Tag Archive: Federal Reserve

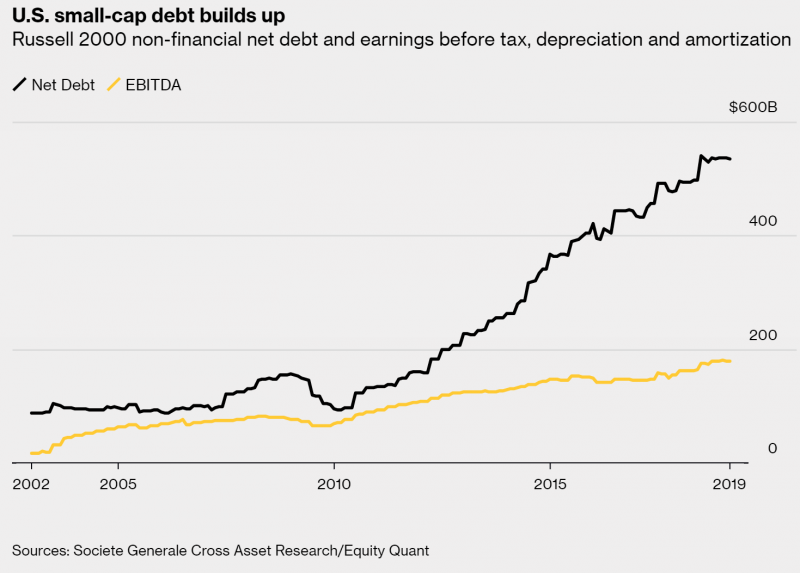

THE CURRENT MONETARY ORDER IS NEARING ITS END

Interview with Dimitri Speck. Given the massive intervention and monetary manipulation experiment by central banks over the last decade, the amount of distortions created in the market, as well as the record debt accumulation at all levels of the economy, have given rise to considerable risks for investors. For a more detailed understanding of these issues and for his outlook, I turned to Dimitri Speck, a renowned expert in the development of...

Read More »

Read More »

FX Daily, May 02: Dollar Consolidates Fed-Inspired Recovery

Overview: The US dollar is consolidating yesterday's post-Fed rally, and this is giving it a slightly heavier tone today. Equities are mostly lower and Europe's Dow Jones Stoxx 600 is off about 0.5% in late morning turnover, which if sustained would be the largest decline in three weeks. The S&P 500 posted a potential key reversal yesterday by setting new record highs and then closing below the previous session's low.

Read More »

Read More »

FX Daily, April 15: Redemption Monday

The holiday-shortened week is off to a slow, tentative start. The surge of the S&P 500 before the weekend failed to inspire today. Asia markets were mostly firmer, led by Japan, while China, Hong Kong, and Singapore moved lower.

Read More »

Read More »

FX Weekly Preview: Important Steps Away from the Abyss

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession.

Read More »

Read More »

Cool Video: Fed’s Independence Challenged and Defended

I was on the set Fox Business set this afternoon talking with Charles Payne and Quincy Krosby about Fed policy. Payne suggested that both the political left and right are trying to politicize the Federal Reserve to print money for their favorite programs.

Read More »

Read More »

FX Weekly Preview: The Green Shoots of Spring

Investors have worked themselves into a lather. Equities crashed in Q4 last year amid on corporate earnings and concerns about growth. The Fed’s tightening decision in December was made unanimously. The above-trend growth, the preferred inflation measure was near target, unemployment was the lowest in a generation and real rates were historically low.

Read More »

Read More »

FX Weekly Preview: Three Highlights in the Week Ahead

Three events next week will shape the investment climate. The Federal Reserve meets and will update its forecasts and guidance. The British House of Commons may vote for a third time on the Withdrawal Bill before Prime Minister May heads of the EU Summit to ask for an extension of the UK leaving the EU. The eurozone sees the flash March PMI, with great hope that the green shoots of spring will be evident.

Read More »

Read More »

FX Daily, February 13: QT is not the Opposite of QE

The Federal Reserve has long been clear on the sequence of events as it innovated the playbook during the Great Financial Crisis. There would be a considerable period between when the Fed would finish its credit easing operations that involved purchasing Treasuries and mortgage-backed securities (MBS) and its first-rate hike.

Read More »

Read More »

Short Note on Jobs Report

The January employment report was mixed. It is unlikely to have a material impact on expectations for Fed policy. However, it does suggest the downside risks may not materialize. The US economy grew 304k jobs, well above expectation. It is marred by a 70k net downward revision of the past two months, and notably a 90k cut in December's estimate, which brings it to 222k (from 312k).

Read More »

Read More »

FX Weekly Preview: Divergence Reinvigorated

Last week the focus was on Europe. Prospects of a delay in Brexit helped extend sterling's gains to 11-week highs. Disappointing flash PMI for the eurozone and a dovish Draghi pushed the euro below $1.13 for the first time since mid-December.

Read More »

Read More »

FX Weekly Preview: Things to Watch in the Week Ahead

"The sky is falling. The sky is falling," they cried, as equities plunged in December. It is signaling a recession, we were told. Instead, global equities have begun the year with a strong advance. The S&P 500 gapped higher ahead of the weekend, extending this year's rally to about 14%.

