Tag Archive: Federal Reserve

Dollar Index: The Chart Everyone is Talking About

Many are discussing a possible head-and-shoulders pattern in the Dollar Index. We are skeptical as other technical signals do not confirm. We recognize scope for disappointment over the border tax and the next batch of employment data, but European politics is the present driver and may not be alleviated soon.

Read More »

Read More »

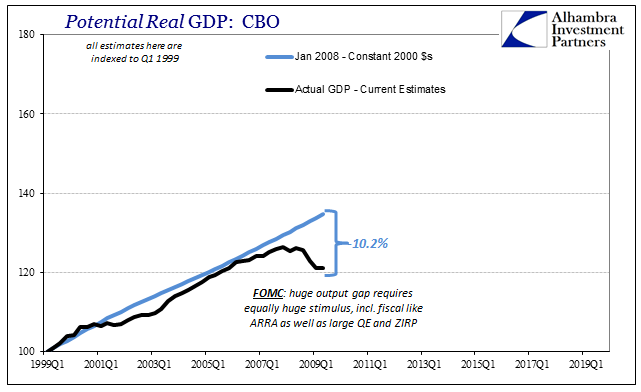

Their Gap Is Closed, Ours Still Needs To Be

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great “Recession” at around 10% of the CBO’s...

Read More »

Read More »

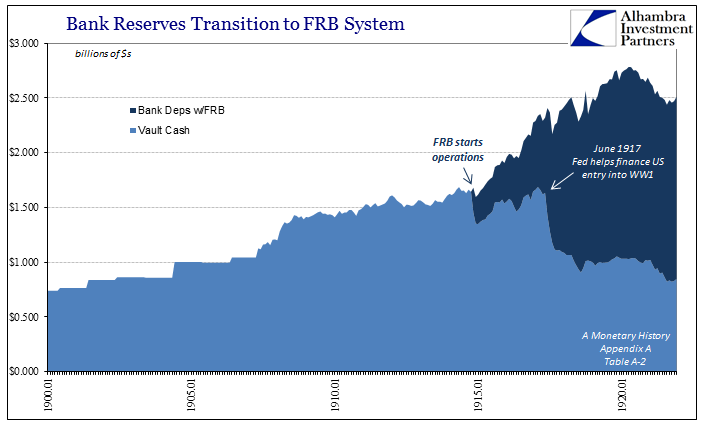

A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it.

Read More »

Read More »

FX Weekly Preview: Yellen’s Path Cleared by Trump’s Moderation

Trump has moderated in several areas, he is being checked in others, and less impactful in others. This will underscore the focus on Yellen's testimony this week. At same time, many will be reluctant to short the dollar ahead of the tax reform plans that may be unveiled in Trump's upcoming speech to Congress.

Read More »

Read More »

FX Weekly Preview: Yellen nor Kuroda nor Carney will Take the Spotlight from Trump

Fed, BOJ, and BOE meet next week, each may adjust economic assessments in more favorable direction. Key challenge for many investors is the new US Administration. US employment, EMU inflation, Q4 GDP, and China's PMI are among the data highlights.

Read More »

Read More »

Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos' elites discussed why the world needs to "get rid of currency," the European Commission has introduced a proposal enforcing "restrictions on payments in cash.

Read More »

Read More »

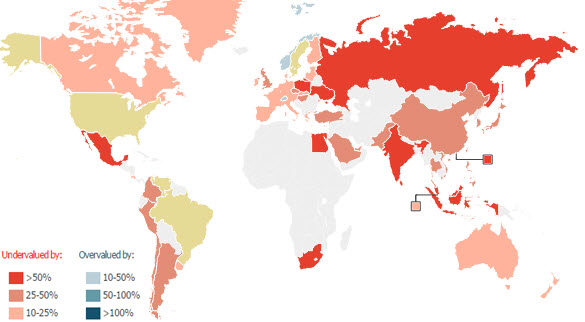

The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto.

Read More »

Read More »

Pension Funds Need Gold before It’s Too Late

Tens of millions of Americans and their employers pour money into pension plans each month, counting on those funds to grow and to be there when needed at retirement. But a time bomb awaits. The bulk of U.S. pension funds are dangerously underfunded, and the assets are often invested in securities that have bleak prospects for providing income that keeps up with a general decline in purchasing power.

Read More »

Read More »

First ZeroHedge Symposium and Live Fight Club

For over four decades, many of the planet's biggest trouble makers and assholes have met each year in Davos, Switzerland, for the World Economic Forum with the humble mission of, "Improving the state of the world."

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

Cool Video: Double Feature on Bloomberg

I am finishing the year like I began it, on Bloomberg Television, talking about the dollar and Fed policy. Bloomberg has made two clips of my interview available.

