Tag Archive: Federal Funds Rate

Another One Inverts, The Retching Cat Reaches Treasuries

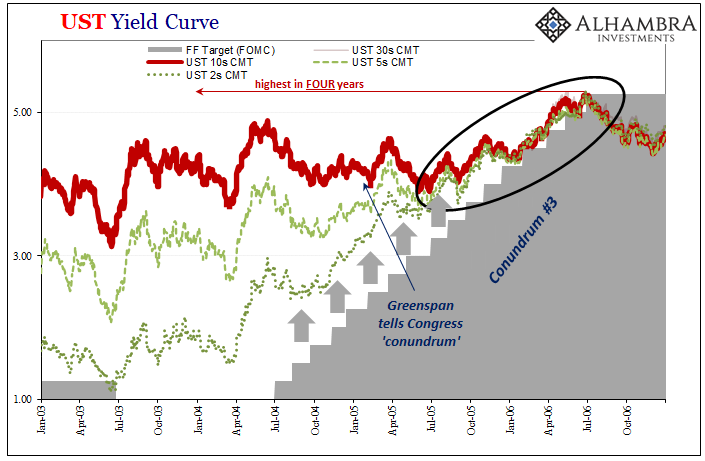

As Alan Greenspan’s rate hikes closed in, longer-term Treasury yields were forced upward as the flattening yield curve left no more room for their blatant defiance. By mid-2005, though, the market wasn’t ready to fully price the downside risks which had already led to that worrisome curve shape (very flat). While all sorts of bad potential could be reasonably surmised, none of it seemed imminent or definite.

Read More »

Read More »

How Dumb Is the Fed?

Bent and Distorted. POITOU, FRANCE – This morning, we are wondering: How dumb is the Fed? The question was prompted by this comment by former Fed insider Chris Whalen at The Institutional Risk Analyst blog.

Read More »

Read More »

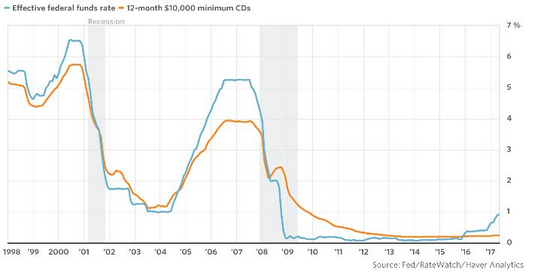

Great Graphic: Sticky Pass Through

This Great Graphic was posted by Steve Goldstein at MarketWatch. The blue line shows the effective Fed funds rate. The orange line depicts the average interest rate on a $10,000 one-year CD.

Read More »

Read More »

Simple Math of Bank Horse-Puckey

We stepped out on our front stoop Wednesday morning and paused to take it all in. The sky was at its darkest hour just before dawn. The air was crisp. There was a soft coastal fog. The faint light of several stars that likely burned out millennia ago danced just above the glow of the street lights.

Read More »

Read More »