Read More »

Read More »

The Death of a Business Cycle

How do business cycles end? In the US, conventional wisdom is that they are murdered by the Federal Reserve. It is too slow to raise rates and then goes too quickly. This view is espoused by numerous well-respected economists and policymakers. President Trump's criticism of the Federal Reserve is anchored by such views.

Read More »

Read More »

Living In The Present

It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable health care or Miami Dolphin playoff games? Will China’s economy succumb to the pressure of US tariffs and make a deal?

Read More »

Read More »

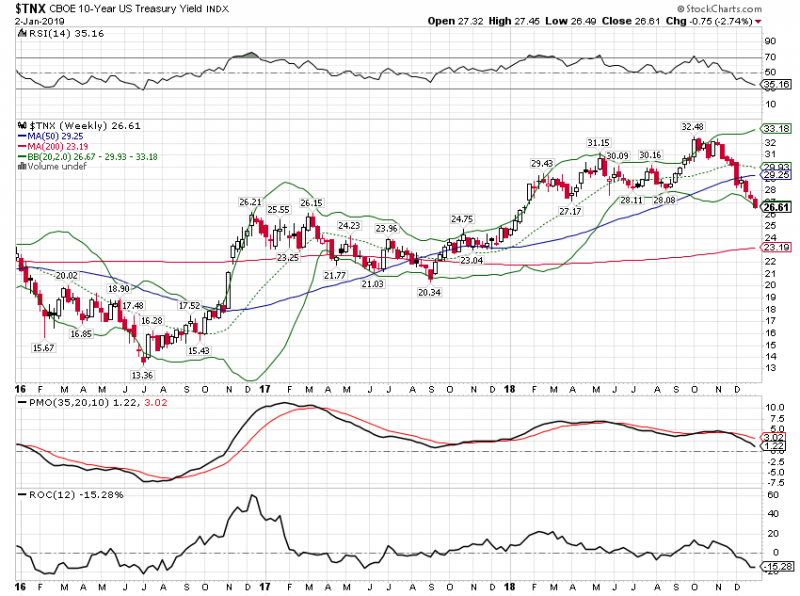

FX Weekly Preview: For the Millionth Time, Markets Exaggerate

The S&P 500 fell more than 12% in a few weeks. The 10-year Treasury yield fell nearly 40 bp. There were cries that the sky was falling. A recession is imminent, we are warned by prognosticators. The Fed went ahead and raised interest rates on March 21, 2018, and the S&P 500 proceeded to gap lower the next day and continued to sell-off the following day. Investors did not like the unanimous decision.

Read More »

Read More »

Technical Musings about the Euro and Dollar Anchored by Macro

The $1.1475-$1.1550 is an important area for the euro. Many bulls see a rounded bottom being carved and a break above it would be embraced as a confirmation. The lower-end corresponds to the 100-day moving average. Such a bottom pattern, if confirmed, would project toward $1.1800 the high in H2 18. On the downside, the low from H2 18 was near $1.1200. This is just above a key (61.8%) retracement of the January 2017-February 2018 rally.

Read More »

Read More »

Some Thoughts on What is Happening

People do not just disagree on what should and will happen, but they disagree on what has happened. As William Faulkner instructed: "The past is not dead. Actually, it's not even past. This is clear in the narratives about the sharp drop in equity markets.

Read More »

Read More »

FX Daily, December 20: Stocks Slump and the Dollar Slides as Market Concludes Fed is Mistaken

Overview: Once again the US equity market failed to hold on to even minimal upticks. The sharply lower close spurred follow-through selling in global equities. Few have been spared the wrath of investors who apparently were disappointed with the Fed and its reluctance to consider stopping the balance sheet unwind.

Read More »

Read More »

FX Weekly Preview: FOMC Dominates Week Ahead Calendar

The last FOMC meeting of 2018 is at hand. After hiking rates three times in 2017, the Fed signaled that four hikes were likely this year and with a widely expected move on December 20, it would have fully delivered, though many steps along the way, skeptical investors had to be led by the nose, as it were, to minimize the element of surprise.

Read More »

Read More »

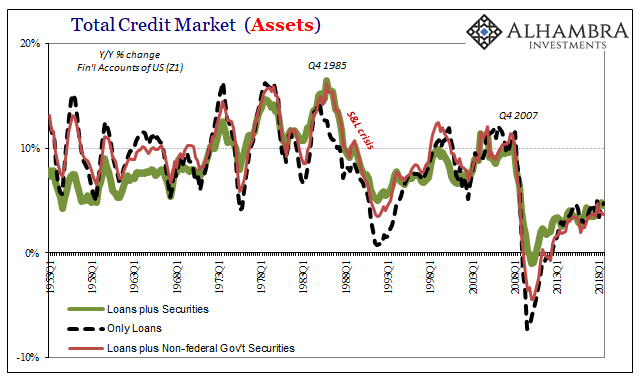

US Banks Haven’t Behaved Like This Since 2009

If there is one thing Ben Bernanke got right, it was this. In 2009 during the worst of the worst monetary crisis in four generations, the Federal Reserve’s Chairman was asked in front of Congress if we all should be worried about zombies. Senator Bob Corker wasn’t talking about the literal undead, rather a scenario much like Japan where the financial system entered a period of sustained agony – leading to the same in the real economy, one lost...

Read More »

Read More »