Tag Archive: New Zealand

Capital Markets are Calm though Anxiety Continues to Run High

Overview: The risk that the war in Israel spreads

remains palatable, and several observers have warned of the greatest risks of a

world war in a generation. Still, the capital markets remain relatively calm. The

US dollar is softer after closing last week firmly. The only G10 currency

unable to post corrective upticks today is the Swiss franc. Among emerging

market currencies, the Polish zloty has been boosted by the pro-EU election

results, and...

Read More »

Read More »

The Dollar Consolidates after Powell Sapped its Mojo

Overview: Federal Reserve Chair Powell's offered a

stronger case for a pause in the monetary tightening before the weekend and

this sapped the dollar's mojo. The greenback is mostly consolidating through

the European morning in quiet turnover. The JP Morgan Emerging Market Currency

Index is trying to snap a four-day decline. The South African rand is

recovering from its recent slide and is up nearly 1%. The South Korea won is

benefitting from...

Read More »

Read More »

Limited Follow-Through Dollar Buying After Yesterday’s Gains

Overview: The dollar sprang

higher yesterday but follow-through buying today has been limited. The

little more than 0.5% gain in the Dollar Index was among the largest since

mid-March. And yet, the debt ceiling anxiety and weak US bank shares persist. Today's

talks at the White House have been postponed until early next week. Both sides

are incentivized to bring it to the brink to demonstrate to their

constituencies that they got the best deal...

Read More »

Read More »

Banking Stress Eases

Overview: The banking crisis is ebbing. The Bank of

England and European Central Bank assured investors that the AT1 bonds are

senior to equity claims, and Switzerland is a unique case. Bank share indices

in the Europe and the US rose yesterday, even though the shares of First

Republic Bank fell by 47% yesterday. The $123-stock at the end of last month

reached almost $11 yesterday. It is trading around $14.75 pre-market. Global equities are...

Read More »

Read More »

Swiss National Bank Support Steadies Market as ECB Faces Difficult Choice

Overview: The pendulum of market psychology is

swinging dramatically. Amid the US banking crisis, Credit Suisse's long-running

pressures percolated back to top-of-mind, sending ripples through the capital

markets, trigging a sharp slide in the euro. The SNB support is helping the

markets calm today. The odds of a 50 bp hike by the ECB today have been cut to

about 50% compared with a nearly 100% a week ago. The market has about a 66%

chance of a 25...

Read More »

Read More »

Upside Surprise in UK’s Flash PMI and Better-than-Expected January Public Finances Lift Sterling

Overview: Rising interest rates are weighing on risk

appetites and the dollar is broadly stronger. Sterling is a notable exception

after a stronger than expected flash PMI and better than expected public

finances. The correlation between higher US rates and a weaker yen is

increasing and the greenback looks poised to rechallenge the JPY135 area. A

slightly better than expected preliminary PMI and hawkish minutes from the

recent RBA meeting has done...

Read More »

Read More »

Poor US Data Cast Doubts on New Found Hopes of a Soft-Landing

Overview: Yesterday's string of dismal US economic

data delivered a material blow to those still thinking that a soft-landing was

possible. Retail sales by the most in the a year. Manufacturing output fell by nearly 2.5% in the last two months of 2022. Bad

economic news weighed on US stocks. The honeymoon of New Year may have ended

yesterday. The US 10-year yield fell below 3.40% for the first time since the

middle of last September. The Atlanta...

Read More »

Read More »

Macro and Prices: Data and Psychology in the Week Ahead

The week ahead has a relatively light economic schedule, punctuated by the US Thanksgiving Day holiday on November 24. Nevertheless, the data highlights include the preliminary November PMIs, Tokyo's November CPI, and the FOMC minutes from this month's meeting.

Read More »

Read More »

Turn Around Tuesday Aside, is the Dollar Topping?

Global equities moved higher in the wake of the strong gains in the US yesterday. US futures point to the possibility of a gap higher opening today. Most of the large Asia Pacific bourses rallied 1%-2%, with China’s CSI a notable exception, slipping fractionally.

Read More »

Read More »

Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things.

