Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity.

Read More »

Tag Archive: marginal productivity of debt

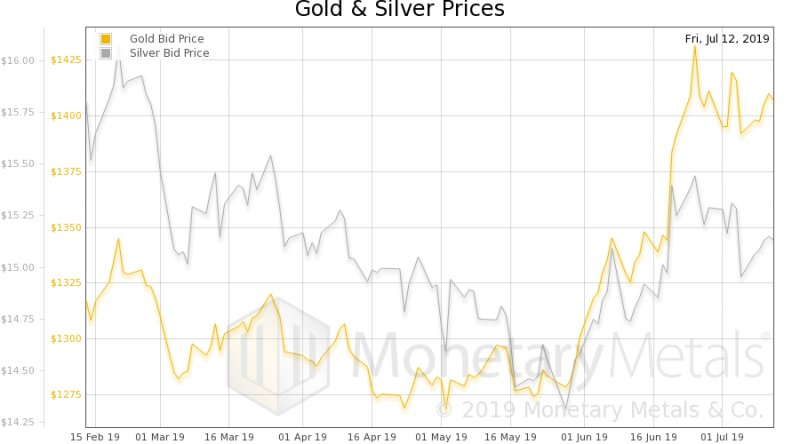

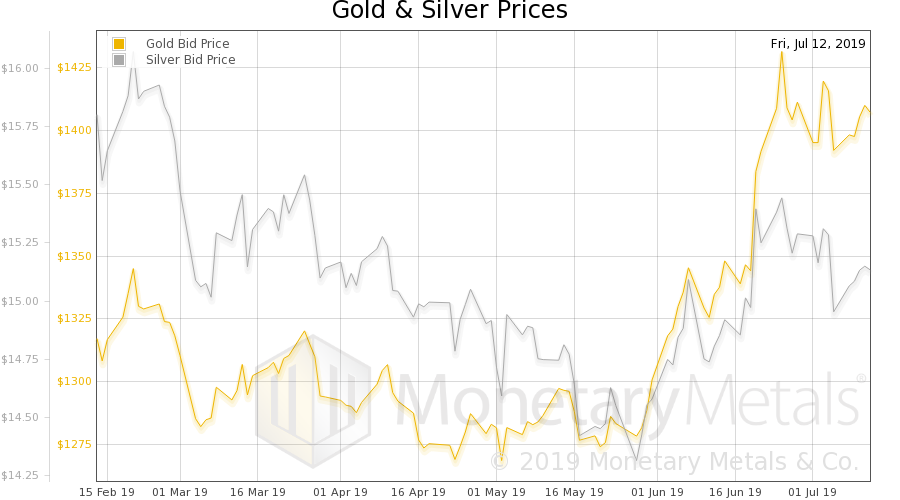

More Squeeze, Less Juice, Report 7 Jul

We have been writing on the flaws in GDP: that it is no measure of the economy, because it looks only at cash and not the balance sheet, and that there are positive feedback loops.

“OK, Mr. Smarty Pants,” you’re thinking (yes, we know you’re thinking this), “if GDP is not a good measure of the economy, then what is?!”

Read More »

Read More »

