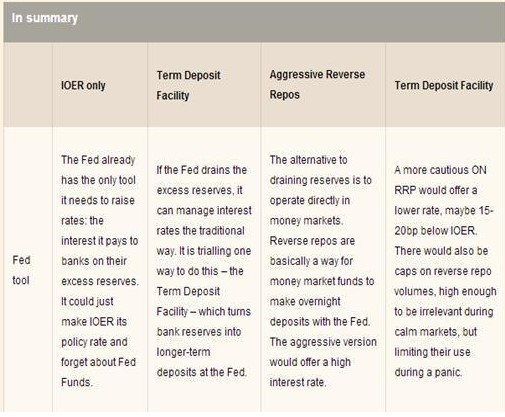

Can The Fed Raise Interest Rates?

Keith Weiner argues that the question should be, not when the Fed will raise interest rates, but if. Before our central planners can raise rates, they must deal with a problem of their own making.

Read More »

Read More »

Germany: Last European Country with Lots of Cash Under Matresses

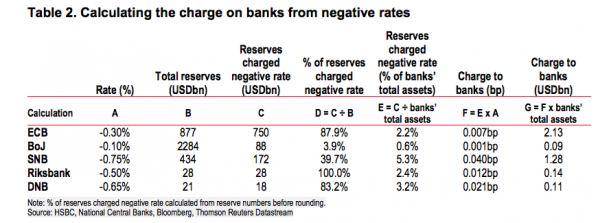

In June 2014, the ECB decided to introduce negative rates on the excess reserves of banks. We explain that German banks had already removed most excess liquidity before the ECB meeting of June 2014, and they will continue to do so. Hence hardly any German bank will pay negative rates after the recent ECB decisions at that meeting.

Read More »

Read More »

Cleveland Fed: Price inflation is a monetary phenomenon

Cleveland Fed: Price inflation is a monetary phenomenon. Hence, the money multiplier theory is still valid, just not in the US and in Europe.

Read More »

Read More »

Is the SNB Intervening Again?

Update March 21, 2014: Total SNB sight deposits increased to 367.8 bln. CHF, but flows reverted a bit. Foreign banks and “non-banks” reduced their CHF exposure at the SNB to 50.8 bln, possibly converting a part of the difference into USD. Dollars are more useful when sanctions will hurt both Russian and German firms. On … Continue...

Read More »

Read More »

Why negative interest rates are contractionary, the base money confusion

From FT Alphaville: Excess reserves do not mean banks are not lending, and enforcing negative rates may do more harm than good because it is ultimately contractionary rather than expansionary.

Read More »

Read More »