Tag Archive: Mexico

FX Daily, September 24: Darkest Before Dawn

The two recent market developments, push lower in stocks, and higher in the dollar is continuing. Tuesday's gains in the S&P 500 and NASDAQ were unwound on Wednesday and this is helping drag global markets lower. The MSCI Asia Pacific Index fell for the fourth consecutive session today and many markets (India, Shenzhen, Taiwan, and Korea) fell more than 2% and most others were off more than 1%.

Read More »

Read More »

FX Daily, September 21: Risk Appetites Join Tokyo on Vacation

Global equity markets are off to a poor start to the week, and the dollar appears to be enjoying a safe-haven bid. Tokyo markets are closed until Wednesday, while Asia-Pacific stocks tumbled, and the regional index is unwinding last week's gains. The Dow Jones Stoxx 600 is off around 2.7% near midday in Europe.

Read More »

Read More »

Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday.

Read More »

Read More »

FX Daily, September 10: ECB and Beyond

Overview: A strong recovery in US stocks, a softer dollar, and higher gold and oil prices may signal the end of the brief though dramatic correction, but the market is in a bit of a holding pattern ahead of the ECB meeting. Most of the major equity markets in the Asia Pacific region stabilized, except for Hong Kong and China.

Read More »

Read More »

FX Daily, August 31: Month-End Gyrations and the Fed’s Ad Hocery

Markets are searching for direction at month-end. Asia Pacific shares outside of Japan lower. Berkshire Hathaway confirmed taking a $6 bln stake in Japanese trading companies over the past year, and the pullback in the yen helped lift shares. The MSCI Asia Pacific Index rose 2% last week.

Read More »

Read More »

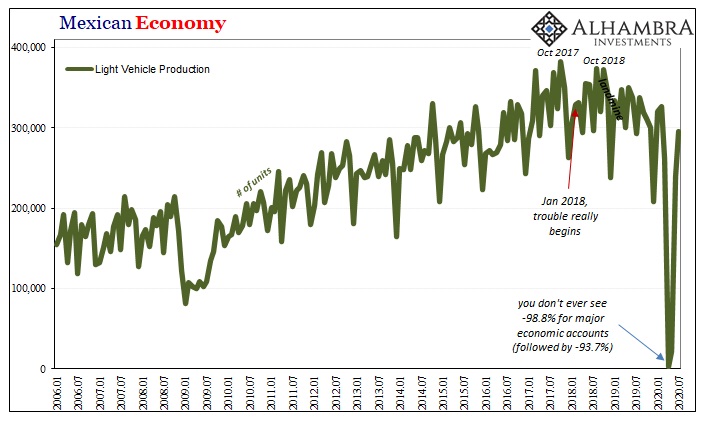

Meaning Mexico

It took some doing, and some time, but Mexico has managed to bring its car production back up to more normal levels. For two months, there had been practically zero automaking in one of the biggest auto-producing nations. Getting back near where things left off, however, isn’t exactly a “V” shaped recovery; it’s only halfway.

Read More »

Read More »

FX Daily, July 30: Greenback’s Bounce is Likely Short-Lived

A wave of profit-taking is seen through most of the capital markets today, with the exception of the bond market, where yields continue to trend lower. The US 10-year is now yielding 55 bp, a new low since early March, and the five-year yield set a new record low near 23 bp. European yields are 2-4 bp lower.

Read More »

Read More »

FX Daily, July 28: Dollar Bounces, Gold Slips, while Equities Hold Their Own

The main development in the capital markets today is the firmer dollar against nearly all the major and emerging market currencies. Among the majors, the New Zealand dollar and Swedish krona are the heaviest (~-0.4%), while the Swiss franc and yen are marginally lower.

Read More »

Read More »

FX Daily, July 23: Powerful Momentum is Still Evident in the Foreign Exchange Market

The powerful momentum moves in the capital markets continues unabated by escalating US-China tensions and continued spread of the virus. Asia Pacific equities were mixed. Tokyo was closed for a holiday, but several other large markets in the region, like China, South Korea, and Taiwan markets slipped lower, while Hong Kong, Australia, and India advanced.

