Tag Archive: inflation

It’s Not Nothing, It’s Everything (including crypto)

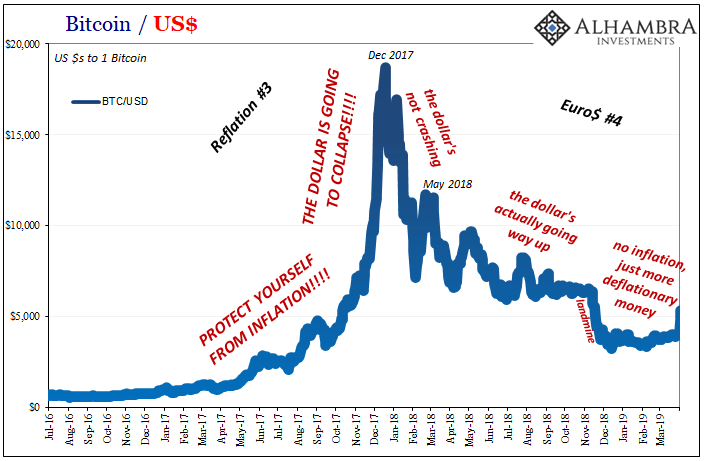

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer.

Read More »

Read More »

Prices As Curative Punishment

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022.

Read More »

Read More »

Simple Economics and Money Math

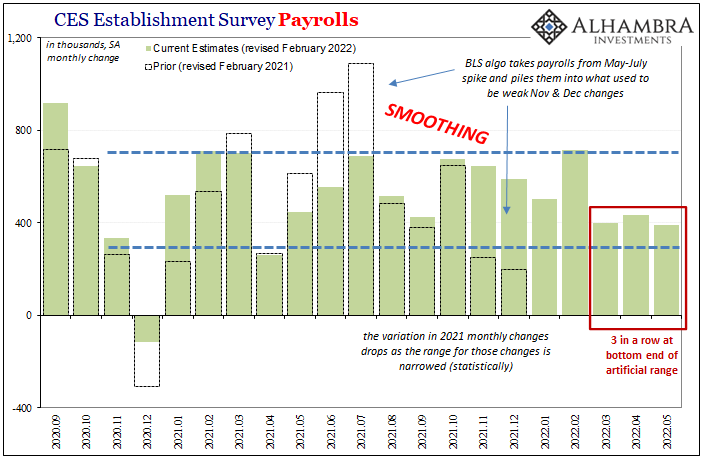

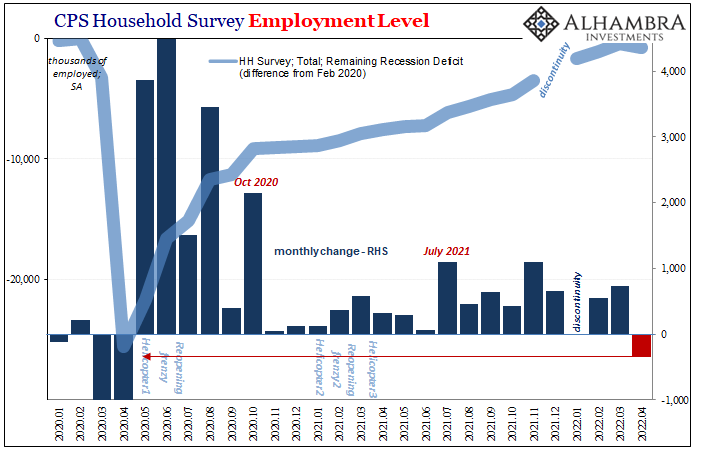

The BLS’s most recent labor market data is, well, troubling. Even the preferred if artificially-smooth Establishment Survey indicates that something has changed since around March. A slowdown at least, leaving more questions than answers (from President Phillips).

Read More »

Read More »

Fed 50, BOE 25, and the BOJ to Stand Pat: Week Ahead

Three G7 central banks meet in the coming days, and they dominate the macro stage. The Federal Reserve's meeting concludes on Wednesday, the Bank of England on Thursday, and the Bank of Japan on Friday.

