Tag Archive: inflation

Will What the Fed Says be More Important than What it Does?

Overview: The focus is squarely on the Federal Reserve today. There is nearly universal agreement that it will lift the target by 25 bp. The market is inclined to see the shift as a sign that the Fed is nearing the end of its tightening cycle, and sees, at most, one more quarter-point hike. Despite the Fed's warnings, including in the December FOMC minutes, about the premature easing of financial conditions, the market has done precisely that.

Read More »

Read More »

Weekly Market Pulse: First, Kill All The Speculators

The Fed meets this week and is widely expected to raise the Fed Funds rate by 0.25% to a range of 4.5% – 4.75%. The market has factored in a small probability that they do nothing and leave rates alone, but they’ll probably do what’s expected because they’ve spent the last couple of months preparing the markets for exactly this outcome.

Read More »

Read More »

Weekly Market Pulse: A Fatal Conceit

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months.

Read More »

Read More »

Dollar Index Gives Back Half of 21-Month Gains in 3 1/2 Months

Overview: The continued easing of US price pressures

has strengthened the market's conviction that the Federal Reserve will further

slow the pace of rate hikes and that the terminal rate will be near 5.0%. The

decline in US rates has removed a key support for the US dollar, which has

fallen against all the G10 currencies this week. The Dollar Index has now retraced half of what it gained since bottoming on January 6, 2021. Meanwhile, there are...

Read More »

Read More »

Here are three things you can learn from the Fed

Anyone who has decided to buy gold, or follows the gold price will be aware of how powerful the US Federal Reserve is. This year the Federal Reserve will turn 110 years old, only in recent years is dollar hegemony appearing to falter. Below we look at the central bank’s origins and three lessons we can learn from the history of the world’s most powerful bank, in order to help our investment decisions in 2023.

Read More »

Read More »

Is it Too Easy to Think the Market Repeats its Reaction to a Soft US CPI?

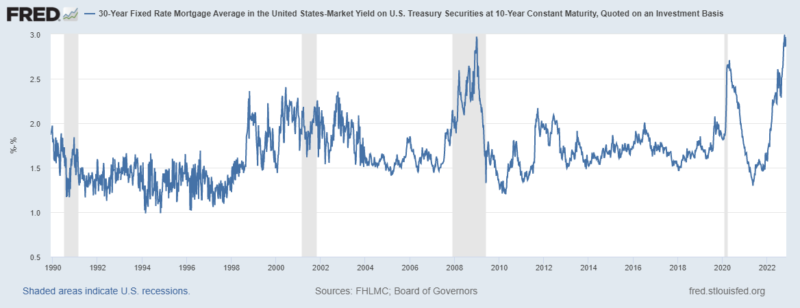

The market expects a soft US CPI print today, which has recently been associated with risk-on moves. The US 10-year yield is holding slightly above 3.50%, the lowest end of the range since the middle of last month. The two-year yield is a little above 4.20%, also the lower end of its recent range. Most observers see the Federal Reserve slowing the pace of its hikes to a quarter point on February 1.

Read More »

Read More »

US CPI Featured and Why the Fed may Still Hike by 50 bp

The most important economic report in the week ahead is the US December Consumer Price Index on January 12. To be sure, the Federal Reserve targets an alternative measure, the deflator of personal consumption expenditures. However, in this cycle, when households, businesses, investors, and policymakers are particularly sensitive to inflation, CPI, which is reported a couple of weeks before the PCE deflator, has stolen the thunder.

Read More »

Read More »

Your Wealth Will Save Central Banks!

Today we ask, what is wealth? As we start a new year many will be looking at their portfolios and wondering what 2023 will have in store for them. Similar to 2022, we suspect there will be a lot of unknowns.

As with anything unforeseen, it’s a good idea to have some insurance. This is why there were record levels of gold buying last year, and we expect the same in the coming months; because people want to protect their wealth with the...

Read More »

Read More »

Yesterday’s Gains Unwound may Make the Greenback a Better Buy Ahead of FOMC Minutes

Overview: Yesterday's greenback gains have been

mostly reversed today. New efforts by China in its property market and

anticipation of more stimulus helped rekindle the animal spirits today. Asia

and Europe shrugged off yesterday's losses on Wall Street and the rally in

bonds continued. The 8-12 bp decline in European benchmark 10-year yields comes

even though the final composite PMI was better than expected fanning hopes of a

short and shallow...