Read More »

Read More »

FX Outlook 2017: Politics to Eclipse Economics

Investors are familiar with a broad set of macroeconomic variables that often drive asset prices. Many are familiar with corporate balance sheets, price-earning ratios, free cash flow, Q-ratio, and the like.

Read More »

Read More »

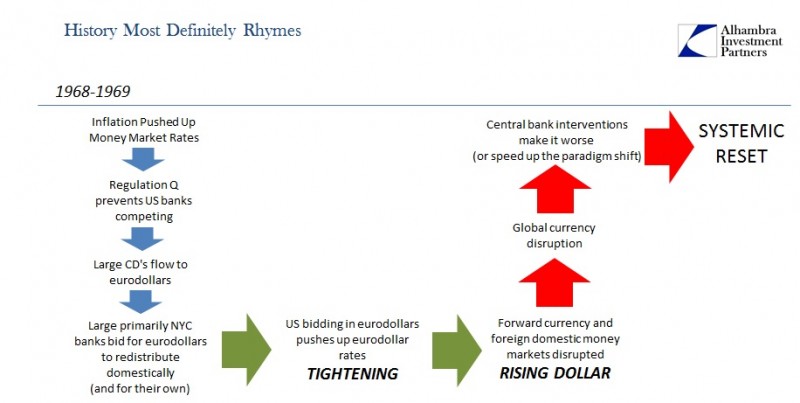

We Know How This Ends – Part 2

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »

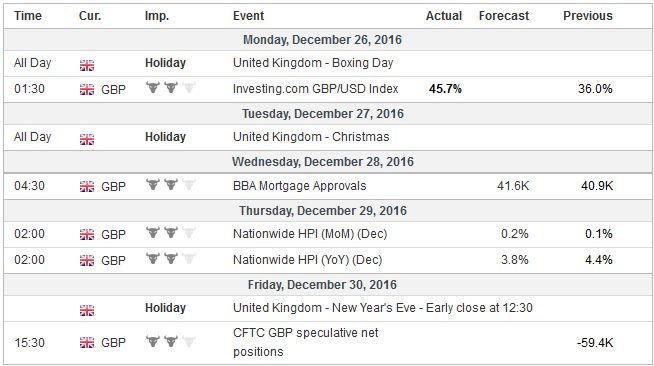

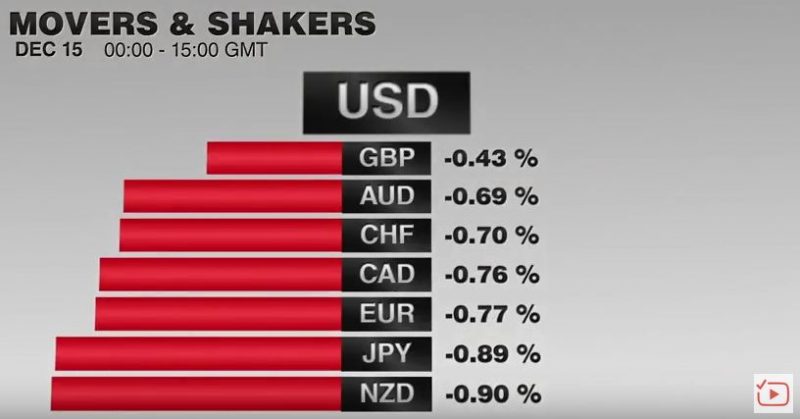

FX Daily, December 15: Greenback Extends Gains on Back of Fed

Sterling has made steady gains against the CHF over the past month and although the spike has levelled this week, the Pound has certainly gained a foothold. Yesterday’s decision by the US Federal Reserve to raise their base rate from 0.25% to 0.5% did little to shift the value of GBP/CHF but with investors still digesting the outcome, we may yet find it still has an effect.

Read More »

Read More »

Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday's agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its highest close since September...

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

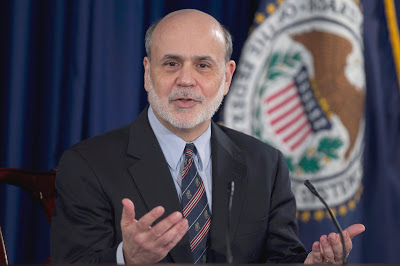

Bernanke Suggests How to Use the Dot Plots

The dot plots are not FOMC commitments or an aggregate view of the FOMC. They are a collection of individual economic forecasts based on the most likely scenario and their view of appropriate policy. The SEP is useful for understanding how Fed officials view the long-term economic parameters, which appears to explain the downward shift in the long-term equilibrium rate for Fed funds.

Read More »

Read More »