Tag Archive: gold market

Demand for Gold is Expected to Grow Exponentially in 2021

The difference between physical gold investing and ETF investing was stark in the first quarter 2021 according to the World Gold Council’s Gold Demand Trends data released last week. Before focusing in on investment demand below a few notes on overall gold demand in the first quarter.

Read More »

Read More »

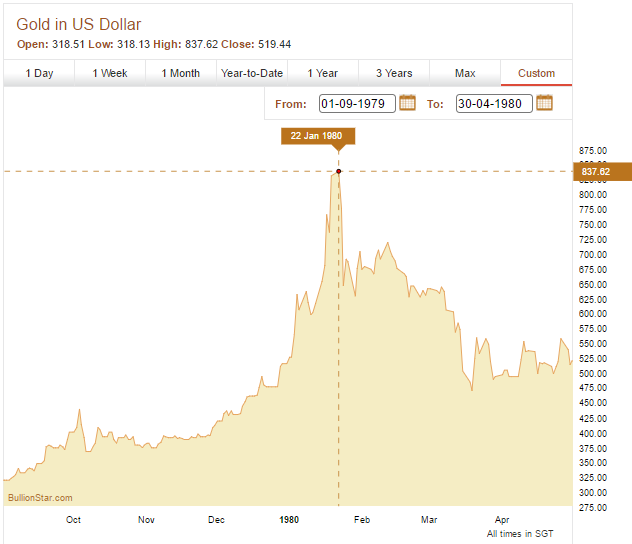

New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil

This is Part 2 of a two-part series. The series focuses on collusive discussions and meetings that took place between the world’s most powerful central bankers in late 1979 and 1980 in an attempt to launch a central bank Gold Pool cartel to manipulate and control the free market price of gold. The meetings centered around the Bank for International Settlements (BIS) in Basle, Switzerland.

Read More »

Read More »

When Rock begins to beat Paper

2022-07-24

by Stephen Flood

2022-07-24

Read More »