Tag Archive: Federal Reserve

Stockman Rages: Ben Bernanke Is “The Most Dangerous Man Walking This Planet”

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life he is surely the pied piper of monetary ruin. At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis.

Read More »

Read More »

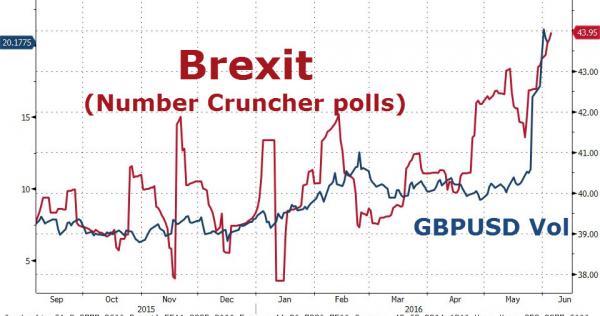

The British Referendum And The Long Arm Of The Lawless

Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law.

Read More »

Read More »

Bullard’s New Paradigm and the Federal Reserve

There is much to like in Bullard's new paradigm.

The problem is that it does not reflect the Federal Reserve's view or approach.

Policy emanates from the Fed's leadership, but be confused by the noise.

Read More »

Read More »

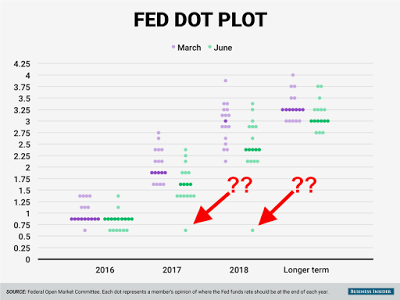

US Negative Interest Rate Bets Surge To Record Highs

As the "deflationary supernova" sweeps across the world, dragging bond yields to zero-and-beyond, even the almighty omniscent Federal Reserve has been forced to capitulate as the 'cheapness' of Treasury bonds lures the world's yield-hunters dragging ...

Read More »

Read More »

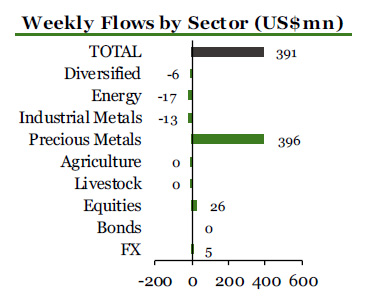

Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely …

Read More »

Read More »

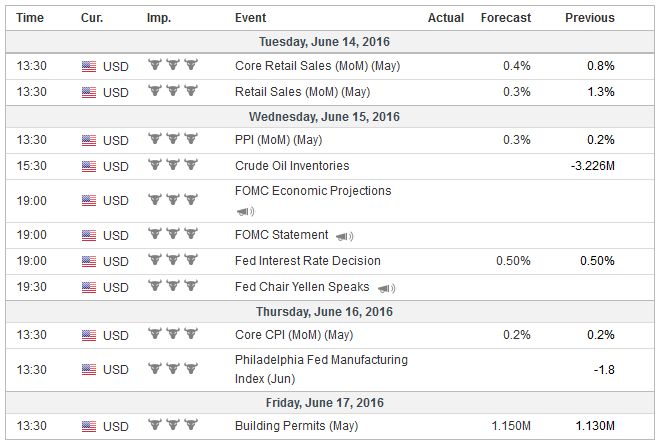

FX Daily, June 15: Key Data and FOMC

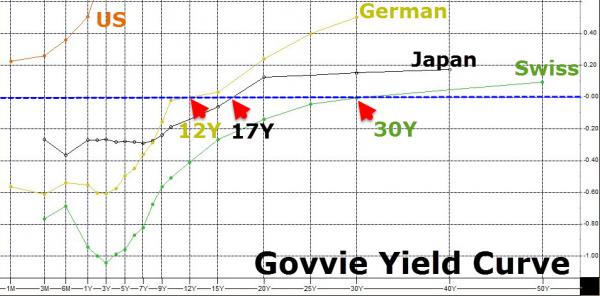

The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar.

Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduce the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again.

Read More »

Read More »

Fed Softens Stance Slightly

The immediate reaction was driven by the Fed's dot plots. Although the median continues to expect two hikes this year, six officials now see only one hike. Only one official anticipated one hike this year in the last forecasts made in March. The m...

Read More »

Read More »

Central Banks & Governments and their gold coin holdings

While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves.

Read More »

Read More »

FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four

central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials

were preparing the market for a summer hike. Risks of a new downturn in

Japan spurred spe...

Read More »

Read More »

Presidential Elections and Fed Policy: How Close is Close?

The most important element in next week’s FOMC meeting may come from the dot plot and whether Fed officials back away from the two hikes thought appropriate in March. When looking the schedule of FOMC meetings, and understanding that when the Fed says “gradual” to describe the normalization process, it does not mean hiking at …

Read More »

Read More »

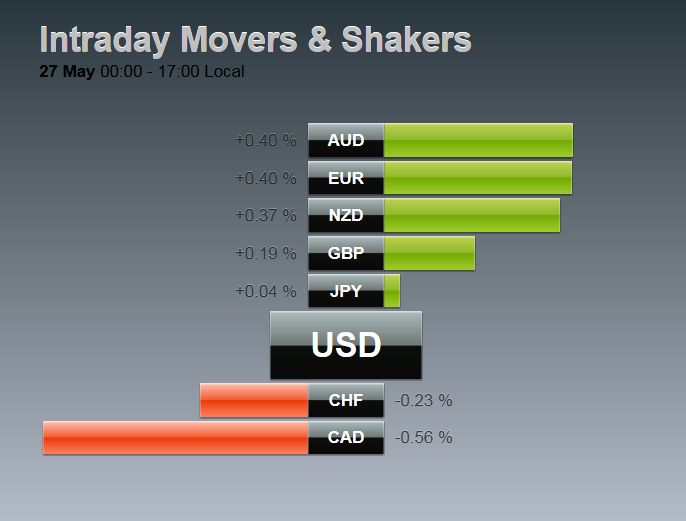

FX Daily, May 27: Dollar Firms as Traders Await Yellen

The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday's ranges while sterling and the Canadian dollar pushing through yesterday's lows.

Asian ...

Read More »

Read More »

LIBOR Alternatives Taking Shape

Since the LIBOR scandal erupted, US officials have been working toward an alternative benchmark. In 2014, the Fed set up a working committee that includes more than a dozen large banks and regulators Before the weekend the committee (Alternative Reference Rates Committee) proposed two possible replacements for LIBOR. There reportedly was some consideration of …

Read More »

Read More »

Three unintended consequences of NIRP

Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues differently: Falling prices are a consequence of low interest rates.

Read More »

Read More »

Fed Suppression, Long Term Economic Repression

The Federal Reserve really wants to raise rates, but they do not dare as the consequence of interrupting an unprecedented level of capital misallocation is too grave to face head on. So our money masters continue their low interest rate policy; pulli...

Read More »

Read More »

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

Mind Control as a method to support the US Dollar

With dollar mind control, the American elites ensure that the dollar remains the global reserve currency. Average Americans should only consume and should not have access to sophisticated financial services.

Read More »

Read More »