Tag Archive: Macroeconomics

Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

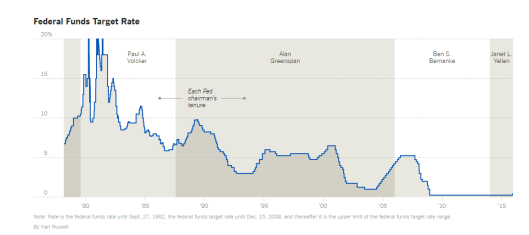

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well.

Read More »

Read More »

Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm.

Read More »

Read More »

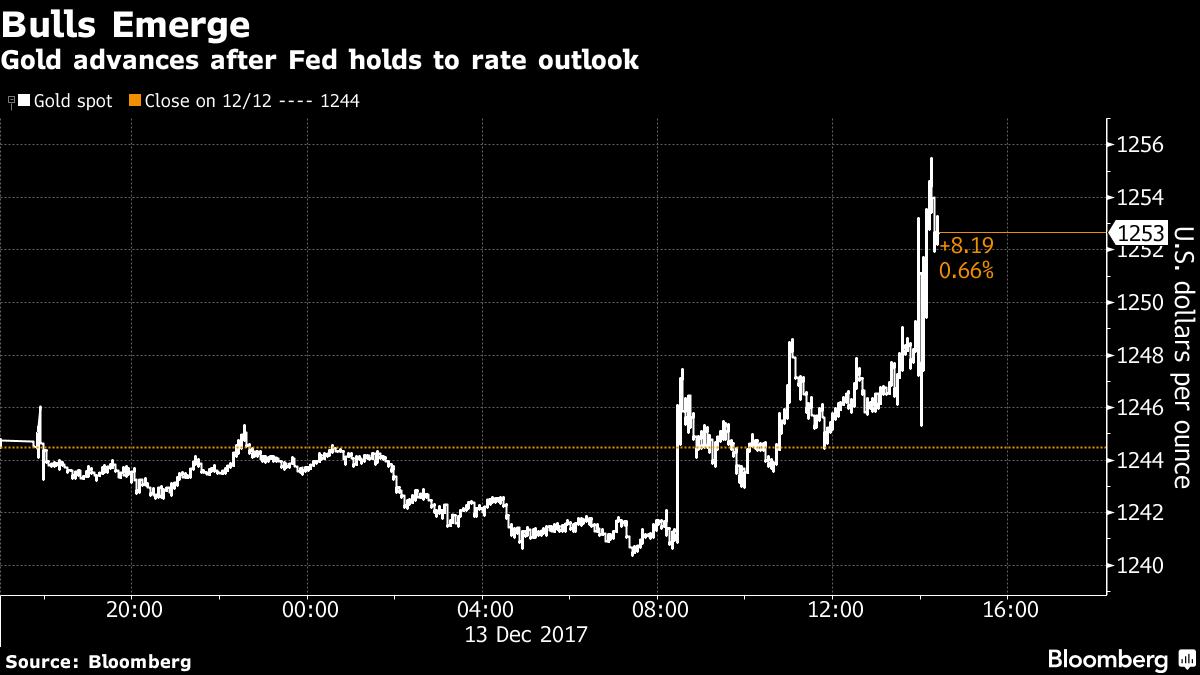

Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price. FOMC follows through on much anticipated rate-hike of 0.25%. Spot gold responds by heading for biggest gain in three weeks, rising by over 1%. Final meeting for Federal Reserve Chair Janet Yellen. Yellen does not expect Trump's tax-cut package to result in significant, strong growth for US economy. No concern for bitcoin which 'plays a very small role in the payment system'.

Read More »

Read More »

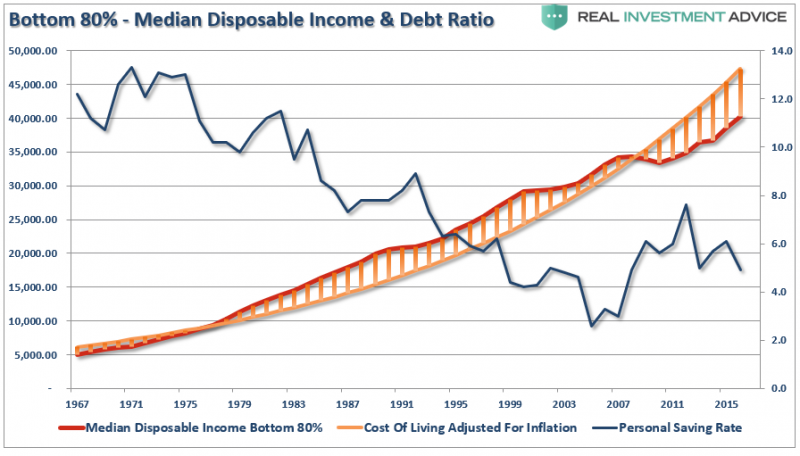

The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth.

