Tag Archive: Federal Reserve

FX Weekly Preview: The Week Ahead is not about the Week Ahead

It's the last week of August. Several economic reports will be released in the coming days. They include the US deflator of consumer expenditures that the Federal Reserve targets, China's PMI, and the eurozone's preliminary August CPI. It is not that the data do not matter, but investors realize the die is cast.

Read More »

Read More »

FX Daily, August 23: Market has Second Thoughts on Magnitude of Fed Cuts Ahead of Powell

Powell speech at Jackson Hole stands before the weekend. Equities in Asia and Europe are finishing the week on a firm tone. Most markets in the Asia Pacific region closed higher today, and the MSCI Asia Pacific Index snapped a four-week slide. European bourses are edging higher, and the Dow Jones Stoxx 600 is poised to end its three-week air pocket.

Read More »

Read More »

FX Daily, August 21: European Stocks Snap Back, Market Hopeful Italian Election can be Delayed

The end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday's losses and more. It was led higher by consumer discretionary, energy, and industrials.

Read More »

Read More »

FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends.

Read More »

Read More »

FX Weekly Preview: Macro Deterioration

The US-China tensions remain the dominant driver of investor risk appetites. President Trump has repeatedly accused China of manipulating its currency on twitter, and finally Treasury Secretary Mnuchiin acquiesced after China failed to prevent the dollar from rising above CNY7.0.

Read More »

Read More »

FX Weekly Preview: The Dog Days of August are Upon Us

The die is cast. To defend the uneven expansion and ward off disinflationary forces, monetary authorities will provide more accommodation. The Federal Reserve delivered its first rate cut in more than a decade and stopped unwinding its balance sheet two months earlier than it previously indicated (worth $100 bln of additional buying of Treasuries and Agencies).

Read More »

Read More »

FX Daily, August 1: Mid-Course Correction Sends Greenback Higher

Overview: The Federal Reserve delivered the first rate cut since the Great Financial Crisis but couched it in terms of a mid-course correction rather than the start of a larger easing cycle. By doing so, Fed chief Powell cast the cut in less dovish terms than the market expected and the reaction function of the market has been clear.

Read More »

Read More »

FX Weekly Preview: The FOMC and US Jobs Headline the Week Ahead

There is little doubt that the Federal Reserve will ease monetary policy at the conclusion of the FOMC meeting on July 31. We never thought the chances of a 50 bp move were anything but negligible, though even at this late stage, the market appears to be pricing in about a one-in-five chance.

Read More »

Read More »

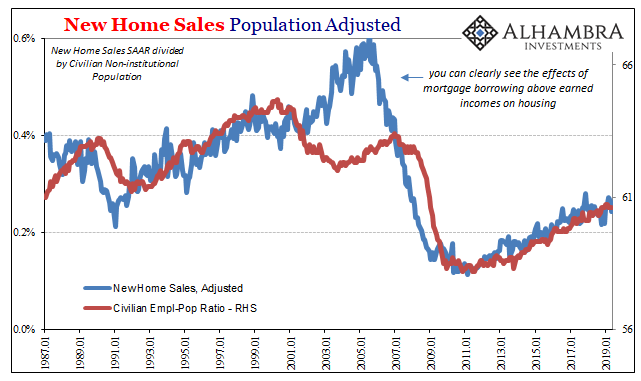

What Does It Mean That Real Estate, Not Equities, Is Driving Monetary Policy?

In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it.

Read More »

Read More »

FX Weekly Preview: Highlights in the Week Ahead

Three events that will capture the market's attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa.

Read More »

Read More »

FX Daily, July 19: Dollar Pares Losses as Market Partly Corrects Confusion of Magntiude and Timing of Fed

Overview: Comments underscoring the importance of acting preemptively by two Fed officials sent the dollar reeling and helped lift equities after the S&P fell to a two and a half week low. The decline in rates and the US shooting down of an Iranian drone in the Gulf helped spur gold to new six-year highs. There was some attempt to clarify the (NY Fed's) comments and the dollar has pared yesterday's losses.

Read More »

Read More »

FX Daily, July 17: Back to the Well Again

Overview: After slapping punitive tariffs on structural from China and Mexico last week, US President Trump threatened to end the tariff truce with China because it is not stepped up its purchases of US agriculture products. Trump said the tariff freeze was in exchange for ag purchases, but at the time it seemed as if granting licenses to US companies to sell to Huawei was the quid pro quo.

Read More »

Read More »

FX Weekly Preview: What to Watch if Fed and ECB are Committed to Easing

There is little doubt after the Federal Reserve Chairman Powell's testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB's move is more debatable, an adjustment at the July 25 meeting appears to have increased.

Read More »

Read More »

FX Daily, July 10: North American Focus: Poloz and Powell

Overview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell's testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is helping drag up global yields, and today Asia Pacific yields mostly rose 2-3 basis points while core European bond yields are 5-7 bp higher and peripheral yields up a little less.

Read More »

Read More »

FX Weekly Preview: In Bizzaro Beauty Contest, the US is Still the Least Ugly

Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing.

Read More »

Read More »

FX Daily, July 03: Yields Extend Decline

Overview: Interest rates are lurching lower. The US 10-year yield is at new two-year lows, but the driver is European bonds where peripheral yields are 6-7 bp lower, though Italy's benchmark is off 12 bp, while core yields are down 2-3 bp to new record lows. The German benchmark is almost minus 40 bp, while the Swiss 10-year is beyond minus 100 bp. Italy's two-year is breaking more convincingly below zero.

Read More »

Read More »

FX Weekly Preview: Macro Update: Melodrama Subsides but Capriciousness Remains

Since President Trump declared the end of the tariff truce with China in early May, an important focus for investors was the G20 meeting. It was only as it drew near was a meeting between the two heads of state confirmed. What was billed as an extraordinary meeting reportedly lasted less than 90 minutes, and the results were broadly as expected.

Read More »

Read More »

FX Weekly Preview: FOMC, EMU PMI, and Pre-G20 Positioning: Crossroads and Crosswinds

The week ahead is likely to provide some clarification for investors on three fronts that have been a source of uncertainty. The FOMC meeting, with updated forecasts, is center stage. The credit markets are pushing the Fed to be aggressive but can be disappointed. In the eurozone, the preliminary PMI may confirm a modest, even if uneven recovery.

Read More »

Read More »

FX Daily, June 05: Dollar Remains on Back Foot

Overview: The Federal Reserve's patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has some tempering of trade anxiety on the margin that is also constructive. Asia and European equities were pulled higher after the strongest rally in several months in the US.

Read More »

Read More »

FX Weekly Preview: The Evolution of Three Issues are Key in the Week Ahead

As May winds down, the light economic calendar will allow investors to take their cues from the evolution of three disruptive forces--trade, Brexit and the US economy. With actions against Huawei and possibly a handful of Chinese surveillance equipment producers, the US raised the stakes. The retaliatory tariffs are effective on June 1, but Beijing has not formally responded to the moves against Chinese companies.

Read More »

Read More »