Tag Archive: franc

Quantitative Easing, its Indicators and the Swiss Franc

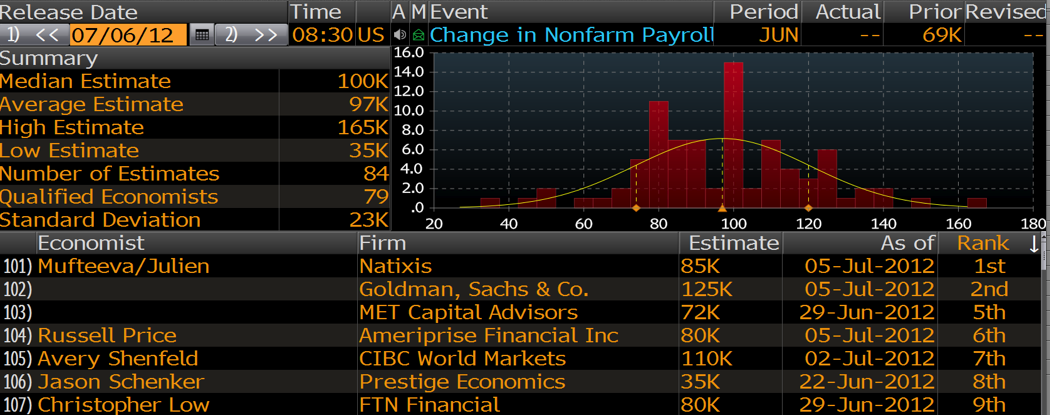

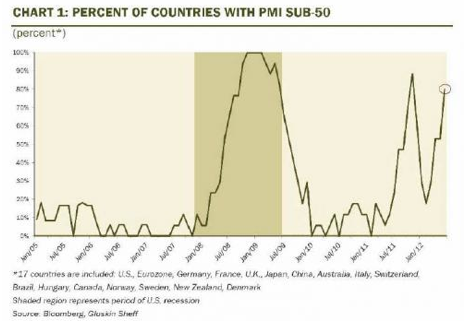

The main drivers of demand for Swiss francs are the euro crisis and, even more, the behavior of American investors, who go out of the dollar in the fear of bad US economic data and/or Quantitative Easing (QE). Risk-friendly investors move into risky assets like stocks or currencies of emerging markets, while risk-averse investors fear inflation and buy inflation-resistant assets like Swiss francs.

Read More »

Read More »

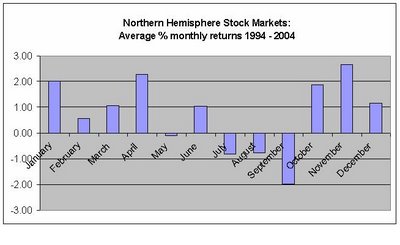

The “Get Stress in May and Relax in October Effect” for the SNB

The U.S. economy regularly improves between October and March. The SNB should use the moment to sell some currency reserves. From May on, the typical seasonal effects will push the SNB into a defense.

Read More »

Read More »

Pictet on the sudden EUR/CHF Appreciation

While we blamed FX traders, that were waiting months for some good European news to push down the CHF, Pictet finds some more explanations.

Read More »

Read More »

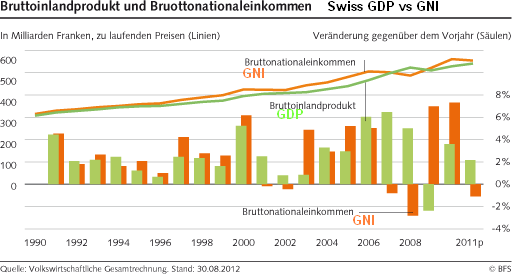

History of SNB monetary policy assessments vs. economic data

History of SNB monetary policy assessments vs. the Swiss gross national product (GDP) and gross national income (GNI).

Read More »

Read More »

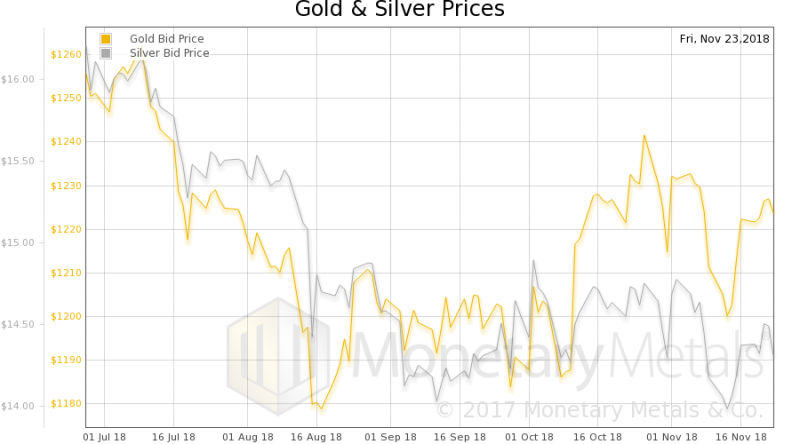

Quantitative Easing, Gold and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis, but even more, the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and of Quantitative Easing. This will push down the dollar, and safe-havens like the CHF, gold or the Japanese Yen up. … Continue reading »

Read More »

Read More »

Are German Bunds finally heading for the big slide ?