Read More »

Read More »

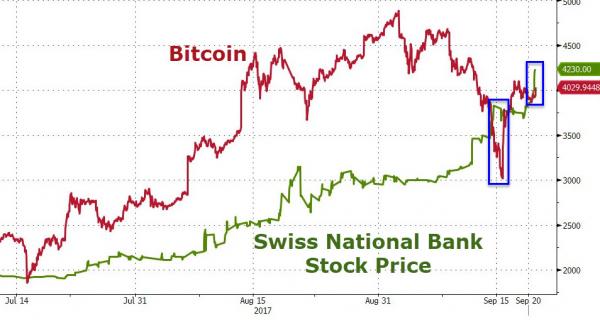

Swiss National Bank Bubble Regains Lead Over Bitcoin

But as Bitcoin rebounded from its China challenges, it overtook The SNB once again as bubbliest bubble. However, a 13% spike in the share price of The Swiss National Bank today has put an end to that leaving the central bank back in first place among the melter-uppers...

Read More »

Read More »

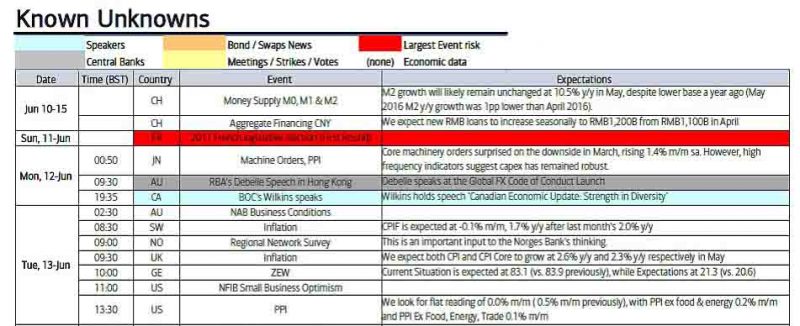

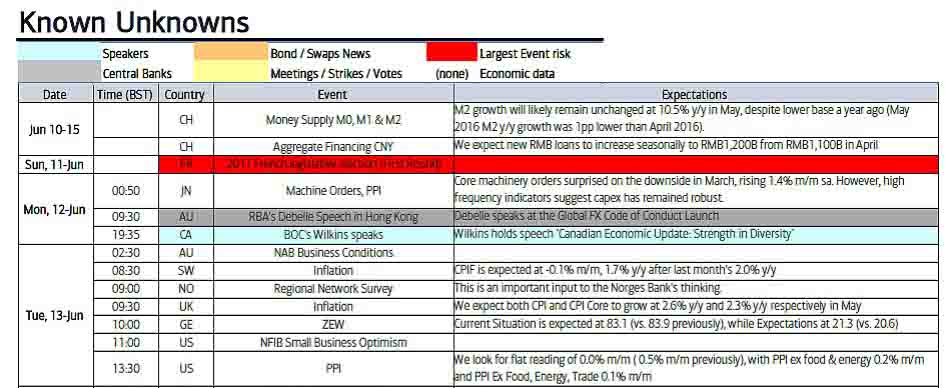

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

The Internet Helped Kill Inflation In America, Says Credit Suisse

Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen - as he told CNBC two days ago - is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt.

Read More »

Read More »

WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but... growth, and inflation, and supply cuts, and growth again... Well that de-escalated quickly... As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th.

Read More »

Read More »

Former Treasury Secretary Summers Calls For End Of Fed Independence

At an event in Davos, Switzerland earlier today, Former U.S. Treasury Secretary, Larry Summers, argued that Central Bank independence from national governments should be scrapped in favor of a coordinated effort between politicians, central bankers and treasury to engineer inflation. Seems reasonable, right?...what could possibly go wrong?

Read More »

Read More »

Inflation is now out of the control of central banks

2022-07-01

by Stephen Flood

2022-07-01

Read More »