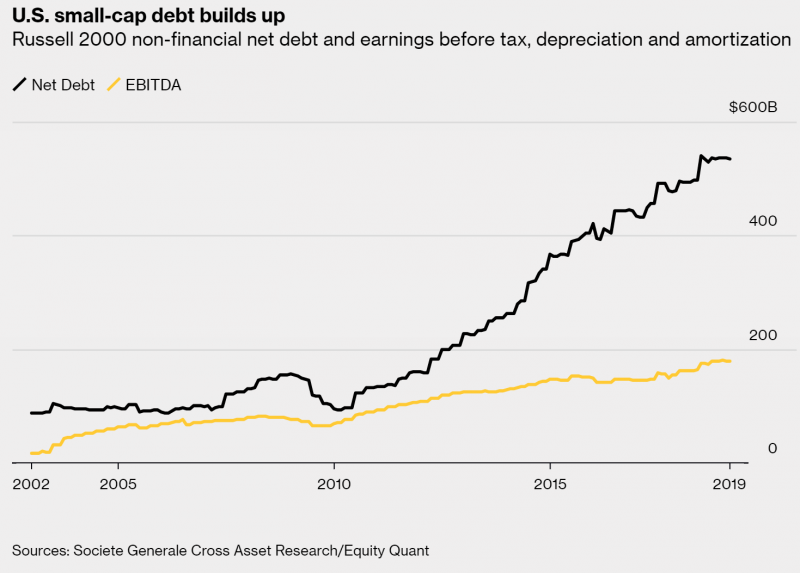

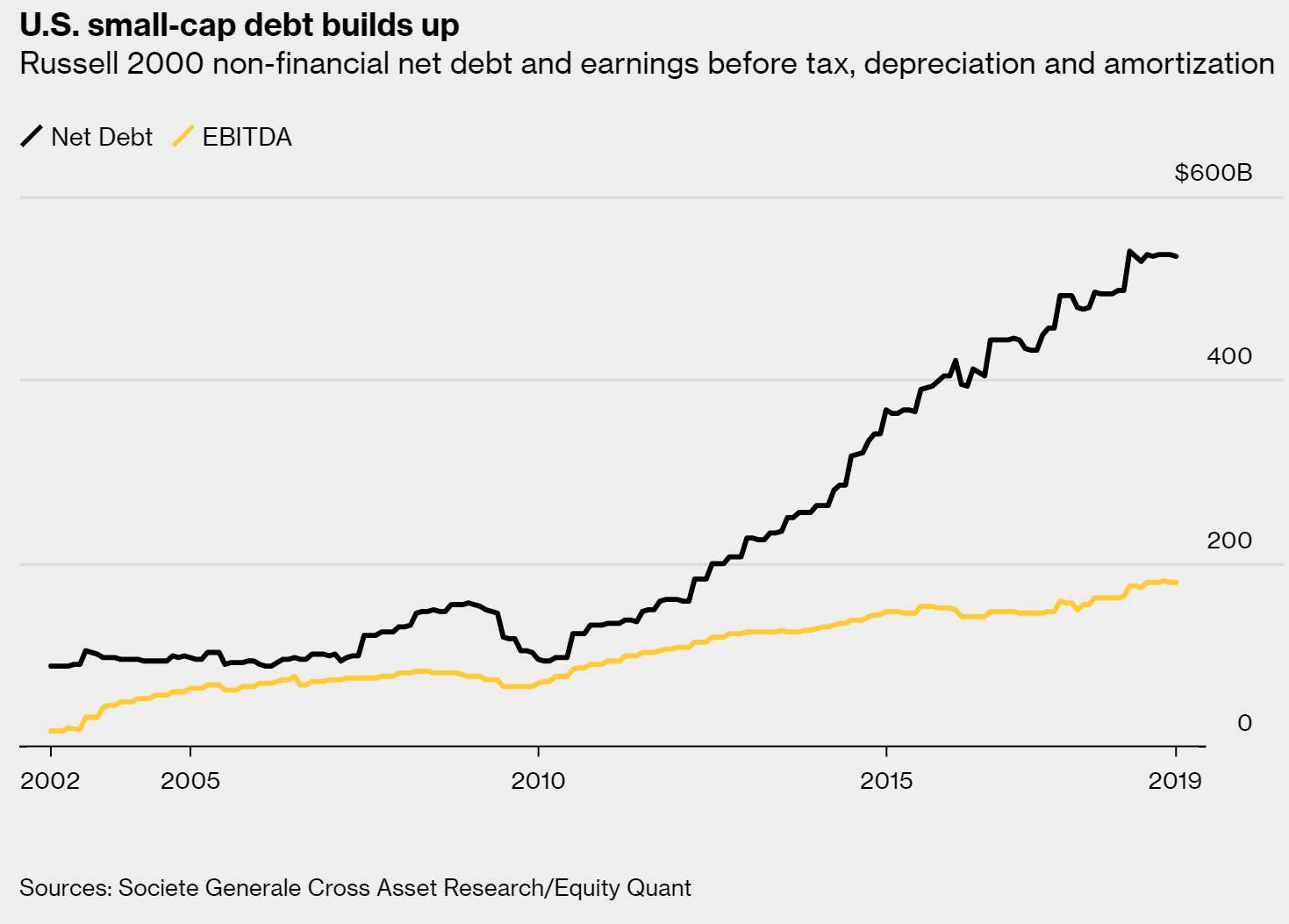

Debt and Profit in Russell 2000 Firms

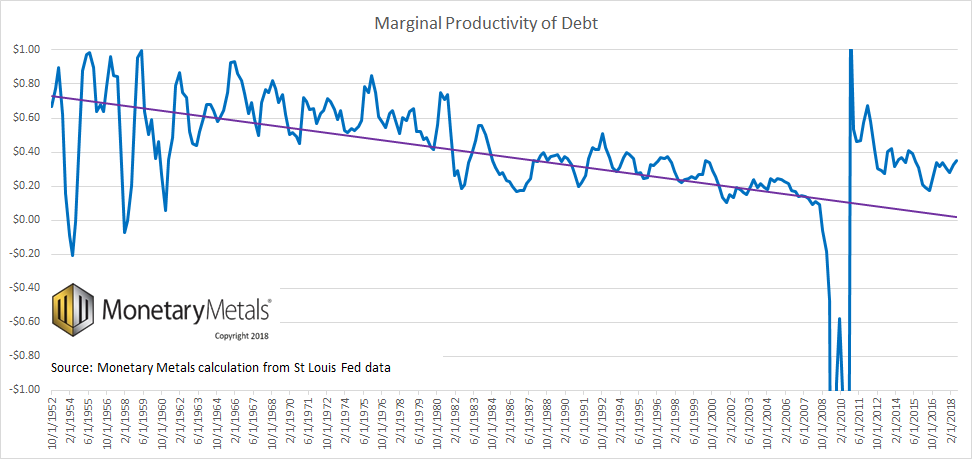

This week, the Supply and Demand Report featured a graph of debt vs profitability in the Russell 2000. Here’s the graph again: This graph shows a theme that we, and practically no one else(!) have been discussing for years. It is the diminishing marginal utility of debt. In this case, more and more debt is required to add what looks like less and less profit (we don’t have the raw data, only the graphic).

Read More »

Read More »

The Duality of Money, Report 10 Mar

This is a pair of photographs taken by Keith Weiner, for a high school project. It seemed a fitting picture for the dual nature of money, the dual nature of wood both as logs to be consumed and dimensional lumber to be used to construct buildings.

Read More »

Read More »

