Tag Archive: FOMC

Waller Pushes on Open Door: Push for Patience Lifts the Dollar, Complicating Japanese Efforts

Overview: Comments by Fed Governor Waller, urging

patience on rates and wanting more evidence that price pressures are moderating

has helped the greenback extend its recent gains. The yen is the notable

exception as the fear of intervention has restrained the dollar bulls. Poor

German data, including a sharp 1.9% drop in February retail sales, the fourth

consecutive monthly decline, underscored the euro's negative divergence, and the

single...

Read More »

Read More »

Dollar Extends Gains Against the Yen but Broadly Firmer Ahead of the FOMC

Overview: The US dollar remains bid ahead of the outcome of today's

FOMC meeting. No change in policy is expected, but the forward guidance, partly

delivered in the updated projections, is the focus. In the last iteration

(December), the Fed "dot" was for three rate cuts this year. Japanese

markets were closed for a national holiday today but dollar's gains against the

yen have been extended and the greenback is nearing the peak seen in...

Read More »

Read More »

Greenback Surges after BOJ Hikes and Ends YCC and RBA Delivers a Dovish Hold

The US dollar is surging today against most of the G10 currencies, and although the intraday momentum is stretched ahead of start of the North American session, there may be little incentive to resist before the end of the FOMC meeting tomorrow.

Read More »

Read More »

Heightened Speculation of a BOJ Move Tomorrow did not Stop the Nikkei from Rallying or Yen from Slipping

Overview: The US dollar is trading with a mostly

softer bias against the G10 currencies. The notable exceptions are the Japanese

yen and Swiss franc. Ironically, speculation of a Bank of Japan rate hike

appears to have increased, while there is a risk that the Swiss National Bank

cuts rates this week. The Norwegian krone is the strongest of the major

currencies. The central bank meets later this week but is widely expected to

stand pat. The...

Read More »

Read More »

Euro’s Recovery to $1.09 Looks Vulnerable while Yen Falls to New Lows for the Week After Strong Pay Raises Confirmed

At the end of last week, the derivatives market was again pricing in nearly four Fed cuts this year, but this week's data have seen expectations re-converge with the Fed's three rate cuts signaled in December, while cutting the odds of June hike to the lowest in the more than four months.

Read More »

Read More »

Strong US Retail Sales may Help Extend the Dollar’s Recovery

Overview: We have put emphasis on today's US retail sales report. A recovery from the weather-induced weakness in January should underscore the resilience of US demand after another 200k jobs were created and personal income jumped 1%.

Read More »

Read More »

China’s CSI 300 Rises for Seventh Consecutive Session and Offshore Yuan Strengthens for the Sixth Session

Overview: The dollar is trading quietly

after being sold yesterday. It is still soft against the dollar bloc and the

Swiss franc but is firmer against the other G10 currencies. Narrow ranges have

dominated. Emerging market currencies are mixed, with central European

currencies and the Taiwan dollar trading softer. The offshore Chinese yuan is

firmer for the sixth consecutive session. The highlights of today's North

American session features minutes...

Read More »

Read More »

US Tech Sell-Off Challenges Risk Appetites Ahead of the FOMC

Overview: Ahead of the US Treasury's quarterly

refunding announcement and the outcome of the FOMC meeting, the dollar is

trading higher against all the G10 currencies. With US high-flying tech stocks

posting steep losses after disappointing earnings reports, the currencies most

sensitive to risk-appetites, the dollar bloc and the Norwegian krone are the

weakest. Emerging market currencies are mixed. The South African rand,

Philippine peso, and...

Read More »

Read More »

Fed to Express More Confidence that Policy is Sufficiently Restrictive Despite the Easing of Financial Conditions

Commentary will resume with a 2024 outlook on December 29. Overview: The dollar is trading with a firmer bias today ahead of the outcome of the FOMC meeting. Standing pat for two

meetings was framed as a pause, but given the decline in price pressures, being

unchanged for a third meeting is understood as the end of the historically

aggressive tightening cycle. Fed Chair Powell is expected to express greater confidence

that policy is sufficiently...

Read More »

Read More »

BOJ Speculation Unwound, Taking the Yen Lower

Overview: The busy week of central bank meetings is

off to a mostly slow start. The dollar is narrowly mixed in quiet turnover,

except against the Japanese yen. Many participants seemed to exaggerate the

risks of a BOJ move next week and dollar continued its recovery that began

ahead of the weekend. Among emerging market currencies, central European

currencies appear to be aided by the firmer euro. They are resisting the

dollar's advance seen...

Read More »

Read More »

Hawkish ECB Comments Boost Risk of a 50 bp Hike Next Month

Overview: The 0.5% decline in US March producer

prices pushed on the door opened by the softer-than-expected CPI on Wednesday.

The Fed funds futures market sees the year end rate to a 4.33%, while still

pricing in a nearly 70% chance of a hike on May 3 to 5.25%. The dollar tumbled

to new lows for the year against the euro, sterling, and Swiss franc. The

Dollar Index made a new low for the year today, a few hundredths of an index

point below the low...