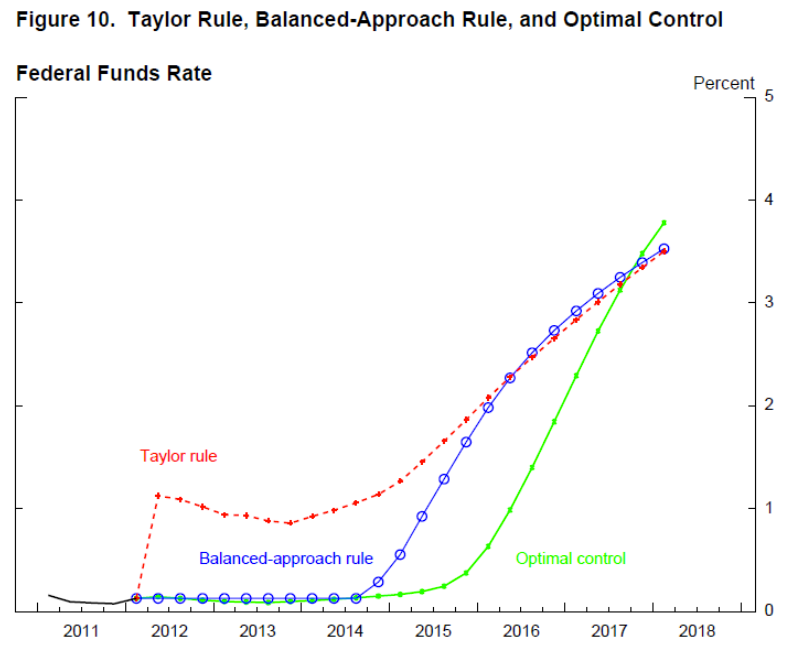

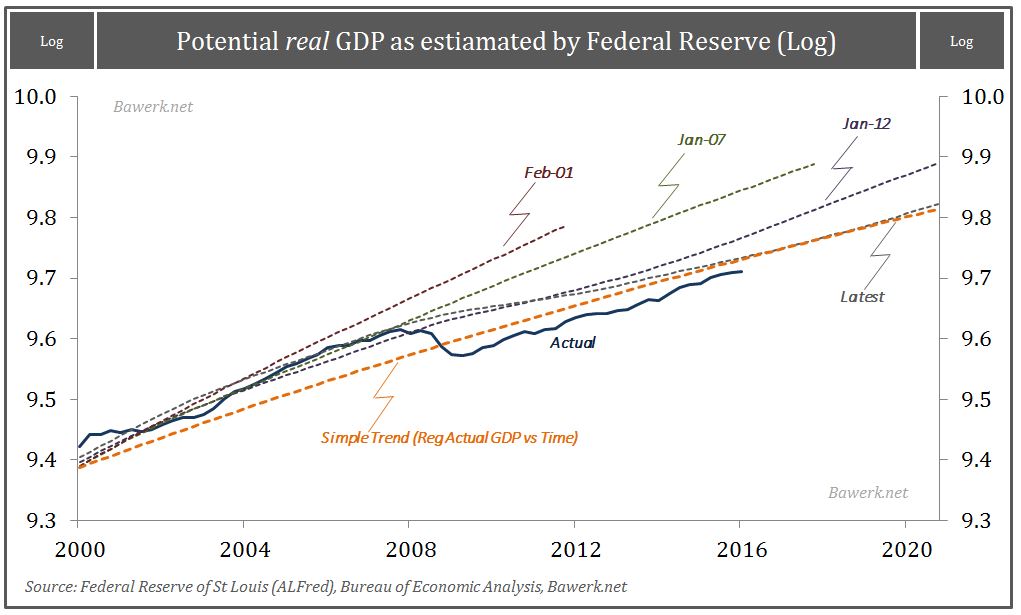

Optimal Lunacy

In June 2012, Janet Yellen, then the Vice Chairman of the Federal Reserve, addressed an audience in Boston with what for the time seemed like a radical departure. It was the latest in a string of them, for conditions throughout the “recovery” period never did quite seem to hit the recovery stride. Because of that, there was constant stream of trial balloons suggesting how the Federal Reserve might try to overcome this economic inertia.

At that...

Read More »

Read More »

The Fed’s “Hothouse” Is in Danger

RHINEBECK, New York – It is a beautiful autumnal day here in upstate New York. The trees are red, brown, and yellow. Squirrels hop across the lawn, collecting their nuts. Unseasonably warm the last few days, rain showers are moving in from across the Hudson, driven by a chilly wind.

Read More »

Read More »

What Happens When Rampant Asset Inflation Ends?

