Tag Archive: treasuries

US Dollar Offered but Stretched Intraday

The US dollar is trading heavily against all the major currencies, led by the Norwegian krone and euro. Emerging market currencies are also firmer. However, risk-appetites seem subdued. Even though most large bourses in Asia Pacific advanced but Japan and Hong Kong, European markets are nursing small losses and US futures are little changed.

Read More »

Read More »

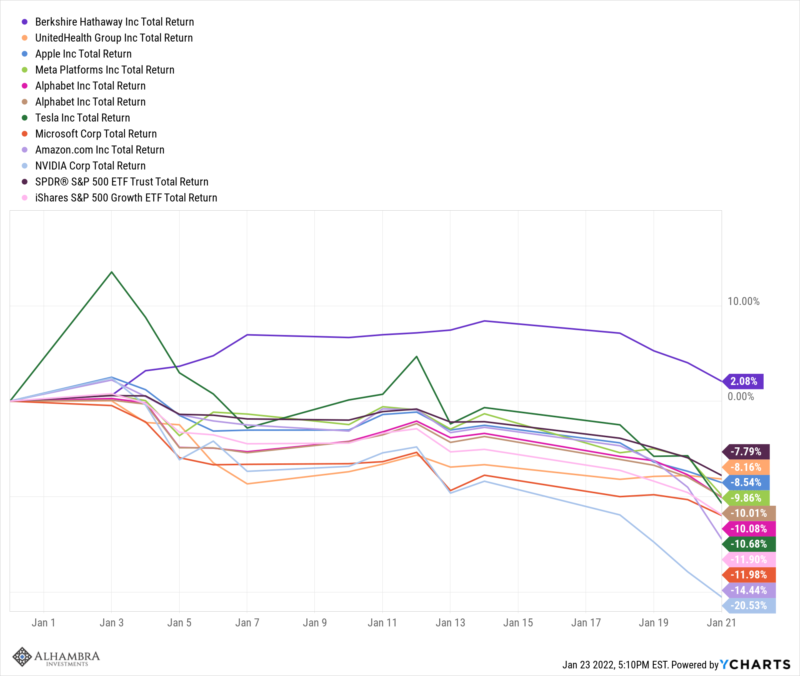

Weekly Market Pulse: Fear Makes A Comeback

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline.

Read More »

Read More »

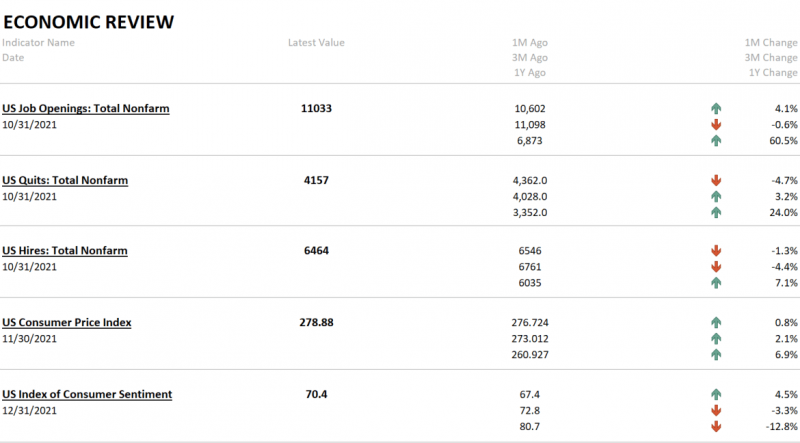

Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years. Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More. Inflation is Soaring..

Read More »

Read More »

FX Daily, February 1: Markets Snap Back

Global equities are snapping back today, while the greenback retained the strength seen last week that was attributed to safe-haven flows. The MSCI Asia Pacific Index snapped a four-day decline led by Hong Kong, South Korea, India, and Indonesia.

