Tag Archive: money printing

What Does Taper Look Like From The Inside? Not At All What You’d Think

Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace.

Read More »

Read More »

You Don’t Have To Take My Word For It About Eliminating QE

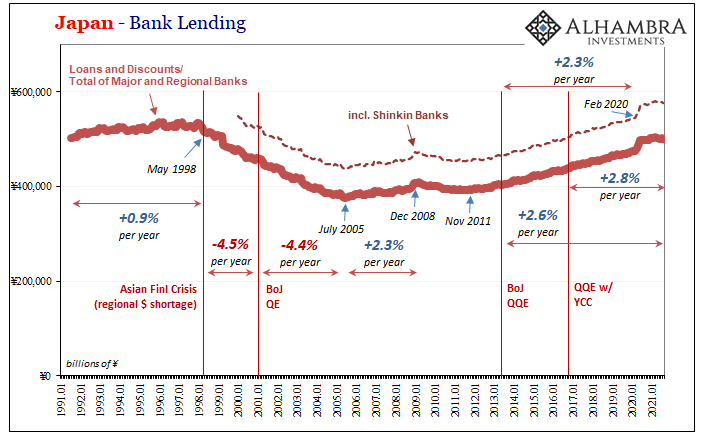

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s.

Read More »

Read More »

August Avoids Zero In JGB’s

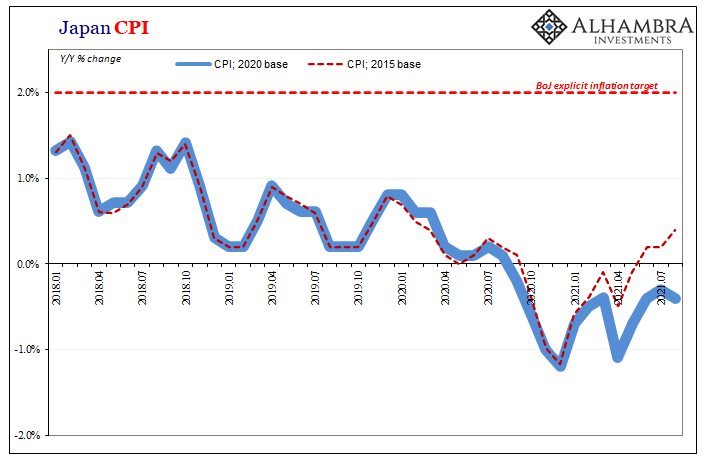

Central banks and their staffs have long been accused of trying to hide inflation. This allegation had been a staple of their critics, those charging reckless monetary policies for creating “too much” money that had allegedly been causing price imbalances all over the financial map.

Read More »

Read More »

The Inflation Emotion(s)

Inflation is more than just any old touchy subject in an age overflowing with crude, visceral debates up and down the spectrum reaching into every corner of life. It is about life itself, and not just quality. When the prices of the goods (or services) you absolutely depend upon go up, your entire world becomes that much more difficult.

Read More »

Read More »

Central Banks Will Still Do “Whatever It Takes”!

Governments are taking a page out of the play book that monetary policy began a decade ago – which will lead to even higher debt levels.

Read More »

Read More »

Gold, the Tried-and-True Inflation Hedge for What’s Coming!

Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the...

Read More »

Read More »

If the Fed’s Not In Consumer Prices, Then How About Producer Prices?