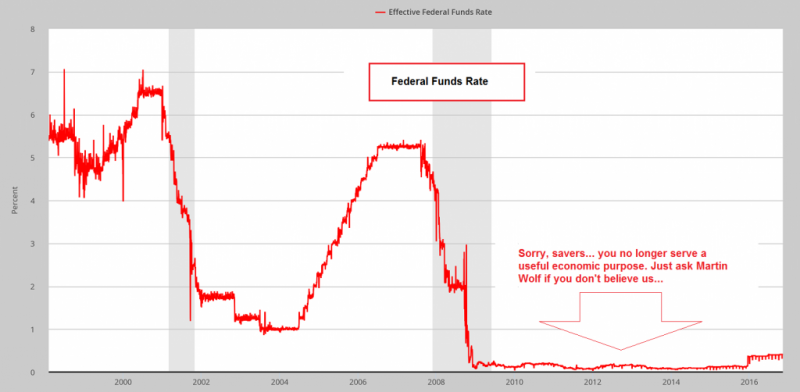

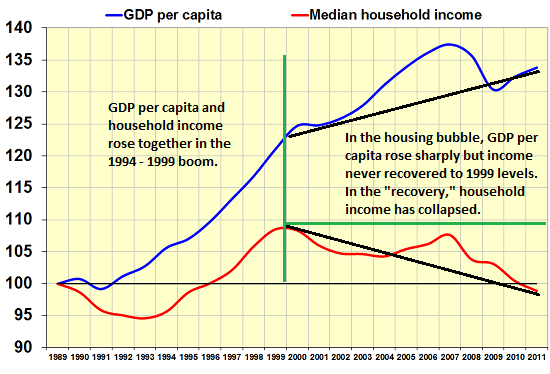

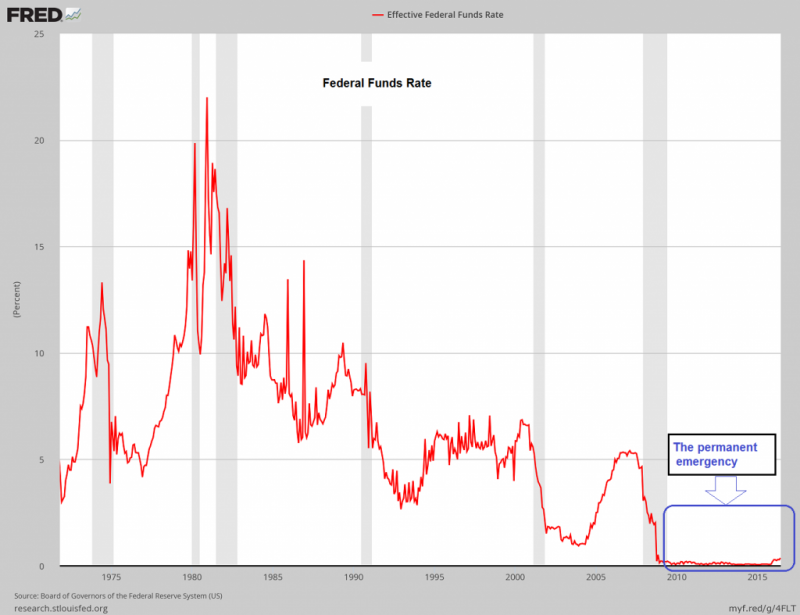

Yesterday I explained why Revealing the Real Rate of Inflation Would Crash the System. If asset inflation ceases, the net result would be the same: systemic collapse. Why is this so? In effect, central banks and states have masked the devastating stagnation of real income by encouraging households to take on debt to augment declining income and by inflating assets via quantitative easing and lowering interest rates and bond yields to near-zero (or...

Read More »

Read More »

Ending a Taking Economy and Creating a Giving Economy (Part 1)

The world can no longer afford a taking economy, where “make a killing” is the motto. Together we need to create a giving and sharing economy that helps us all “make a living.” This essay will unveil the present unjust and unworkable economic system that punishes responsibility and rewards fraud.

Read More »

Read More »

The Fed and the Everything Bubble

John Hussman on Recent Developments We always look forward to John Hussman’s weekly missive on the markets. Some people say that he is a “permabear”, but we don’t think that is a fair characterization. He is rightly wary of the stock market’s historically extremely high valuation and the loose monetary policy driving the surge in asset prices.

Read More »

Read More »

The Trump Risk: Will President Trump Trigger a Recession?

“The economic consequences of a Trump win would be severe,” claims Mr. Summers in the headline. But he has no way of knowing what the consequences would be, let alone if they would be severe. Would they be worse than if Ms. Clinton were elected? No one knows.

Read More »

Read More »

Economy “Improves”, Americans Get Poorer

No Surprises BALTIMORE – We were not surprised by the big news last week. We saw it coming. Figures from the Conference Board research group revealed productivity sinking for the first time in three decades. We promised to explain why it was such a...