Read More »

Read More »

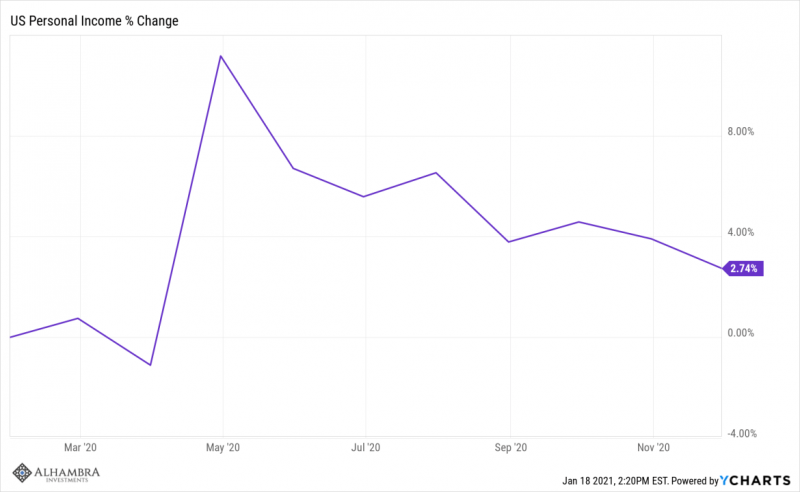

Politics Get Weird, Markets Don’t Care

A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag.

Read More »

Read More »

FX Daily, September 4: Markets Look for more Solid Footing, but Need to Get Passed US Jobs Data

The dramatic sell-off of US shares yesterday is the main focus, capturing the limelight from other forces, including today's US employment report. It was the third-worst session for the S&P 500 since the March 23 bottom, and the other two did not see follow-through selling.

Read More »

Read More »

