Tag Archive: Jerome Powell

Global Asset Allocation Update:

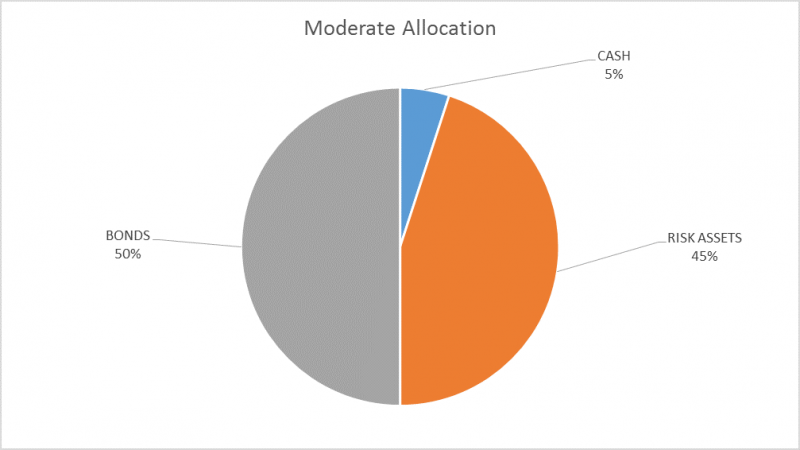

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in correction territory, down 10% from the...

Read More »

Read More »

FX Daily, June 29: Fragile Calm Ahead of Quarter-End

Sterling is firmer, but quarter-end considerations seem to be the key driver. Poor Japanese retail sales keep focus on policy response likely next month. New Zealand and Australian dollars are leading today's advance against the US dollar.

Read More »

Read More »

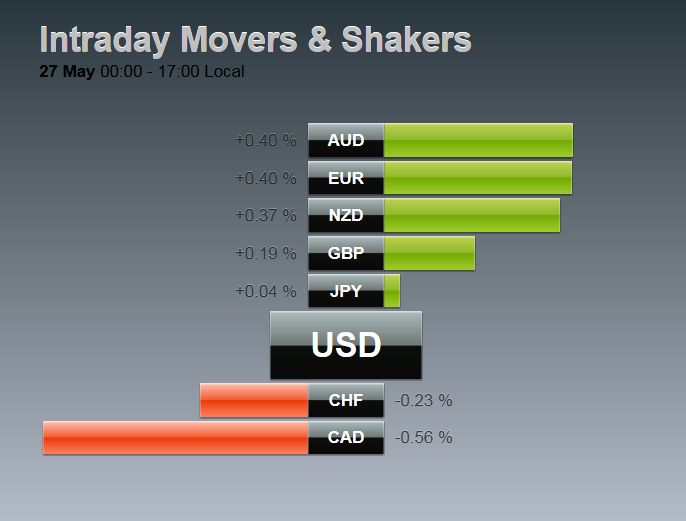

FX Daily, May 27: Dollar Firms as Traders Await Yellen

The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday's ranges while sterling and the Canadian dollar pushing through yesterday's lows.

Asian ...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

Some dovish signals from the Fed and a bounce in oil prices helped EM end last week on a firm note. This week, the US retail sales report could be important, and the same goes for CPI and PPI data too. The Fed?...

Read More »

Read More »

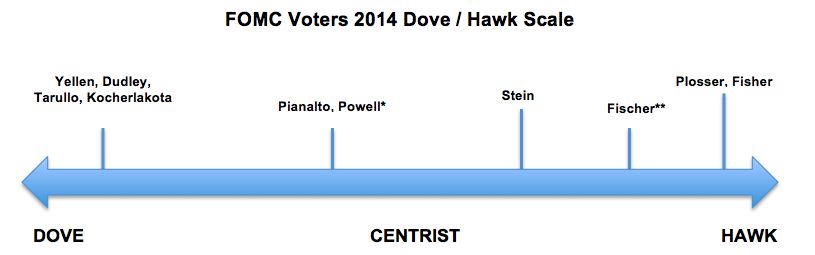

Fed FOMC: Who is Hawk, Who is Dove? 2015 Update

Composition of the Fed's Federal Open Market Committee (FOMC composition), needed to know if the Fed is opting for quantitative easing or not.