Read More »

Read More »

The Power Elite: Bumbling Incompetents

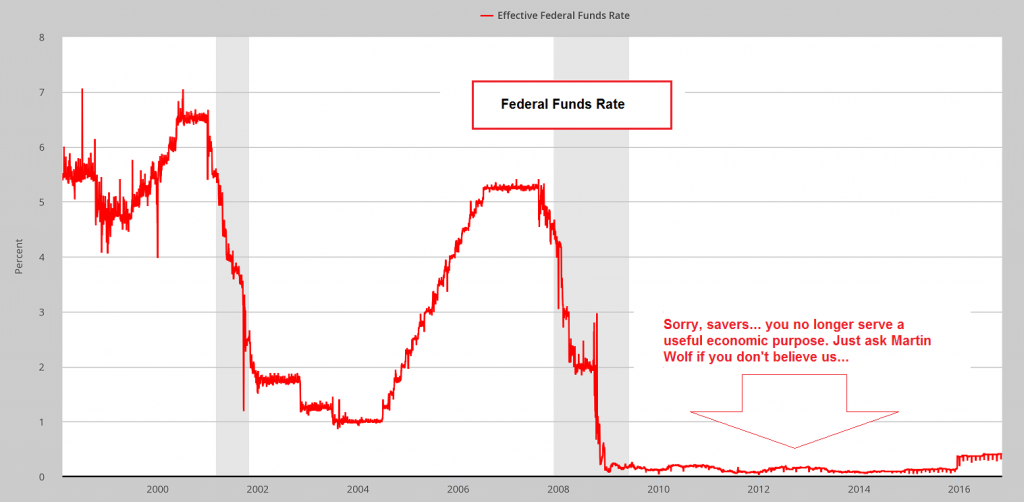

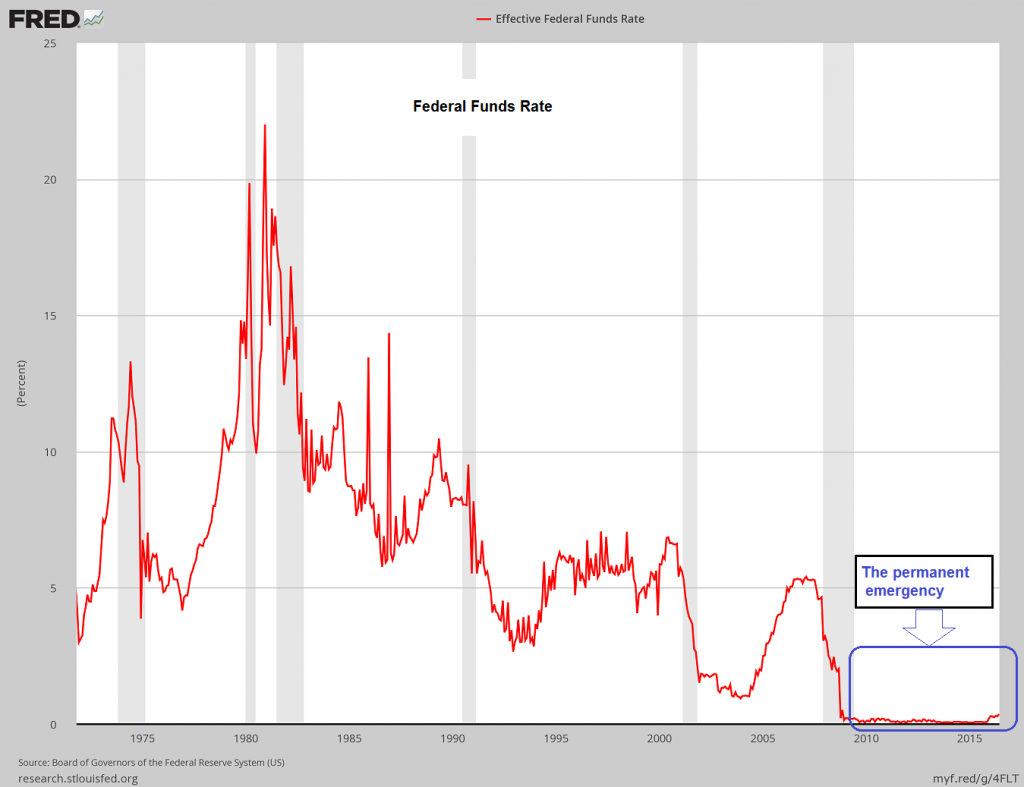

Is there any smarter group of homo sapiens on the planet? Or in all of history? We’re talking about Fed economists, of course.

Not only did they avoid another Great Depression by bold absurdity…giving the economy more of the one thing of which it clearly had too much – debt. They also carefully monitored the economy’s progress so as to avoid any backsliding into normalcy.