Read More »

Read More »

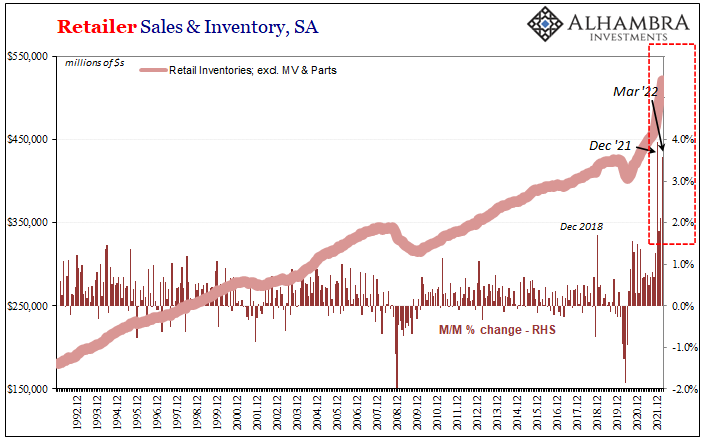

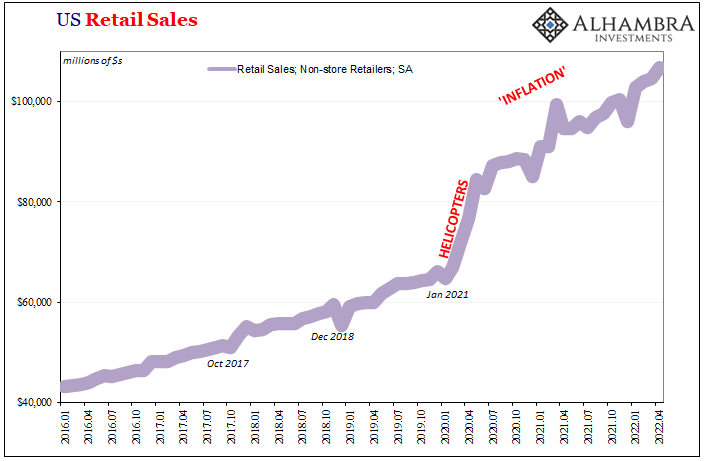

“Inflation” Not Inflation, Through The Eyes of Inventory

It isn’t just semantics, nor some trivial, egotistical use of quotation marks. There is an actual and vast difference between inflation and “inflation.” And in the final results, that difference isn’t strictly or even mainly about consumer prices.Who cares, most people wonder. After all, what does it really matter why prices are going up so far?

Read More »

Read More »

A Volcker Pan Recession

The Volcker Myth is simple because there isn’t math for it just voodoo economics (to borrow George HW Bush’s phrase). In theory, the FOMC finally realized after more than a decade of currency devastation and its economic, financial, and social consequences, hey, inflation and money.

Read More »

Read More »

May Payrolls (and more) Confirm Slowdown (and more)

May 2022’s payroll estimates weren’t quite the level of downshift President Phillips had warned about, though that’s increasingly likely just a matter of time. In fact, despite the headline Establishment Survey monthly change being slightly better than expected, it and even more so the other employment data all still show an unmistakable slowdown in the labor market.

Read More »

Read More »

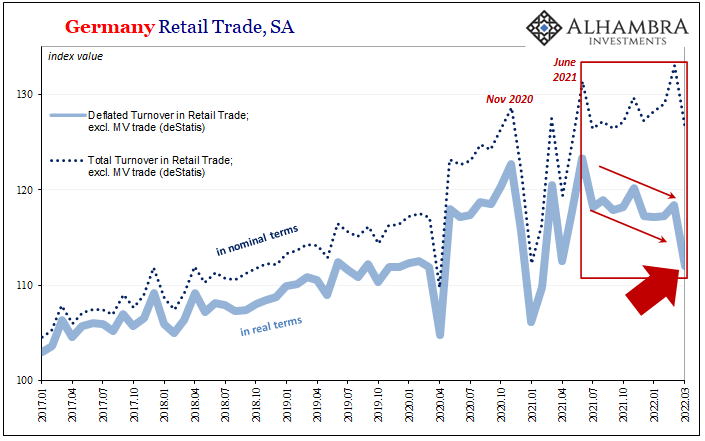

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

Inflation outlook – A battle lost before it started

After months of consumer price increases and after countless working households found themselves in dire financial straits struggling to make ends meet, in the late May, President Biden finally revealed his grand plan to fight inflation in an op-ed for the Wall Street Journal. The much-anticipated response to the cost of living crisis that has been ravaging the nation sadly did not contain the silver bullet that so many Americans were hoping for....