Read More »

Read More »

Second Wave Global Trade

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting.

Read More »

Read More »

FX Daily, June 29: USD is Offered in Quiet Start to the New Week

The combination of rising virus cases and the sell-off in the US before the weekend dragged nearly all the Asia Pacific bourses lower. The Nikkei led the way with more than a 2% drop, but most bourses were off more than 1%. China and Taiwan were also greeted with selling as markets re-opened from a two-day holiday at the end of last week.

Read More »

Read More »

FX Daily, June 26: Investors Wrestle with Notion that More Covid Cases mean More Stimulus

It may be that a new surge in virus cases will elicit more policy support from officials, but the immediate focus may be on the economic disruption. The number of US cases is reaching records, and at least a couple of states are stopping their re-opening efforts. Several other countries, including parts of Australia, Japan, and Germany, are wrestling with the same thing, And some emerging markets, like Brazil and Mexico, have not experienced a lull.

Read More »

Read More »

FX Daily, June 24: Risk Appetites Satiated for the Moment

Overview: The rally in risk assets in North America yesterday is failing to carry over into today's activity. Asia Pacific equities were mixed. Korea and Indonesia led the advances with more than 1% gain. China and Taiwan also gained. Japan and Hong Kong. Europe's Dow Jone's Stoxx 600 is giving back yesterday's gains (~1.3%) plus some and US stocks are heavy.

Read More »

Read More »

FX Daily, May 26: Fear is Still on Holiday

Overview: The heightened tensions between the US and China sapped risk-appetites before the weekend, but appear to be missing in action today. Equity markets have rebounded strongly. Nearly all the equity markets in the Asia Pacific region rose (India was a laggard) led by an almost 3% rally in Australia, which was seen as particularly vulnerable to the Sino-American fissure.

Read More »

Read More »

FX Daily, May 14: Risk Appetites Wane

Overview: Risk appetites have been gradually waning this week. US equity losses mounted yesterday after Tuesday's late sell-off. Asia Pacific equities were off, with many seeing at least 1.5% drops. Europe's Dow Jones Stoxx 600 is off a little more to double this week's decline and leaves it in a position to be the biggest drop since panicked days in mid-March.

Read More »

Read More »

FX Daily, May 11: Quiet Start to New Week

Overview: The new week begins slowly in the capital markets. Many markets in the Asia Pacific region, including Japan, Hong Kong, and Australia, gained over 1%, but European and US shares are heavier. Benchmarks off all three regions rallied by 3.4%-3.5% over the past two weeks. Bond markets are also little changed, with the US 10-year benchmark just below 70 bp ahead of this week's record refunding.

Read More »

Read More »

FX Daily, May 5: German Court Adds to the Euro’s Woes

Overview: The S&P 500 recovered yesterday after dipping trading below the 20-day moving average for the first time in a month. The key area is the gap between the April 30 low (~2892.5) and the May 1 high (~2869). Oil reversed higher as well. June crude was off nearly 9% in the US morning and closed 7% higher on the day and above $21 for the first time since April 21, the day of negative oil prices.

Read More »

Read More »

FX Daily, April 22: Investors Catch Collective Breath, but Sentiment remains Fragile

Overview: Risk-appetites appear to have stabilized for the moment. Most equity markets are higher. Japan and Malaysia were exceptions, but the MSCI Asia Pacific Index rose for the first time this week. In Europe, the Dow Jones Stoxx 600 is recouping about a third of yesterday's loss.

Read More »

Read More »

FX Daily, April 16: Markets Brace for another Jump in US Weekly Jobless Claims

Overview: Equity losses in the US appeared to drag most Asia Pacific markets lower today, with China and India the notable exceptions. European bourses are higher, and the only energy sector is a drag on the Dow Jones Stoxx 600, which is around 1% higher in late morning turnover, while US shares are also trading firmer. Asia Pacific 10-year benchmark yields eased.

Read More »

Read More »

FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today. Japan and Australia are exceptions to the generalization.

Read More »

Read More »