Read More »

Read More »

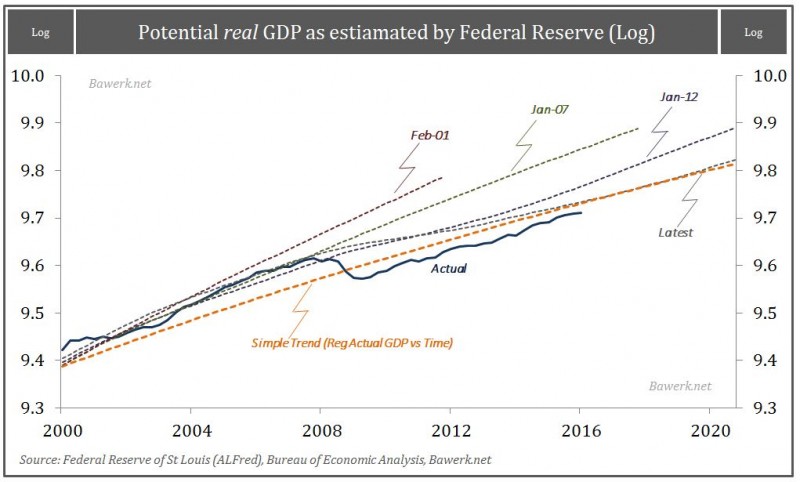

Academic Skulduggery – How Ivory Tower Hubris Wrecks your Life

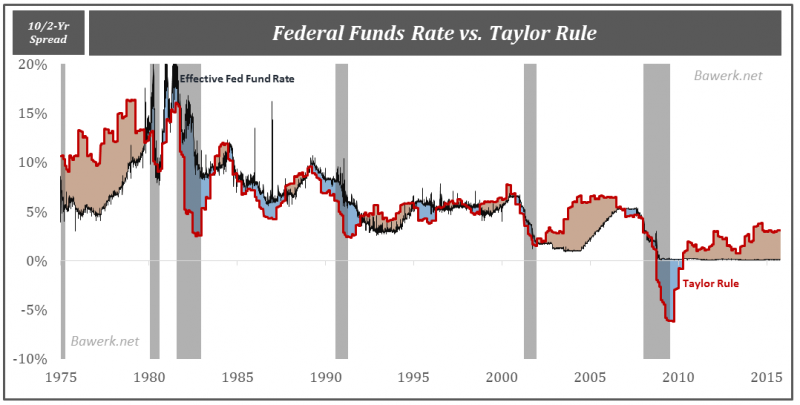

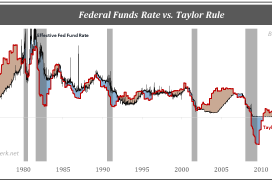

In the 1970s economists started to incorporate rational expectations into their models and not long after the seminal Kydand & Prescott (1977) article named Rules Rather than Discretion: The Inconsistency of Optimal Plan was published. Their work has...

Read More »

Read More »