Read More »

Read More »

Moderating Labor Market is what the Fed Wants

Overview: For the large rally in US stocks yesterday and the sell-off in the dollar, US rates were surprisingly little changed. This set the tone for today's action, ahead of the US employment data. Asia Pacific equities moved higher and Europe’s Stoxx 600 has edged up to extend yesterday’s rise. The 10-year US Treasury yield is little changed, hovering around 2.91%. European benchmark yields are 1-3 bp higher.

Read More »

Read More »

Can’t Blame COVID For This One

Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal.

Read More »

Read More »

President Phillips Emerges To Reassure On Growing Slowdown

Just the other day, President Biden took to the pages of the Wall Street Journal to reassure Americans the government is doing something about the greatest economic challenge they face. Biden says this is inflation when that’s neither the actual affliction nor our greatest threat.

Read More »

Read More »

Peak Policy Error

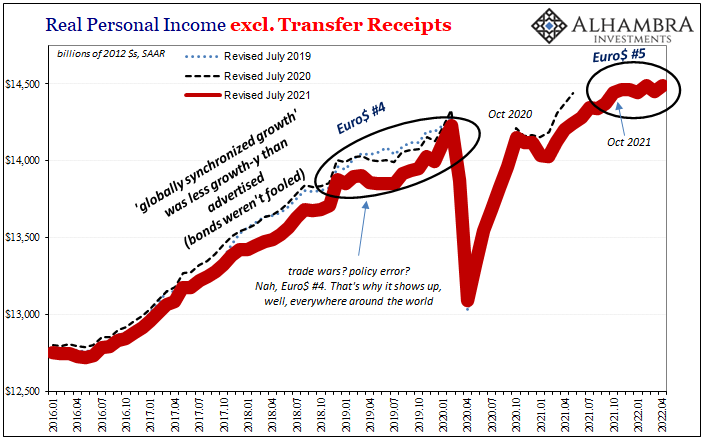

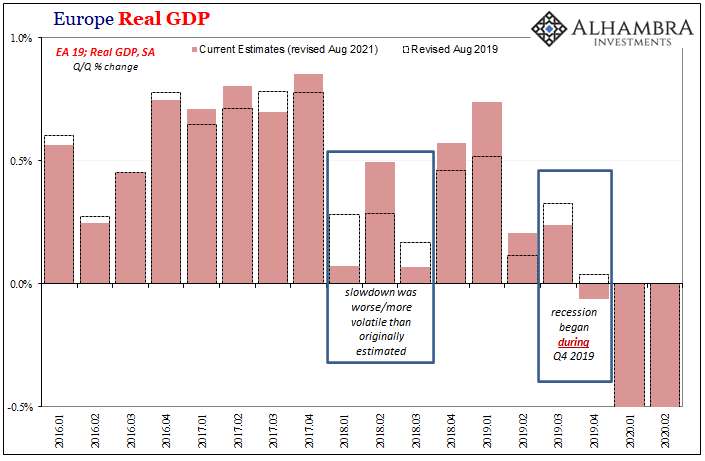

Another economic discussion lost to the eventual coronavirus pandemic mania was the 2019 globally synchronized downturn. Not just downturn, outright recession in key parts from around the world, maybe including the US.

Read More »

Read More »

Inventory Flood Continues Just As Consumers Tap Out

If it continues to play out the same way, it would be all the worst scenarios lumped together all at the same time. A real unfortunate convergence, yet one that has been entirely predictable. Consumers reaching their absolute spending limits.

