Tag Archive: Tax

Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos' elites discussed why the world needs to "get rid of currency," the European Commission has introduced a proposal enforcing "restrictions on payments in cash.

Read More »

Read More »

Basic Income Arrives: Finland To Hand Out Guaranteed Income Of €560 To Lucky Citizens

Just over a year ago, we reported that in what was set to be a pilot experiment in "universal basic income", Finland would become the first nation to hand out "helicopter money" in the form of cash directly to a select group of citizens.

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

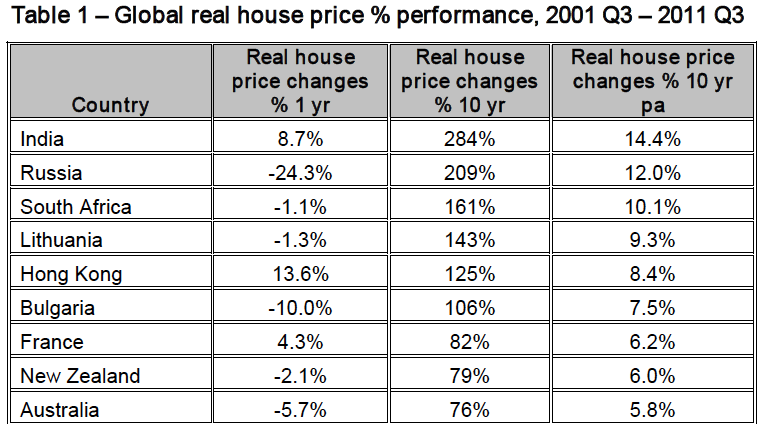

The latest bubble: Real estate in Russia

Still a draft, From Barnaul, Siberia, Russia Inna, 28, is a high-school teacher, she has one child. Her monthly salary is 8’500 Russian Rubel, about 257 USD. Similarly as many state employees her salary is very low. Recently the state doubled the salary of policemen and soldiers from 20’000 RUB to 40’000 RUB. A main …

Read More »

Read More »

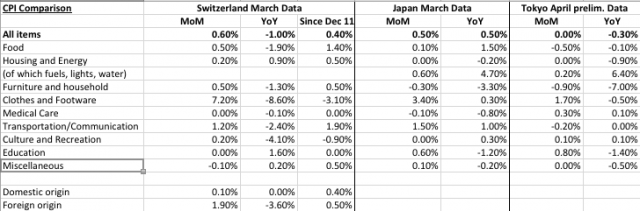

Rumors about tax on Swiss deposits for foreigners and further SNB measures: SNB begging for pips

Exactly when the US had a relatively good Markit Flash PMI, rumors are sent out that deposits in CHF for foreigners should be taxed. To send out this rumor together with good US data seems to be intentional. According to Banque CIC the SNB has declined to comment. We remember the last SNB meeting when similar rumors circulated.

Read More »

Read More »

Former SNB chief economist: Capital controls are just empty words

A former SNB chief economist says that capital controls are impossible, just empty words. In case of a Euro break-up the Swissie must rise together with USD, GBP and JPY An article, surprisingly from the usually left-wing Tagesanzeiger, more or less closely translated with some additional remarks.

Read More »

Read More »

Why is the Swiss safe-haven so completely different from the Yen ?

4 future scenarios for the Swiss franc and the Japanese yen For many people it is astonishing that the Swiss franc continuously rises against the euro, especially when markets are up. Is the CHF no safe-haven any more ? This year the Japanese yen has strongly fallen against the major currencies. Together with the upturn …

Read More »

Read More »