Tag Archive: Federal Reserve

Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year.

Read More »

Read More »

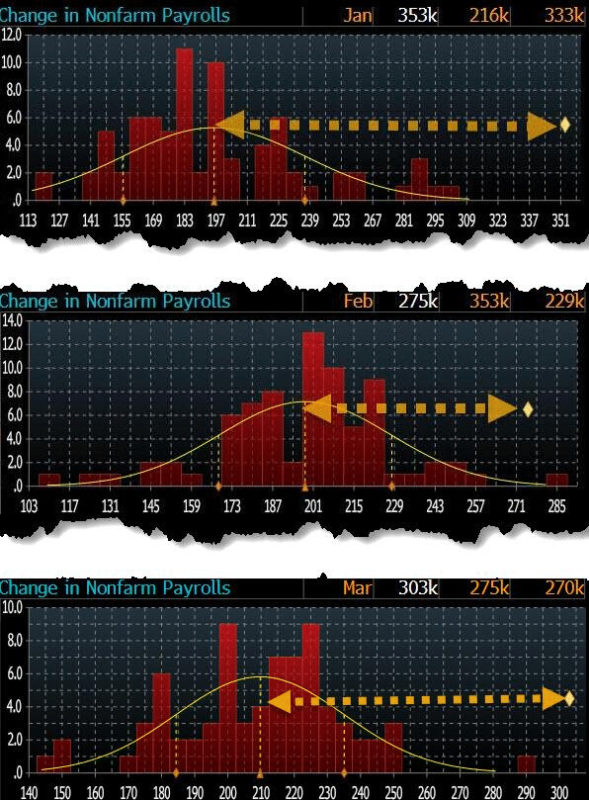

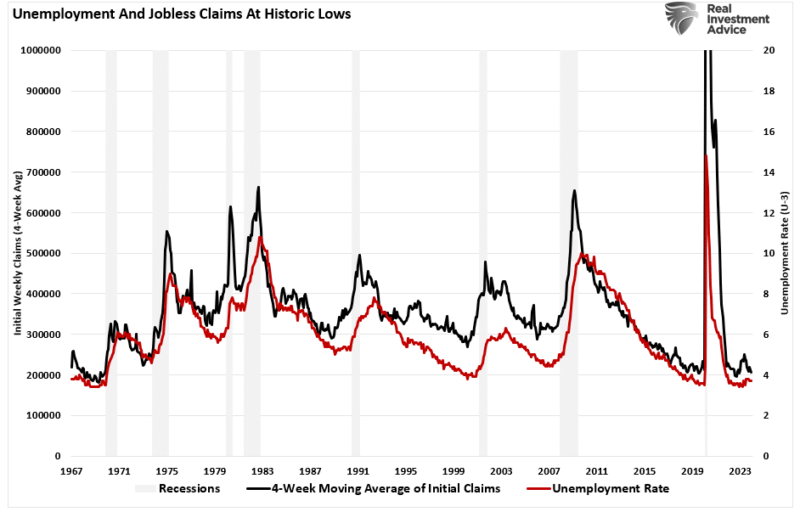

Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border.

Read More »

Read More »

Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote.

Read More »

Read More »

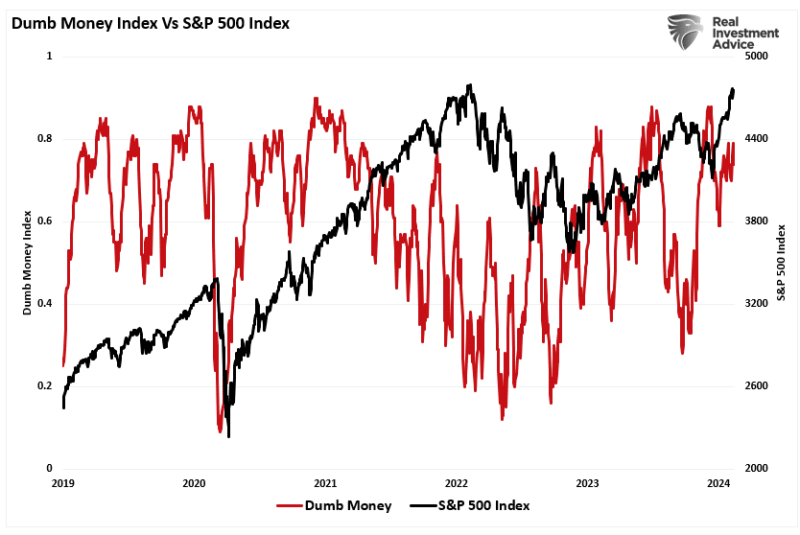

Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

Read More »

Read More »

Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies.