Read More »

Read More »

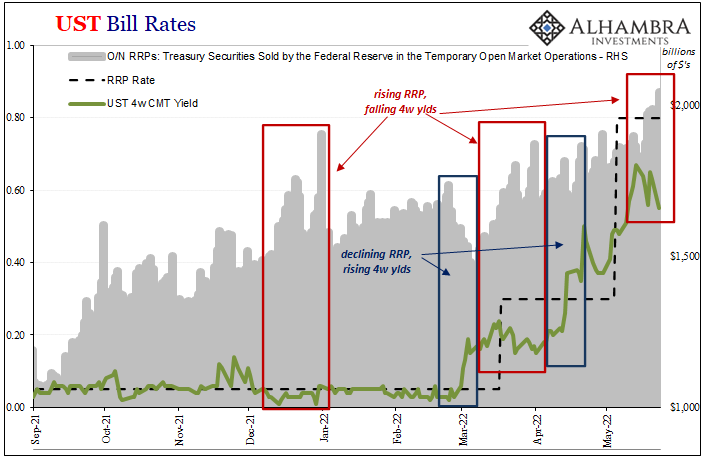

RRP (use) Hits $2T, SOFR Like T-bills Below RRP (rate), What Is (really) Going On?

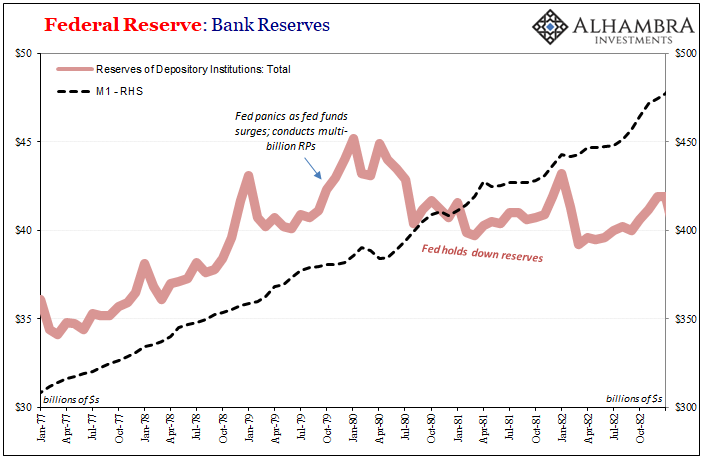

You might not know it, but front-end T-bill yields are not the only market spaces which are making a mockery of the Federal Reserve’s “floor.” There are others, including the same money number the same Fed demanded the world (or whatever banks in its jurisdiction it could threaten) ditch LIBOR over.

Read More »

Read More »

Another Month Closer To Global Recession

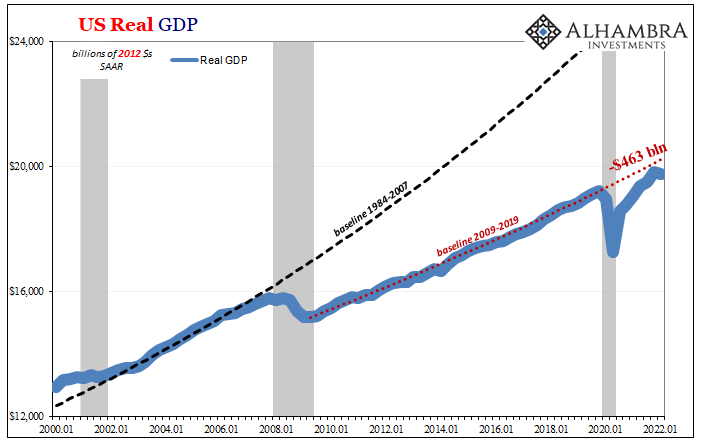

We always have to keep in mind that the major economic accounts perform poorly during inflections. Europe in early 2018, for example, was supposed to have been just booming only to have run right into the brick wall that was Euro$ #4.

Read More »

Read More »

UST 2s & Euro$ Futures *Whites* Both Ask, Landmine At Last?

The 2-year Treasury right now is the key point, the spot on the yield curve which is influenced mostly by potential alternative rates including those offered by the Federal Reserve. Because of this, the market for the 2s is looking forward at what those alternate rates are likely to be, then pricing yields accordingly.

Read More »

Read More »

Shipping Around Retail ‘Inflation’

This whole “inflation” scenario isn’t really that difficult to piece together, effect from cause. Sure, Jay Powell’s trying to nuke it by hiking the federal funds rate, but no one really uses fed funds and the problem isn’t the unsecured cost of borrowing bank reserves (not money) that are literally overflowing.

Read More »

Read More »

Did Central Banks arrive at their Target Inflation Rate by Mere Fluke?

2022-05-26

by Stephen Flood

2022-05-26

Read More »