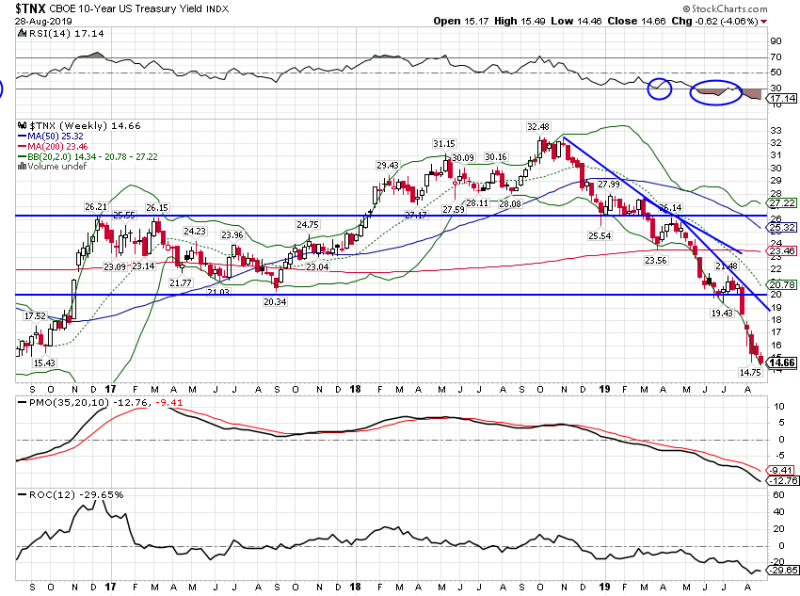

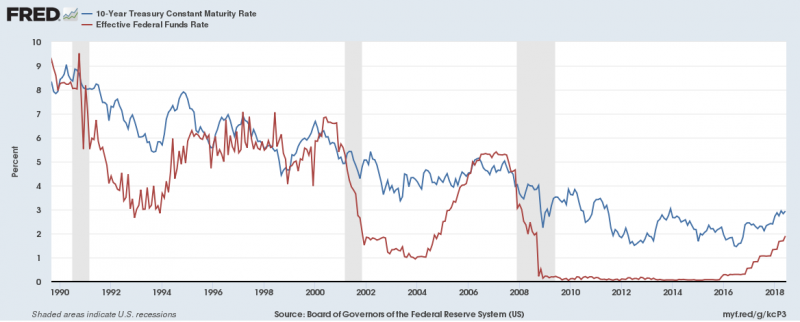

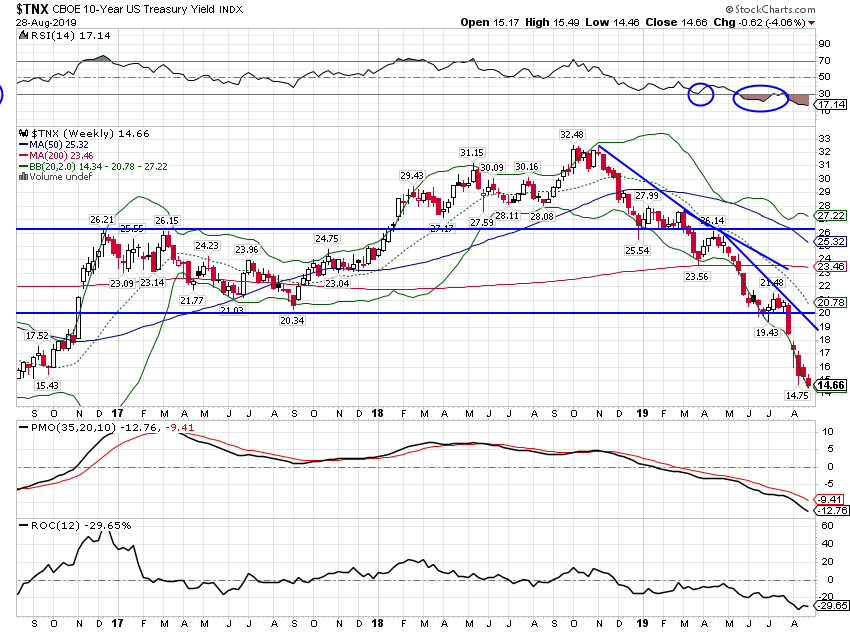

Monthly Macro Monitor: Market Indicators Review

The Treasury market continues to price in lower nominal and real growth. The stress, the urgency, I see in some of these markets is certainly concerning and consistent with what we have seen in the past at the onset of recession. The move in Treasuries is by some measures, as extreme as the fall of 2008 when we were in a full blown panic.

Read More »

Read More »

FX Daily, May 16: US Struggles to Strike a Less Strident Tone

Overview: Retail sales and industrial production disappointed in both the US and China prior to the end of the tariff truce, declared by the US in a series of presidential tweets on May 5. The reaction function of the US to the drop in equities was to play down tensions on three fronts. First, a US team is expected to return to Beijing in the coming weeks.

Read More »

Read More »

Why China Finds it Difficult to Weaponize the Yuan and US Treasuries

It looks so easy on paper. China can sell its holding of US Treasuries and/or weaken the yuan to offset the tariffs and boost exports. It is the first and easy answers from strategists, journalists, and some academics. Often times, it is presented a novel idea; as if diplomats, investors, and policymakers have not thought it.

Read More »

Read More »

Monthly Macro Monitor: Well Worried

Don’t waste your time worrying about things that are well worried. Well worried. One of the best turns of phrase I’ve ever heard in this business that has more than its fair share of adages and idioms. It is also one of the first – and best – lessons I learned from my original mentor in this business. The things you see in the headlines, the things everyone is already worried about, aren’t usually worth fretting over.

Read More »

Read More »

FX Weekly Preview: The Week Ahead is Mostly About Digestion

The information set investors have is unlikely to substantively change in the coming days. The important macro points are known. The first part of February may be about digesting and making sense of that information rather than an incremental increase.

Read More »

Read More »

Keep Fitch’s Warning in Perspective

The global head of Fitch's sovereign ratings warned that the continued US government shutdown could jeopardize the AAA-status the rating agency grants America. It spurred little market reaction (and for good reason).

Read More »

Read More »

