Tag Archive: recession

Immigration And Its Impact On Employment

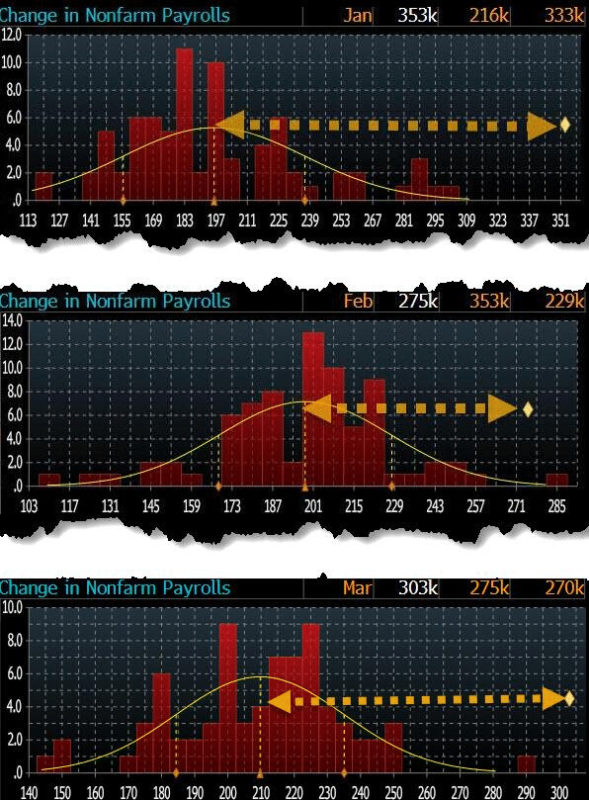

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border.

Read More »

Read More »

Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote.

Read More »

Read More »

Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

Read More »

Read More »

Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies.

Read More »

Read More »