Read More »

Read More »

As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

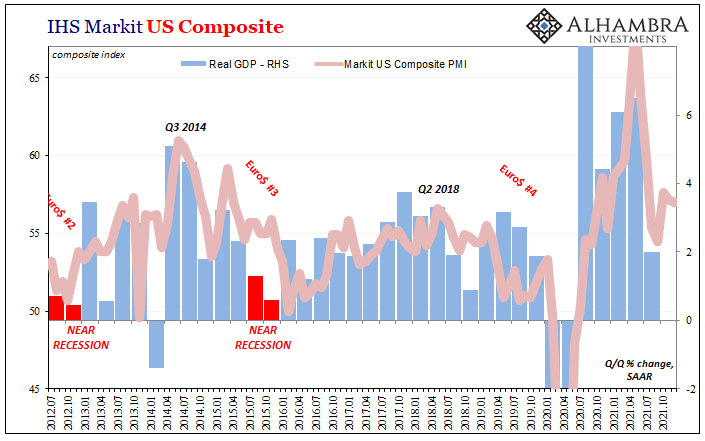

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going.

Read More »

Read More »

Flash PMIs Play Second Fiddle to US PCE Deflator and Accelerating Inflation

The flash November PMIs would be the main focus in the week ahead if it were more normal times. But these are not normal times, and growth prospects are not the key driver of the investment climate. This quarters' growth is largely baked into the cake. The world's three largest economies, the US, China, and Japan, are likely to accelerate for different reasons in Q4 from Q3. Europe is the weak sibling, and growth in the eurozone and UK may slow...

Read More »

Read More »

Euro Bounces Back, but the Turkish Lira Remains Unloved

Overview: The US dollar's sharp upside momentum stalled yesterday near JPY115 and after the euro met (and surpassed) a key retracement level slightly below $1.1300. Led by the Antipodean currencies today, the greenback is mostly trading with a heavier bias. Among the majors, helped by a steadying of US yields, the yen is soft. In the emerging market space, the Turkish lira continues its headlong plunge while the yuan softened and the Mexican...

Read More »

Read More »

FX Daily, August 17: Antipodeans and Sterling Bear Brunt of Greenback’s Gains

Overview: Concern about the economic impact of the virus and new efforts by China to curb "unfair" competition among online companies has triggered a dramatic response by investors. A lockdown in New Zealand and the Reserve Bank of Australia signaling it will respond if the economic fallout increases sent the Antipodean currencies sharply lower.

Read More »

Read More »

FX Daily, February 26: Fed Hike Ideas Give the Beleaguered Greenback Support

A poor seven-year note auction and ideas that the first Fed hike can come as early as the end of next year spurred a steep sell-off in bonds and equities. Technical factors like the triggering of stops losses, large selling in the futures market, which some also link to hedging of mortgage exposure (convexity hedging), also play a role.

Read More »

Read More »

FX Daily, February 24: Equities Try to Stabilize and Low Short-Term Rates Help Keep the Dollar on the Defensive

Overview: The sharp recovery in US shares yesterday that saw the S&P 500 snap a five-day slide failed to carry into Asia Pacific trading earlier today. All the markets fell save India and Singapore. Losses were led by a 3% drop in Hong Kong as the first increase in the stamp duty (financial transaction tax) since 1993 was announced (0.13% from 0.10%).

Read More »

Read More »

FX Daily, February 22: Stocks Wilt under Pressure from Rising Yields

Higher interest rates, driven by inflation expectations, is forcing an adjustment to equity markets. The S&P 500 is poised to gap lower today following slides in the Asia Pacific region and Europe. Japanese and Taiwanese indices advanced by steep losses were seen in China, Hong Kong, and India.

Read More »

Read More »

FX Daily, November 11: Reduced Risk of Negative Policy Rates Lifts Sterling and the Kiwi

Overview: Investors are trying to figure out the impact of the likelihood of a vaccine. One thing that has happened is that the market perceives less chance that the UK or New Zealand will adopt negative rates, and their respective currencies are adjusting higher. Meanwhile, the equity rally is continuing in Asia and Europe.

Read More »

Read More »

FX Daily, October 08: Markets Catch Collective Breath

The S&P 500 and NASDAQ closed at their highest levels in around a month yesterday, recouping Tuesday's presidential tweet-driven drop. We thought the market overreacted to the end of the fiscal talks as many had already recognized that a stimulus agreement was unlikely before the election, but the near round-trip seen in stocks and bonds was surprising.

Read More »

Read More »

FX Daily, August 13: Dollar Remains Offered

The poor price action on Tuesday in the S&P 500 was shrugged off, and new highs for the recovery were made as the record high nears. The dollar, on the other hand, seemed to find plenty of sellers against most of the major currencies. The yen was a notable exception.

Read More »

Read More »