Read More »

Read More »

What Can the Fed tell the Market it Does Not Already Know?

Overview: The softer than expected US CPI drove the

dollar and interest rates lower, while igniting strong advances in equities,

risk assets, commodities, and gold. Calmer market conditions are

prevailing today, and we suspect that in the run-up to the FOMC meeting, a broadly

consolidative tone will emerge. The dollar is mostly softer, but within yesterday’s

ranges. Only the New Zealand and Canadian dollars among the G10 currencies are softer....

Read More »

Read More »

Gold is money – everything else is credit!

What physical precious metals investors can expect 2023 and beyond

Throughout the better part of 2022 there has been one question that has consistently, and predictably, popped up in conversations with my friends, clients and readers. Those who know me and are familiar with my ideas are well aware of my position on precious metals and the multiple roles they serve, so I can’t blame them for them for being curious whether I still “stick to my...

Read More »

Read More »

US CPI ahead of FOMC Outcome Tomorrow

Overview: The dollar

softer against the G10 currencies ahead of today’s CPI report and the FOMC meeting

the concludes tomorrow. Emerging market currencies are most mixed. The

Hungarian forint leads the complex with around a 1% gain on news of a

preliminary deal struck with the EU. The South African rand is the worst

performer, off around 0.8%, as impeachment proceedings against Ramaphosa

proceed. Global equities are mostly higher today after the...

Read More »

Read More »

Five G10 Central Banks Meet and US CPI on Tap

Half of the G10 central banks meet in the week ahead. The Fed is first on December 14, and the ECB, BOE, Swiss National Bank, and Norway's Norges Bank meet the following day. Before turning a thumbnail sketch of the central banks, let us look at the November US CPI, which will be reported as the Fed's two-day meeting gets underway on December 13.

Read More »

Read More »

Week Ahead: RBA and BOC Meetings Featured and China’s Inflation and Trade

The week ahead

is more than an interlude before five G10 central banks meet on December

14-15. The data highlights

include the US ISM services and producer prices, Chinese trade and inflation

measures, Japanese wages, household consumption, and the current account.

Also, the Reserve Bank of Australia and the Bank of Canada hold policy

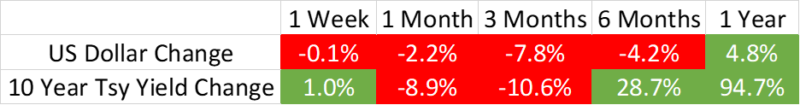

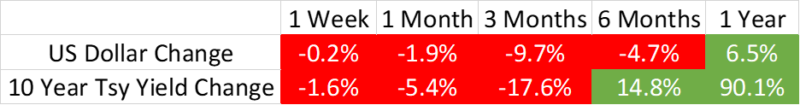

meetings. Central banks from India, Poland, Brazil, Peru, and Chile also meet.The dollar appreciated in Q1 and Q2...

Read More »

Read More »

Hope Springs Eternal in China

Overview: Hope that the recent events in China are cathartic continues to lift risk appetites. Led by Hong Kong and mainland shares that trade there, the large bourses in the Asia Pacific region rallied. Japan, where macro data continues to disappoint, was the notable exception. Europe’s Stoxx 600 is snapping a three-day down draft and is up about 0.6% in late morning turnover. US futures are trading with a slightly firmer bias.

Read More »

Read More »

US Jobs and Eurozone CPI Highlight the Week Ahead

Two high-frequency economic

reports stand out in the week ahead: The US November employment report

and the preliminary eurozone CPI. The Federal Reserve has deftly distanced itself from any one

employment report. As a result, it would take a significant miss of the median forecast

(Bloomberg survey) to alter market expectations for a 50 bp hike when the FOMC

meeting concludes on December 14.Economists are looking for

around a 200k increase in US...

Read More »

Read More »

The Bitcoin is ‘as-good-as-gold’ myth is over

When you invest in gold or buy silver coins with GoldCore you are choosing to invest in an asset that has no counterparty risk. Sadly those who have been holding their bitcoin on the crypto exchange FTX, have not experienced the same level of reassurance and service from the exchange’s management.

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

China and the US at sovereign debt war

2023-01-27

by Stephen Flood

2023-01-27

Read More »