Read More »

Read More »

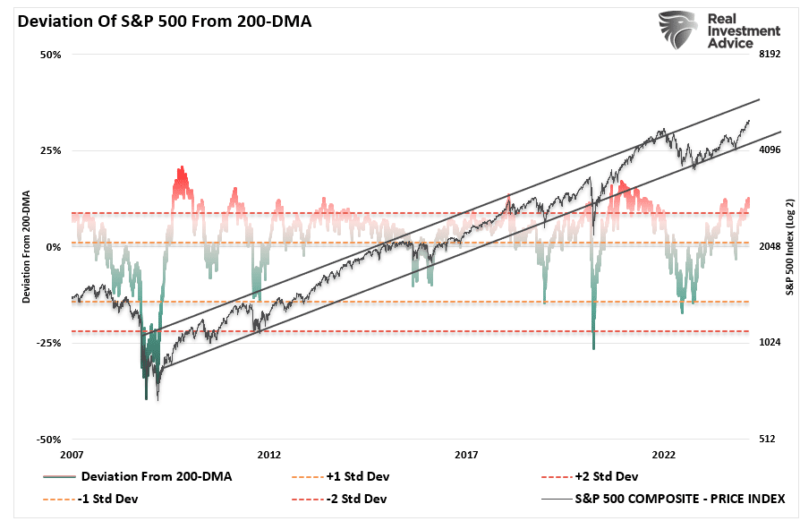

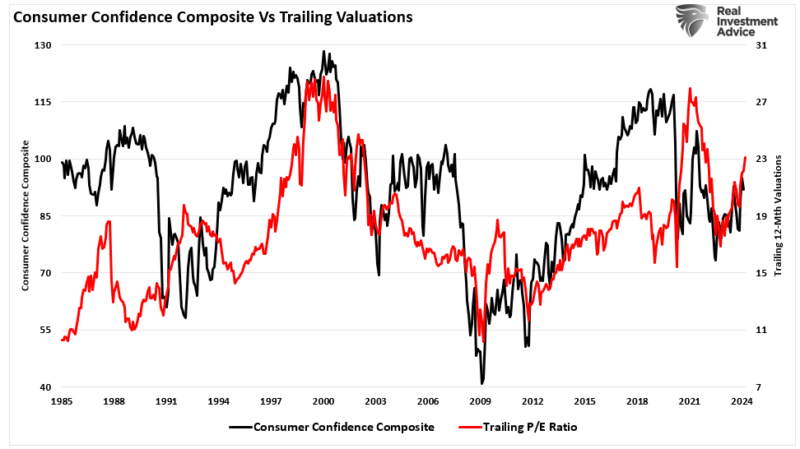

Valuation Metrics And Volatility Suggest Investor Caution

Valuation metrics have little to do with what the market will do over the next few days or months. However, they are essential to future outcomes and shouldn’t be dismissed during the surge in bullish sentiment. Just recently, Bank of America noted that the market is expensive based on 20 of the 25 valuation metrics they track.

Read More »

Read More »

Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average...

Read More »

Read More »

The US Dollar and Rates Rise Further

Overview: The US dollar and interest rates have continued to

rise after the strong employment report before the weekend helped drive home the

Fed's message at last week's FOMC meeting. The greenback has been bid to new

highs for the year against the G10 currencies but the Canadian dollar. The

dollar also rose to a marginal new high for the year against the Chinese yuan. Interest

rates are jumping, and the market has downgraded the chances of a May...

Read More »

Read More »

Sobering PMI Readings Sap Risk Appetites

Overview: As US markets prepare to re-open from yesterday's holiday, the dollar

is trading mostly higher, though the euro and yen are steady to slightly firmer.

Narrow ranges are prevailing. The Canadian and Australian dollars are

exceptions and are off about 0.3%. Emerging market currencies are mostly lower,

including Russia, China, South Africa, and Turkey. Final service and composite

PMIs were mostly revised lower in Japan, Australia, and the...

