Tag Archive: statistics

China Exports, China Imports: Textbook

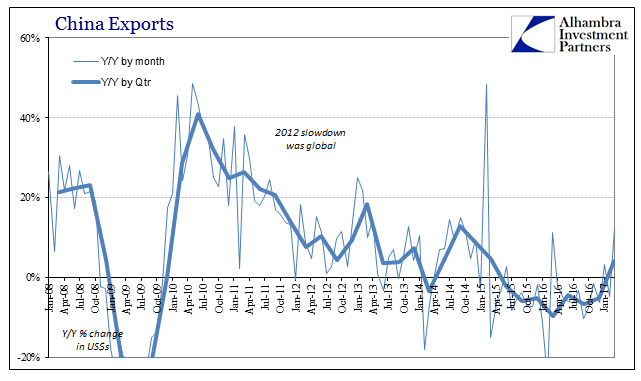

China’s export growth disappointed in July, only we don’t really know by how much. According to that country’s Customs Bureau, exports last month were 7.2% above (in US$ terms) exports in July 2016. That’s down from 11.3% growth in June, which as usual had been taken in the mainstream as evidence of “strong” or “robust” global demand.

Read More »

Read More »

Chinese Basis For Anti-Reflation?

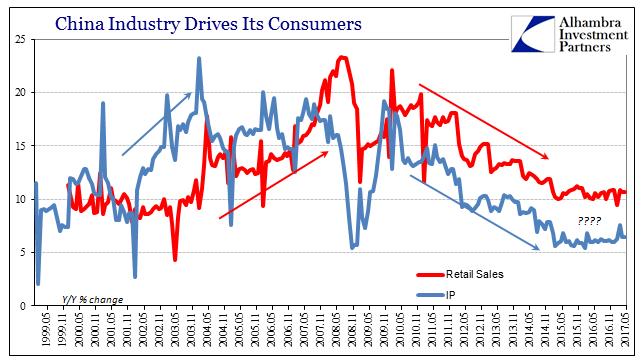

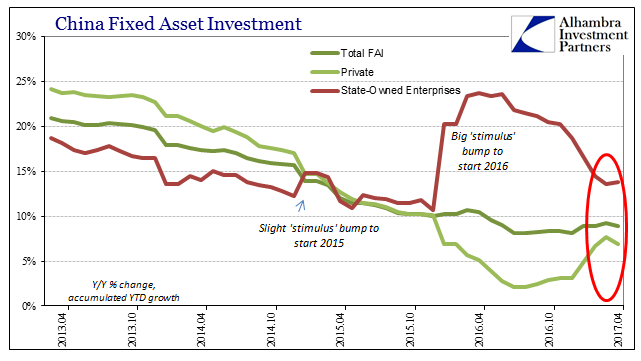

Yesterday was something of a data deluge. In the US, we had the predictable CPI dropping again, lackluster US Retail Sales, and then the FOMC’s embarrassing performance. Across the Pacific, the Chinese also reported Retail Sales as well as Industrial Production and growth of investments in Fixed Assets (FAI). When deciding which topics to cover yesterday, it was easy to leave off the Chinese portion simply because much of it didn’t change.

Read More »

Read More »

Questions Persist About China Trade

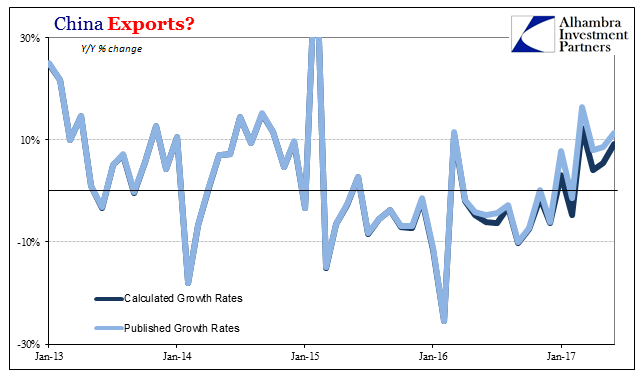

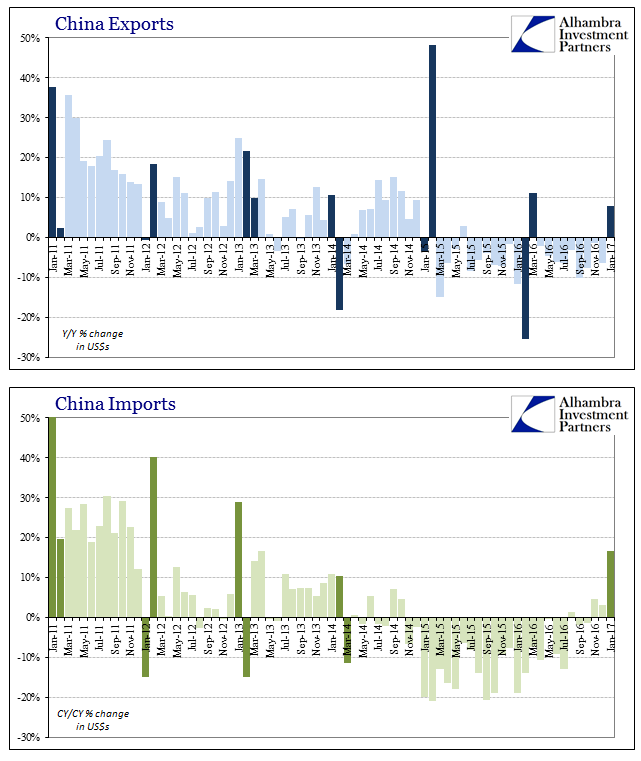

Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became noticeable.

Read More »

Read More »

Trying To Reconcile Accounts; China

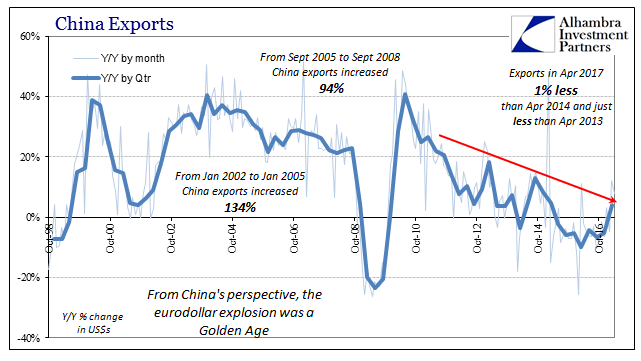

Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern.

Read More »

Read More »

Lackluster Trade, China April Edition

China’s trade statistics for April 2017 uniformly disappointed. They only did so, however, because expectations are being calibrated as if the current economy is actually different. It is instead merely swinging between bouts of contraction and low-grade growth, but so low-grade it really doesn’t qualify as growth.

Read More »

Read More »

What Was Chinese Trade in March?

As with all statistics, there are discrepancies that from time to time may obscure the meaning or validity of the particular estimate in question. For the vast majority of the time, any such uncertainties amount to very little. Overall, harmony among the major accounts reduces the signal noise from any one featuring a significant inconsistency.

Read More »

Read More »

No China Trade Interpretations

The National Bureau of Statistics (NBS) of China does not publish any of the big three data series (Industrial Production, Retail Sales, Fixed Asset Investment) for the month of January. It combines January data with February data because of the large distortions caused by Lunar New Year holidays.

Read More »

Read More »