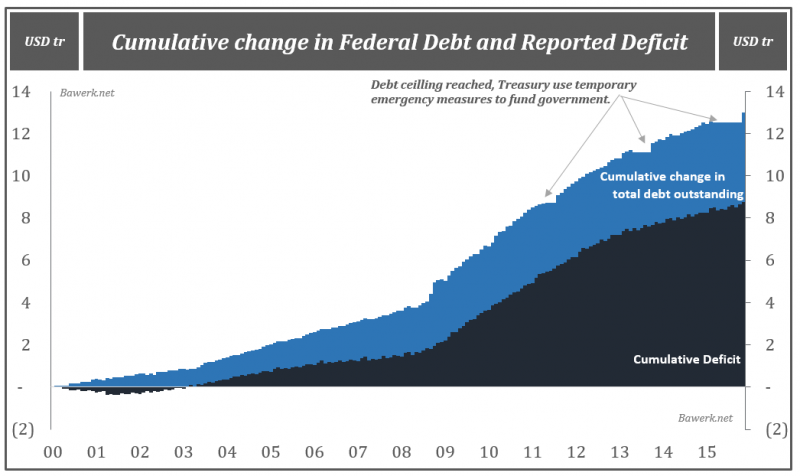

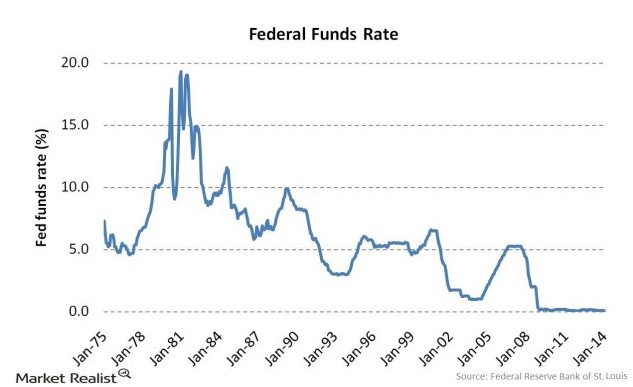

How the Fed gave away its independence – Interest Rate Sensitivity at ZLB

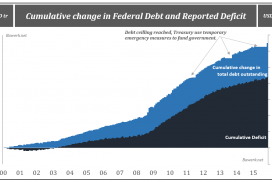

In fiscal year 2014, which ended September 30 2014, the Federal government of the United States reported a cumulative deficit of US$484 billion, while the total debt outstanding increased by more than a trillion dollars. For fiscal year 2015, the dif...

Read More »

Read More »

The Yield Curve and GDP – a causal relationship?

One of the most reliable indicators of an imminent recession through recent history has been the yield curve. Whenever longer dated rates falls below shorter dated ones, a recession is not far off. Some would even say that yield curve inversion, or backwardation, help cause the economic contraction.

Read More »

Read More »

Can The Fed Raise Interest Rates?

Keith Weiner argues that the question should be, not when the Fed will raise interest rates, but if. Before our central planners can raise rates, they must deal with a problem of their own making.

Read More »

Read More »

(6) FX Theory: Carry Trade and Reverse Carry Trade

This page discusses two closely related concepts: the carry trade and the reverse carry trade.

Read More »

Read More »

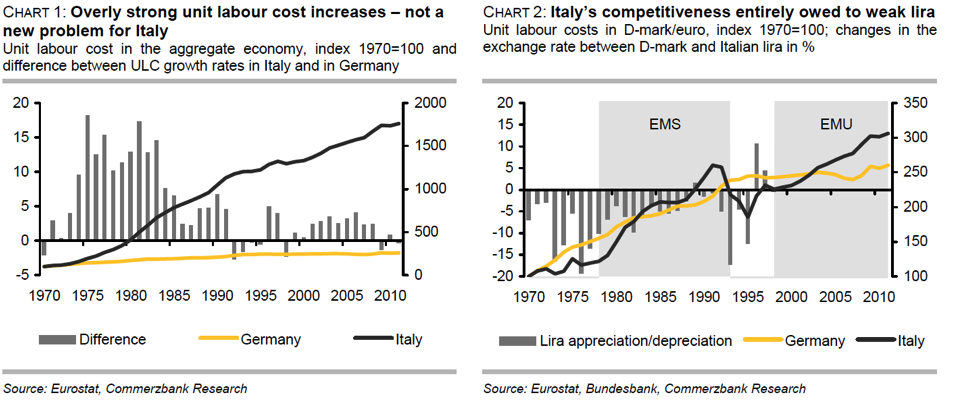

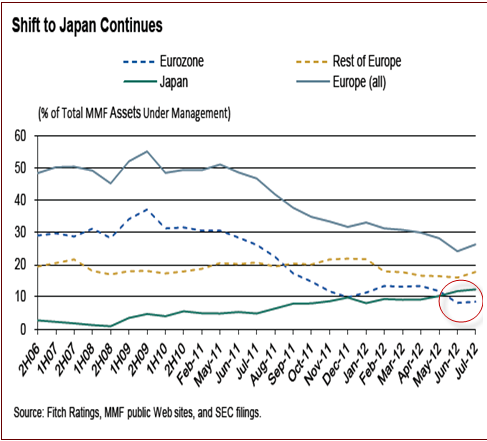

Who Has Got the Problem? Europe or Japan?

A couple of months ago the euro traded close to EUR/USD 1.20 and the whole world was betting on its breakdown. Once the euro downtrend ended thanks to QE3, OMT and euro zone current account surpluses, the common currency did not stop to appreciate against the yen and reached levels of EUR/JPY 104 and above. … Continue reading...

Read More »

Read More »

Can The SNB Make Profit On Currency Reserves ?

Abstract We determine the main criteria with which markets evaluate currency prices. We focus on explaining the differences between the carry trade era (or like Ben Barnanke called it “The Great Moderation”) and the period after the financial crisis. Our research shows that each one of the following three main preconditions must be fulfilled, …

Read More »

Read More »