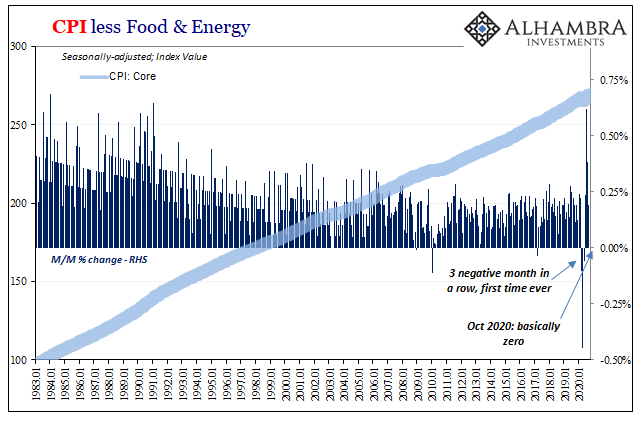

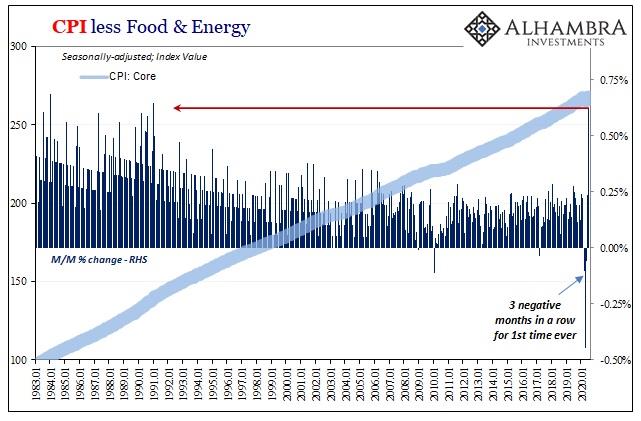

It’s not just that there isn’t much inflation evident in consumer prices. Rather, it’s a pretty big deal given the deluge of so much “money printing” this year, begun three-quarters of a year before, that consumer prices are increasing at some of the slowest rates in the data.

Read More »

Read More »

Where Is It, Chairman Powell?

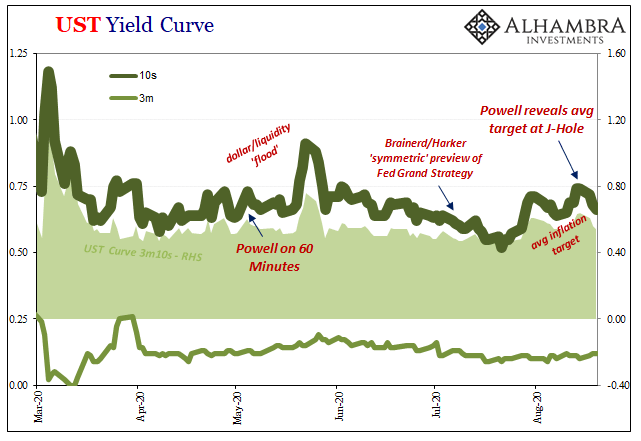

Where is it, Chairman Powell? After spending months deliberately hyping a “flood” of digital money printing, and then unleashing average inflation targeting making Americans believe the central bank will be wickedly irresponsible when it comes to consumer prices, the evidence portrays a very different set of circumstance.

Read More »

Read More »

Meanwhile, Outside Today’s DC

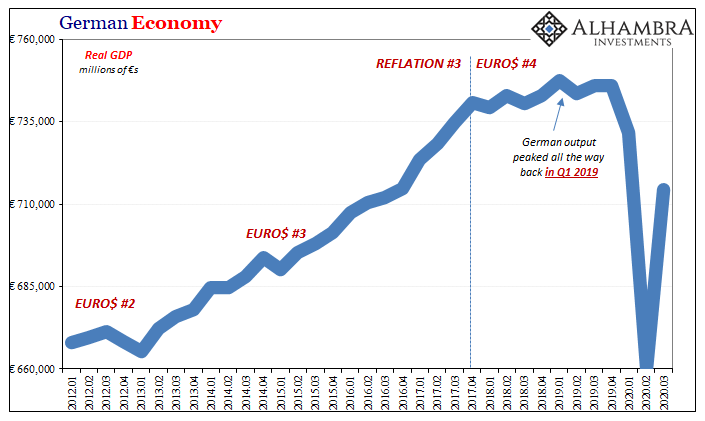

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

What’s Going On, And Why Late August?

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here?