Read More »

Read More »

BOJ Stands Pat while the Dollar is Consolidating Ahead of the Weekend

Overview: The market has not yet become convinced

that the Fed will in fact deliver the two hikes the median dot anticipates this

year, and the dollar was sold off sharply yesterday, the day after the FOMC

meeting. In fact, the swaps market is more convinced that the ECB hikes in July

than the Fed. Outside of the yen, which was sold after the BOJ stood pat, the

G10 currencies are mostly little changed, consolidating the recent moves. Emerging...

Read More »

Read More »

ECB’s Turn

Overview: The Fed's

hawkish hold and signal that it may raise rates two more time this year sent

ripples through the capital markets. Risk appetites have been dealt a blow. However,

China's rate cut and likely additional supportive measures after disappointing

data, helped lift the CSI 300 by 1.6%, the most this year. The Hang Seng rose

by nearly 2.2%, the most in three months. Europe's Stoxx 600 is snapping a

three-day advance and US index futures...

Read More »

Read More »

Dollar Comes Back Bid, as First Republic Taken Over (Mostly) by JP Morgan

Overview: Most markets are closed for the May Day

holiday. News that JP Morgan will acquire most of First Republic assets will be

a relief for the markets. US equity futures are slightly firmer, and the

10-year Treasury yield is around three basis points higher, slightly above

3.45%. Recall that before the weekend, it has fallen from almost 3.55% to 3.42%.

The market has more than a 90% chance of a quarter-point hike discounted for

Wednesday. The...

Read More »

Read More »

Greenback Pares Yesterday’s Gains

Overview: As the long-holiday ends, risk appetites

have returned. Equities and yields are mostly higher. The dollar is seeing

yesterday's gains pared. Yesterday's setback in the yen helped lift Japanese

stocks, with the Nikkei advancing 1%. Several other markets in the region also

gained more than 1%, including Australia and South Korea. China's CSI was an

exception. It slipped fractionally. Europe's Stoxx 600 is up nearly 0.6%

through the European...

Read More »

Read More »

The Dollar Jumps Back

Overview: The pendulum of market expectations has

swung dramatically and now looks for 100 bp cut in the Fed funds target this

year. That seems extreme. At the same time, the dollar's downside momentum has

stalled, suggesting that the dollar may recover some of the ground lost

recently as the interest rate leg was knocked out from beneath it. The euro

twice in the past two days pushed through $1.09 only to be turned away.

Similarly, sterling pushed...

Read More »

Read More »

Market Hears Dovish Fed Hike and Sells Dollars

Overview: The dollar remains under pressure

following the Federal Reserve's rate hike. The market thinks it heard that the

Fed was done hiking, even though Fed Chair Powell held out the possibility that

"some additional firming may be necessary." The Norwegian krone

is the strongest of the G10 currencies today, up more than 1%, spurred by a 25

bp hike and a commitment to do more. The Dollar Index briefly traded below

102.00 for the...

Read More »

Read More »

North America likely will Sell USD Bounce Seen in Europe

Overview: The failure of the Federal Reserve to push harder against the market's dovish views and the easing of financial conditions encouraged a risk-on trade that saw the dollar and yields slump and equities rally. There has been limited follow-through dollar selling today, and a small recovery ahead of the Bank of England and European Central Bank meetings.

Read More »

Read More »

“Markets and civil society are win-win institutions, government and politics are zero-sum.”

Division, friction and polarization have been on the rise in the West for at least a decade, but the escalation we saw during the “covid years” was especially worrying. Over the last year, this “worry” has become a truly pressing concern, even a real emergency one might argue, as inflationary pressures and an actual war were added to the mix of political and social tensions.

Read More »

Read More »

“It begins”: The rise of the digital dollar

In mid-November, while the whole world was focused on the Ukraine crisis, the US midterms or whatever other “big story” the media decided was more important, a truly momentous shift took place in the global financial system. It might seem like a small step on the surface, but it has the potential to bring about a real and possibly irreversible sea change in the way we use money; or better said, the way it uses us.

As Reuters reported on the...

Read More »

Read More »

Is Central Banks’ License to Print Money About to Expire?

2022-10-29

by Stephen Flood

2022-10-29

Read More »