Read More »

Read More »

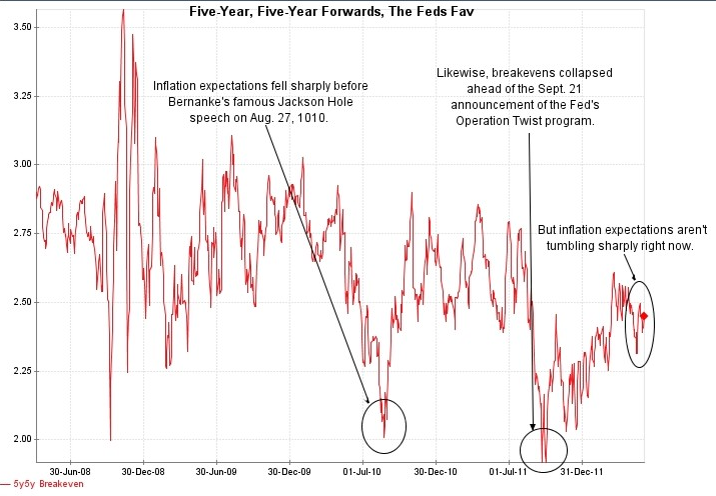

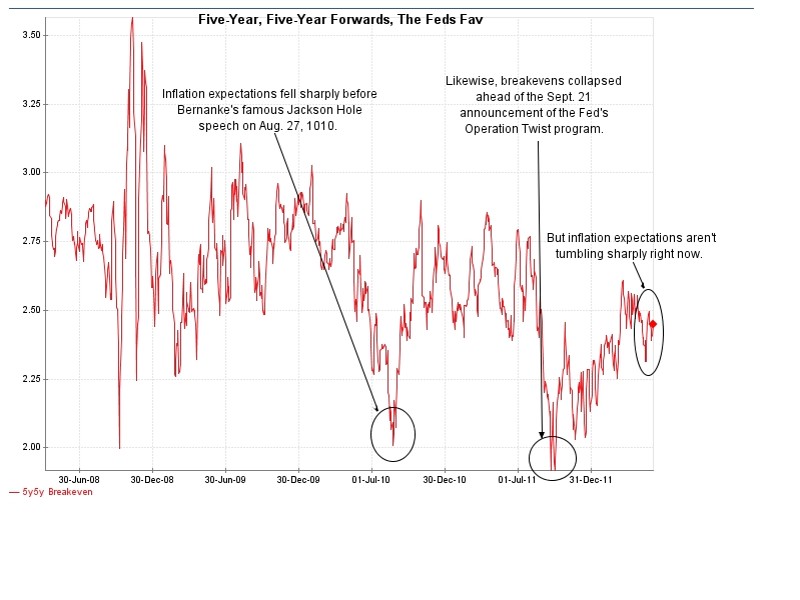

Brad DeLong on Jackson Hole and Quantitative Easing

Berkeley Professor Brad DeLong has delivered a nice allegorical entry in his type pad on a quick Quantitative Easing. Letting speak old greek mythological figures he hides his personal opinion. A half now completely written platonic dialogue on what the Federal Reserve is Doing — or not Doing — Right Now DeLong explains the …

Read More »

Read More »

Fed Violates its Own Inflation Targets. Should QE3 Be Postponed?

At this year’s Jackson Hole symposium, Ben Bernanke promised to help the economy via further easing if needed. We doubt his promises because because the Fed might contradict their inflation targets. Current levels of around 2 % for the consumer price inflation excluding food and energy (“core CPI“) and the deflator of the GDP …

Read More »

Read More »

Quantitative Easing Indicators, June 2012

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This will push down the dollar and safe-havens like the CHF, gold or the … Continue reading »

Read More »

Read More »