Citibank judges that the Swiss National Bank (SNB) does not need a peg anymore. The EUR/CHF exchange rate would be now over 1.20 even if exposed to the free market. Yesterday we showed that the upward move in the EUR/CHF is just the behavior of some euphoric Forex traders. In the meantime we see a completely … Continue reading »

Read More »

Read More »

Net Speculative Positions, Technical Outlook, Global Markets Ahead of Eventful Week September 3rd

Submitted by Mark Chandler, from marctomarkets.com The week ahead kicks off what we expect to be a period of intense event risk. The combination of positioning, judging from the futures market and anecdotal reports, and the low implied volatility in currencies and equity markets warn of heightened risk in the period ahead. The week begins …

Read More »

Read More »

The Swiss television interview with Thomas Jordan, or was it Leonid Brezhnev ?

Today Thomas Jordan gave a quick interview in the Swiss television. Everything was so well prepared and as sterilized. Thomas Jordan learned all answers by heart and was answered the questions about one second after the question was asked. It reminded me of an interview in Soviet television with former Soviet leader Leonid Brezhnev. Each …

Read More »

Read More »

SNB only major central bank missing at Jackson Hole, are important SNB decisions looming ?

The Jackson Hole Symposium is traditionally a meeting of global central bankers, here the 2010 attendance list. This year it takes place between August 30 and September 1. Central bankers assemble The annual economic symposium for central bankers staged by the Federal Reserve Bank of Kansas City begins in Jackson Hole, Colorado (until September 1). …

Read More »

Read More »

SNB Results: SNB poised for 10 billion CHF quarterly profit

On July 31st the Swiss National Bank will publish interim results for the second quarter 2012. Already now we offer an estimate to our readers. Our estimate does not cover the central bank’s Forex trading results, they are difficult to estimate. A central bank is not a day trader, therefore the influence should be limited. …

Read More »

Read More »

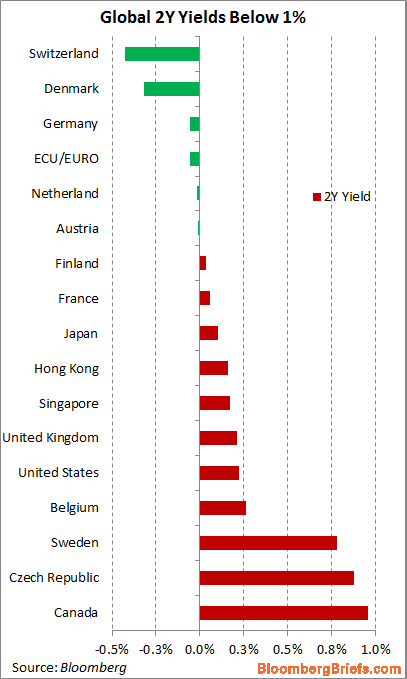

German Schatz turns negative again

After the first time End May, the German Schatz turns negative:

German June 2014 Schatz Average Yield -0.06% vs 0.10% on June 20

Swiss Eidgenossen 2yrs still at -0.4%

Read More »

Read More »

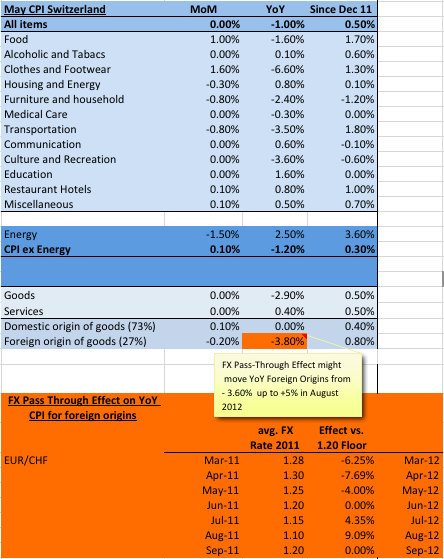

The End of Swiss and Japanese Deflation

At a time of speculations about global deflation, we show an interesting and very different aspect. Our CPI and wage data comparison among different developed countries, shows that Switzerland and Japan will see both inflation, whereas other countries like Australia will see disinflation.

Read More »

Read More »

German constitutional court injunction decision on ESM and the potential referendum

What is the injunction procedure of the German constitutional court exactly about. What are the arguments of the Anti-ESM and the Pro-ESM fractions ?

Read More »

Read More »

At EUR/CHF 1.10 SNB with 31 bln. loss, each Swiss losing 150 francs per week

The Swiss National Bank would realize a loss of 31 bln. francs, if it accepted a EUR/CHF exchange rate of 1.10 instead 1.20 and if we assume that the Swissie also appreciates against the dollar and other currencies

Read More »

Read More »