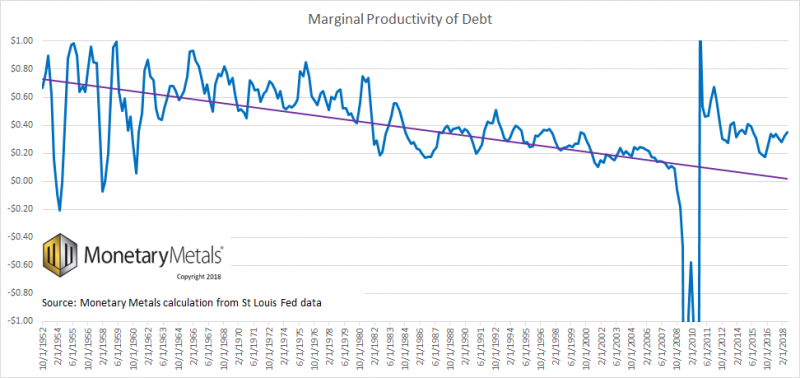

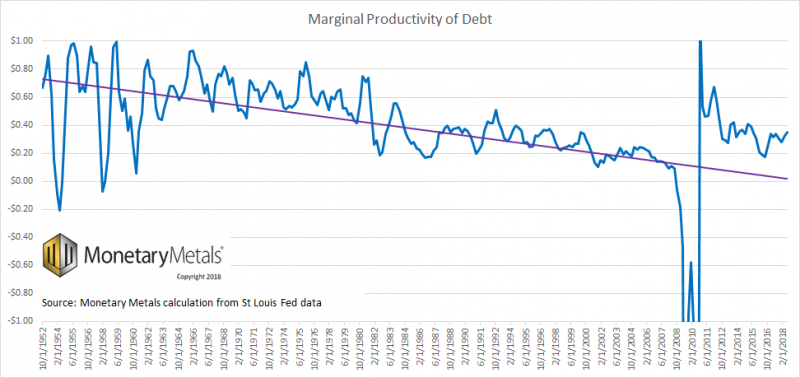

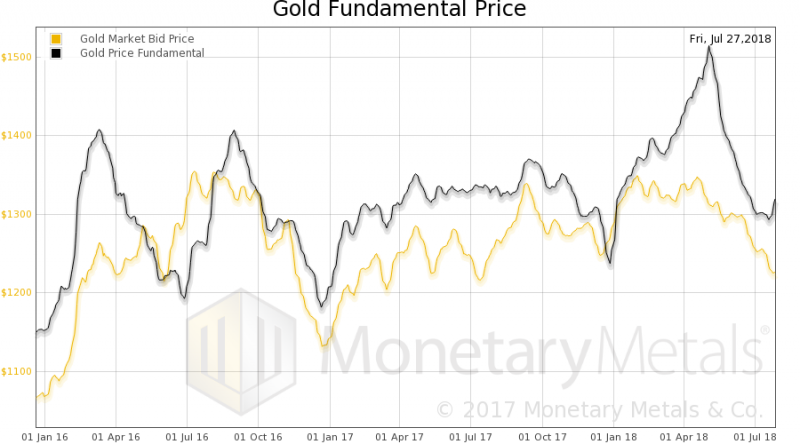

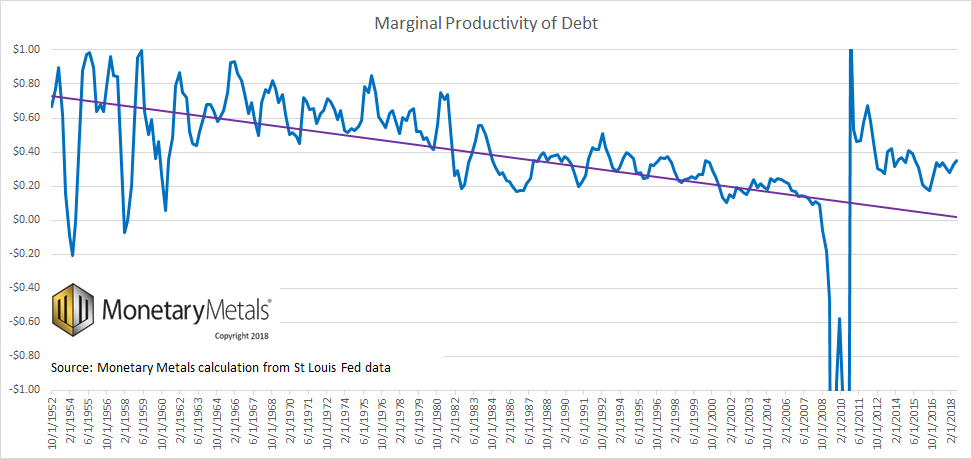

A Dire Warning, Report 29 July 2018

Let’s return to our ongoing series on the destruction of capital, and how to identify the signs. Steve Saville posted a thoughtful article this week entitled The “Productivity of Debt” Myth. His article provides a good opportunity to add some additional thoughts. We have written quite a lot on this topic. Indeed, we have a landing page for marginal productivity of debt (MPoD) with four articles so far.

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF stays above 0.9100 nearing the highs since October

8 days ago -

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

8 days ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

9 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

9 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

15 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

8 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Diese Aktien sind extrem günstig!

Diese Aktien sind extrem günstig! -

The DNA of Success: Habits of Millionaires Unveiled

The DNA of Success: Habits of Millionaires Unveiled -

Chapter 8. Why the US Supports Secession for Africans, but Not for Americans

-

Chapter 16. How Early Americans Decentralized Military Power

-

Chapter 17. Before Roe v. Wade, Abortion Policy was a State and Local Matter

-

Chapter 18. When Immigration Policy Was Decentralized

-

Chapter 19. Why Indian Tribal Sovereignty Is Important

-

Preface

-

Chapter 20. Sovereignty for Cities and Counties: Decentralizing the American Statesbal Sovereignty Is Important

-

Postscript: A Tale of Two Megastates: Why the EU Is Better (In Some Ways) than the US

More from this category

How to Fix GDP, Report 14 Jul

How to Fix GDP, Report 14 Jul16 Jul 2019

More Squeeze, Less Juice, Report 7 Jul

More Squeeze, Less Juice, Report 7 Jul8 Jul 2019

Debt and Profit in Russell 2000 Firms

Debt and Profit in Russell 2000 Firms12 Apr 2019

The Duality of Money, Report 10 Mar

The Duality of Money, Report 10 Mar11 Mar 2019

A Dire Warning, Report 29 July 2018

A Dire Warning, Report 29 July 201831 Jul 2018