Read More »

Read More »

Powell Would Ask For His Money Back, If The Fed Did Money

Since the unnecessary destruction brought about by GFC2 in March 2020, there have been two detectable, short run trendline upward moves in nominal Treasury yields. Both were predictably classified across the entire financial media as the guaranteed first steps toward the “inevitable” BOND ROUT!!!!

Read More »

Read More »

Part 2 of June TIC: The Dollar Why

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

Fama 2: No Inflation For Old Central Banks

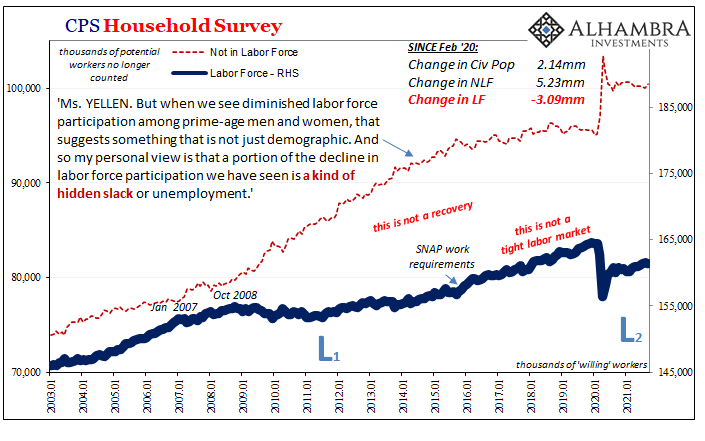

The Bureau of Labor Statistics reported that the core CPI in July 2020 jumped by the most (+0.62%) in almost thirty years. After having dropped month-over-month for three months in a row for the first time in its history, it has posted back to back gains the latest of which pushing the index back above its February level.

Read More »

Read More »

Transitory, The Other Way

After a record three straight months of decline for the seasonally-adjusted core CPI March through May 2020, it turned upward again in June. Buoyed by a partially reopened economy, the price discounting (prerequisite to the Big D) took at least one month off.

Read More »

Read More »

Wait A Minute, The Dollar And The Fed’s Bank Reserves Are Directly Not Inversely Related

One small silver lining to the current situation, while Jay Powell is busily trying to sell you his inflation fantasy, he’s actually undermining it at the very same time. No mere challenge to his own “money printing” fiction, either, the Fed’s Chairman is actively disproving the entire enterprise. While he says what he says, pay close attention instead to what he’s done.

Read More »

Read More »

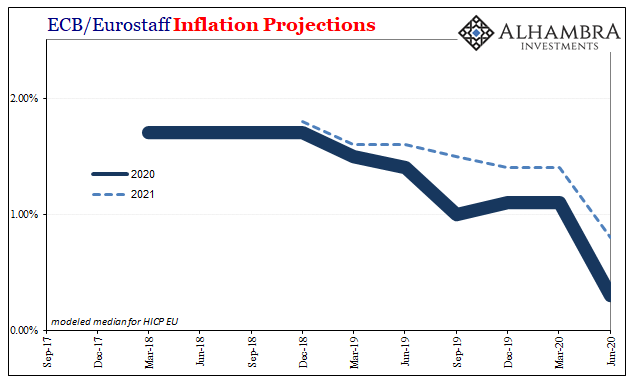

ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press.

Read More »

Read More »

No Flight To Recognize Shortage

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it.

Read More »

Read More »

Everyone Knows The Gov’t Wants A ‘Controlled’ Weimar

There are two parts behind the inflation mongering. The first, noted yesterday, is the Fed’s balance sheet, particularly its supposedly monetary remainder called bank reserves. The central bank is busy doing something, a whole bunch of something, therefore how can it possibly turn out to be anything other than inflationary?The answer: the Federal Reserve is not a central bank, not really.

Read More »

Read More »

Is Central Banks’ License to Print Money About to Expire?

2022-10-29

by Stephen Flood

2022-10-29

Read More »