Read More »

Read More »

Terms of UBS Acquisition Wipes out Additional Tier 1 Capital and Spurs Fresh Concerns

Overview: UBS takeover of Credit Suisse, the sale of

Signature bank assets, and the daily dollar swaps could have helped stabilize

the budding banking crisis. However, the wipeout of the additional tier 1

capital cushion (16 bln Swiss francs) at Credit Suisse has raised concern about

the vulnerability of other such assets, which post-GFC is a $275 bln market in

Europe. Asia Pacific equities was a sea of red, led by a 2.65% drop in the Hang

Seng...

Read More »

Read More »

Investors Shaken by Rising Rates

Overview: The surge in US interest rates and sharp

losses in US stocks sent the dollar broadly higher in North America yesterday. The

$42 bln of two-year notes auctioned by the US Treasury saw the highest yield in

more than a quarter-of-a-century (4.67%) and it still produced a small tail.

Sterling, helped by its own surprisingly strong data, was the only G10 currency

to have gained against the surging dollar. Still, no important technical levels...

Read More »

Read More »

The Market Appears to Shrug Off the Fed’s Warning

Overview: The US dollar is consolidating in a mixed

fashion today. The FOMC minutes drew much attention but failed, at least

initially, to spur a significant shift in expectations. The pricing in the Fed

funds futures strip is still consistent with a cut later this year, which the

minutes were clear, no officials anticipate. Today's US ADP jobs estimate, and

November trade balance are being overshadowed by tomorrow's nonfarm payroll

figures. The...

Read More »

Read More »

Five G10 Central Banks Meet and US CPI on Tap

Half of the G10 central banks meet in the week ahead. The Fed is first on December 14, and the ECB, BOE, Swiss National Bank, and Norway's Norges Bank meet the following day. Before turning a thumbnail sketch of the central banks, let us look at the November US CPI, which will be reported as the Fed's two-day meeting gets underway on December 13.

Read More »

Read More »

China Shakes Markets, Euro Shakes it Off

Overview: The surging Covid cases in China and the protests in

several cities seemed to set the tone for today’s session. Equities are lower. China,

Hong Kong, Taiwan, and South Korea were marked down the most. Of the large

bourses, only India escaped unscathed. Europe’s Stoxx 600 is off more than 0.8%

and US futures are poised to gap lower. Bond markets are quieter. The 10-year

US Treasury yield is off a little more than one basis point to around...

Read More »

Read More »

RBA, FOMC, BOE Meetings Featured while the Greenback’s Recovery can be Extended

The week ahead is important from a macro perspective. The data highlights include China's PMI, eurozone preliminary October CPI and Q3 GDP, and the US (and Canadian) employment reports. In

addition, the Federal Reserve meeting on November 2 is sandwiched between the Reserve Bank of Australia meeting and the Bank of England meeting.

Read More »

Read More »

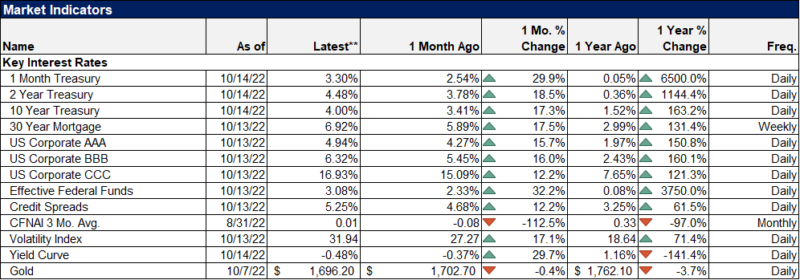

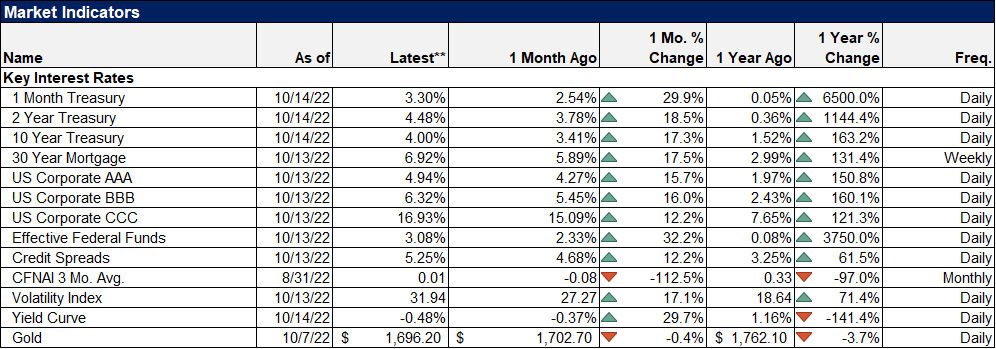

Weekly Market Pulse: Just A Little Volatility

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is.

Read More »

Read More »

No One Wants a Recession, but Central Banks are willing to Take the Risk to Demonstrate Anti-Inflation Resolve

The

week ahead is busy. Three G7 central banks meet, the Federal

Reserve, the Bank of Japan, and the Bank of England. In addition, Japan and Canada

report their latest CPI readings, and the flash September PMI are

released. There

are three elements of the Fed's meeting that are worth previewing. First is the

interest rate decision itself and the accompanying statement. Ironically, this

seems to be the most straightforward. Even before the August...

Read More »

Read More »

US Federal Reserve Sticks To The Script But For How Long?

2023-02-04

by Stephen Flood

2023-02-04

Read More »