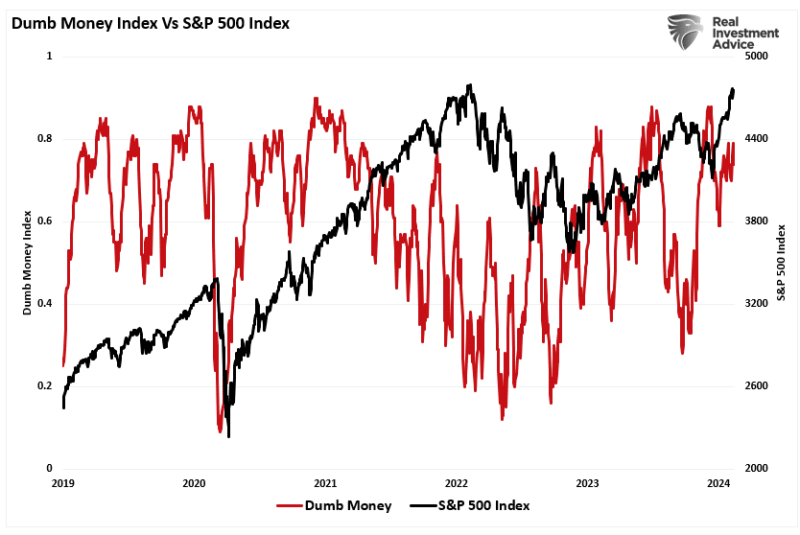

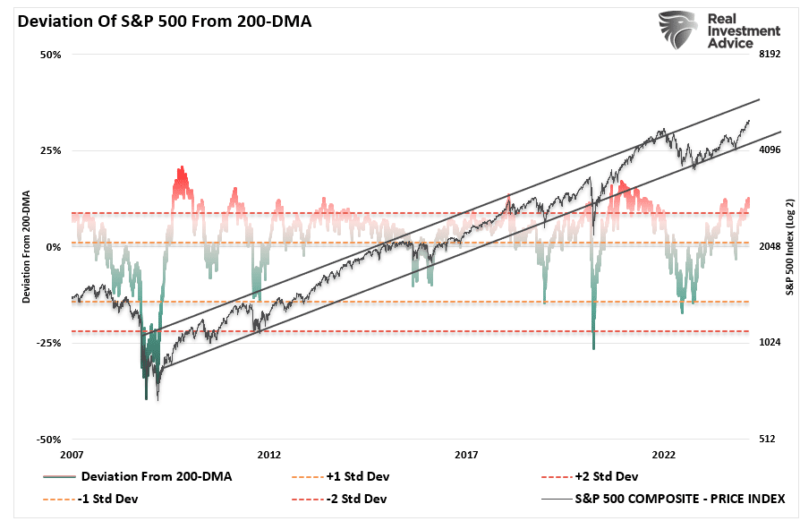

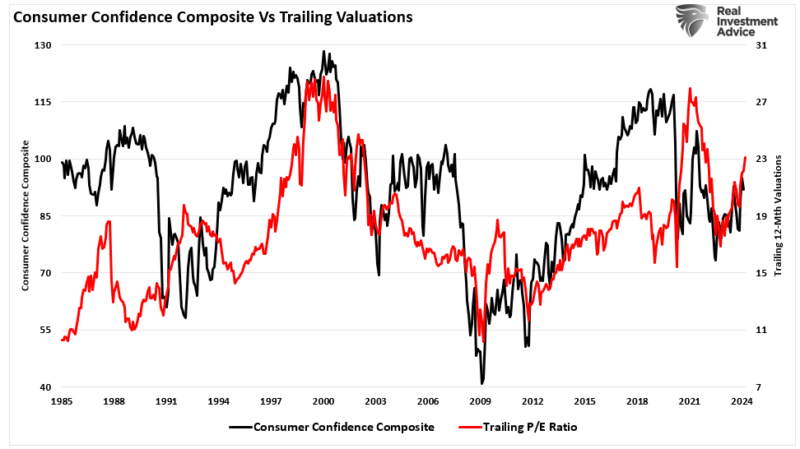

Valuation Metrics And Volatility Suggest Investor Caution

Valuation metrics have little to do with what the market will do over the next few days or months. However, they are essential to future outcomes and shouldn’t be dismissed during the surge in bullish sentiment. Just recently, Bank of America noted that the market is expensive based on 20 of the 25 valuation metrics they track.

Read More »

Read More »

Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average...

Read More »

Read More »

Market Morsels: ISM and Recession

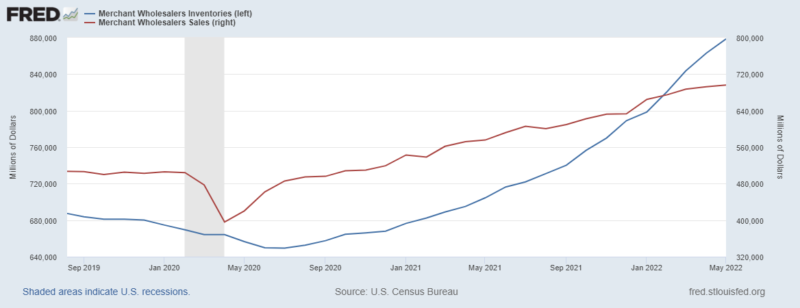

The ISM manufacturing survey has been below 50 for 15 months in a row and sits today at 49.1. This survey, along with a lot of other manufacturing data and anecdotes, has been cited repeatedly by the economic bears as evidence we are heading for recession. That, of course, hasn’t happened and that is consistent with this indicator.

Read More »

Read More »

Rethinking “safe” investments

Part I of II by Claudio Grass, Hünenberg See, Switzerland

To most observant citizens and diligent investors it is surely quite obvious that the current monetary, fiscal and banking system is inherently flawed, hopelessly unjust, corrupt, unsustainable and simply destined to collapse sooner or later. With every (predictable) recession and every (foreseeable) crisis, this structure gets weaker; its very own architects increasingly second-guess...

Read More »

Read More »

Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air.

Read More »

Read More »

Weekly Market Pulse: Happy Days Are Here Again!

Your cares and troubles are gone

There’ll be no more from now on!

Happy days are here again!

The skies above are clear again

Let us sing a song of cheer again

Happy days are here again!

Lyrics: Jack Yellen, Music: Milton Ager

That’s certainly how it’s felt since the turn of the new year with the NASDAQ up nearly 15%, European stocks continuing to recover, emerging markets anticipating a Chinese recovery and a solid January for the S&P...

Read More »

Read More »

Weekly Market Pulse: First, Kill All The Speculators

The Fed meets this week and is widely expected to raise the Fed Funds rate by 0.25% to a range of 4.5% – 4.75%. The market has factored in a small probability that they do nothing and leave rates alone, but they’ll probably do what’s expected because they’ve spent the last couple of months preparing the markets for exactly this outcome.

Read More »

Read More »

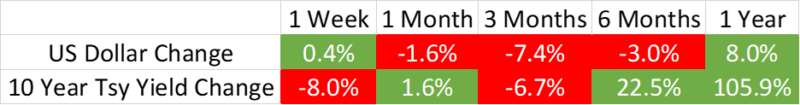

Poor US Data Cast Doubts on New Found Hopes of a Soft-Landing

Overview: Yesterday's string of dismal US economic

data delivered a material blow to those still thinking that a soft-landing was

possible. Retail sales by the most in the a year. Manufacturing output fell by nearly 2.5% in the last two months of 2022. Bad

economic news weighed on US stocks. The honeymoon of New Year may have ended

yesterday. The US 10-year yield fell below 3.40% for the first time since the

middle of last September. The Atlanta...

Read More »

Read More »

Weekly Market Pulse: The Consensus Will Be Wrong

What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business.

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine.

Read More »

Read More »

Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong.

Read More »

Read More »

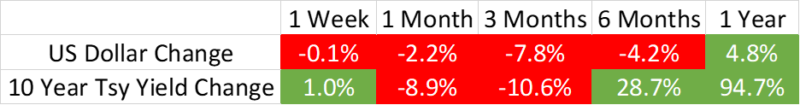

Euro Parity Holds ahead of US CPI

Overview: The US dollar is consolidating with a slight downside bias ahead of the June CPI report. The euro held above $1.00 but is still pinned in the trough. The rate hike by the Reserve Bank of New Zealand failed to have much impact.

Read More »

Read More »

Will Silver Prices Go Up to $300?

2022-08-11

by Stephen Flood

2022-08-11

Read More »