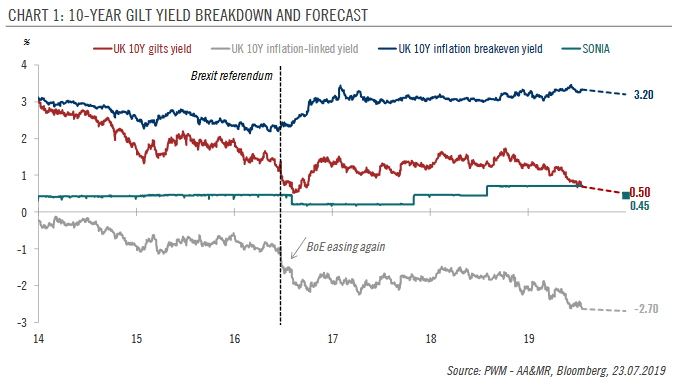

UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall.

Read More »

Tag Archive: Gilts

Sterling: Has the Breaking Point been Reached?

Sterling's decline is not longer coinciding with lower rates. Sterling's decline is boosting inflation expectations. If the inflation expectations are realized (Sept CPI next week), it will quickly erode what ever competitive gains there may have been.

Read More »

Read More »

IIF Chief Warns “Brexit Bigger Threat To Global Economy Than Lehman”

As Brexit appears to gathering pace among British voters, Bloomberg Briefs interviews Hung Tan, executive managing director at the Institute of International Finance in Washington, DC., to understand the global impact of a decision by Britain to leav...

Read More »

Read More »

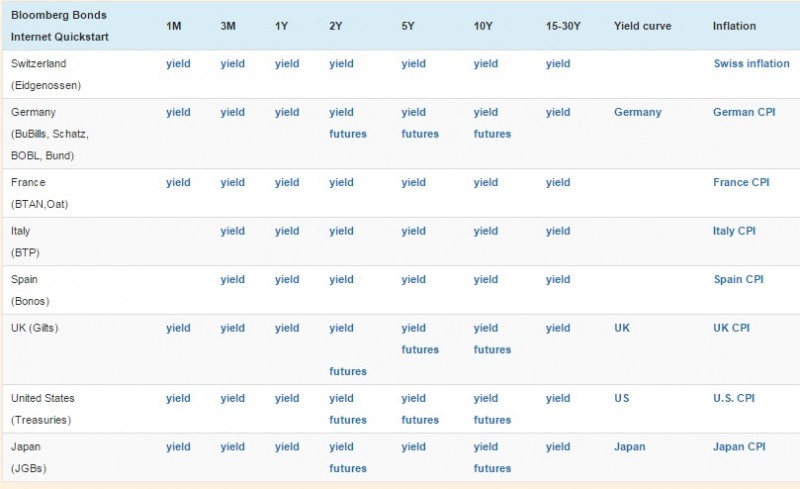

With Daily Record Lows: Chart of German Bund Yields Since 1977

The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates.

Read More »

Read More »