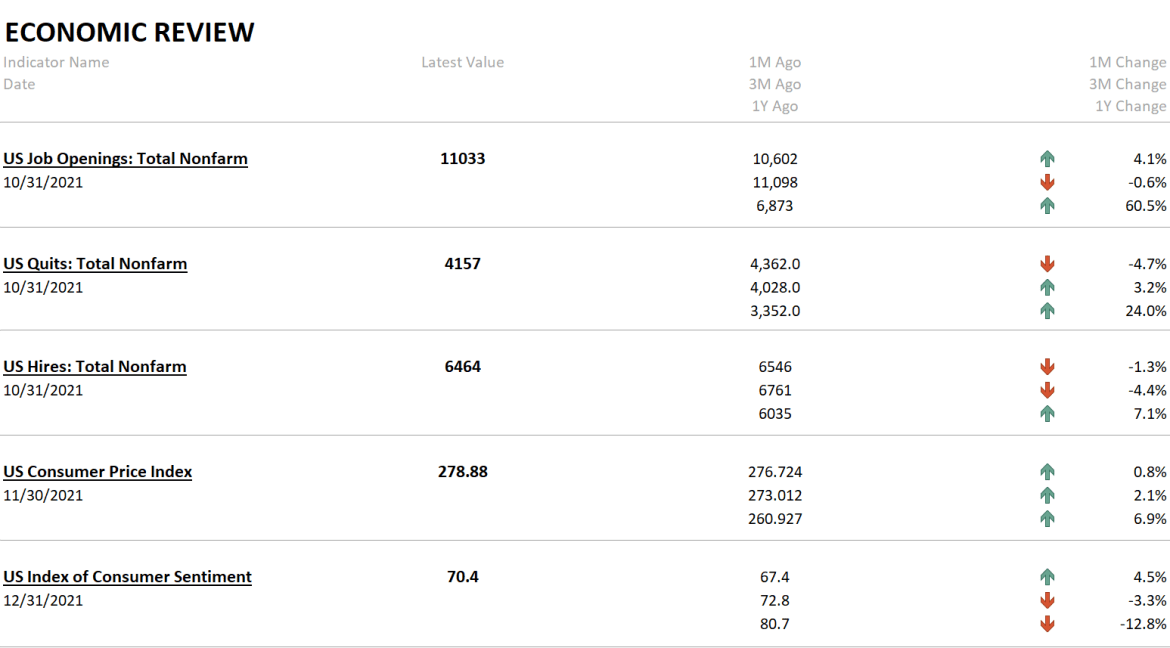

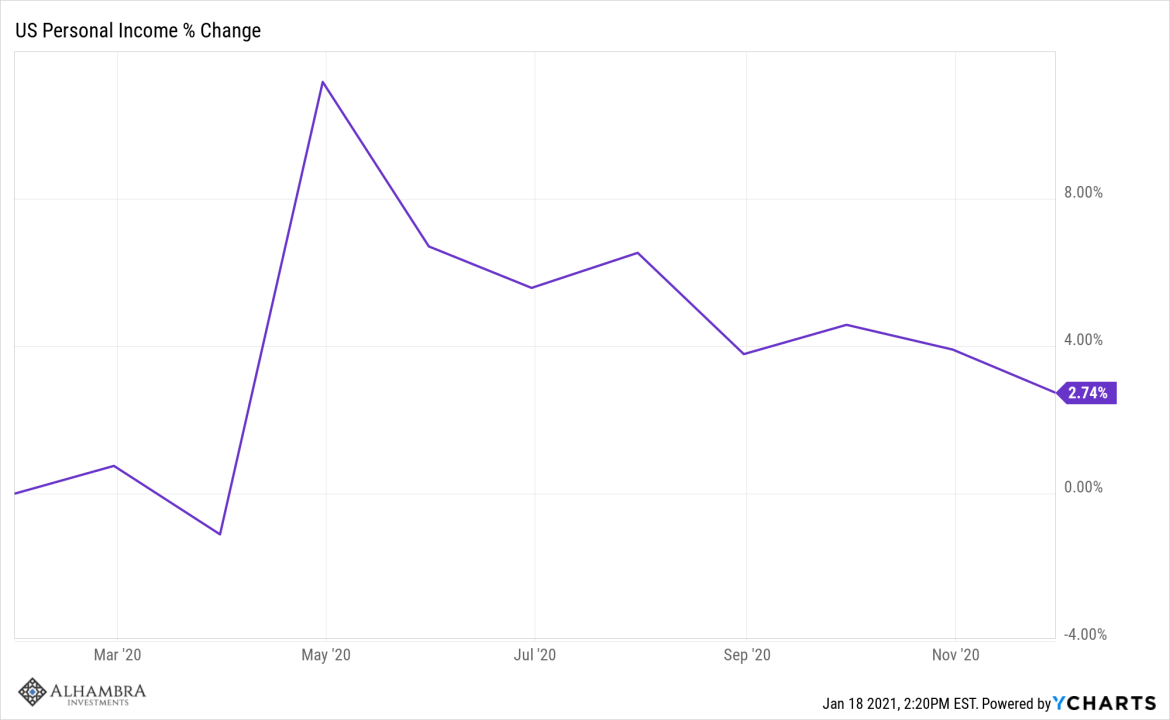

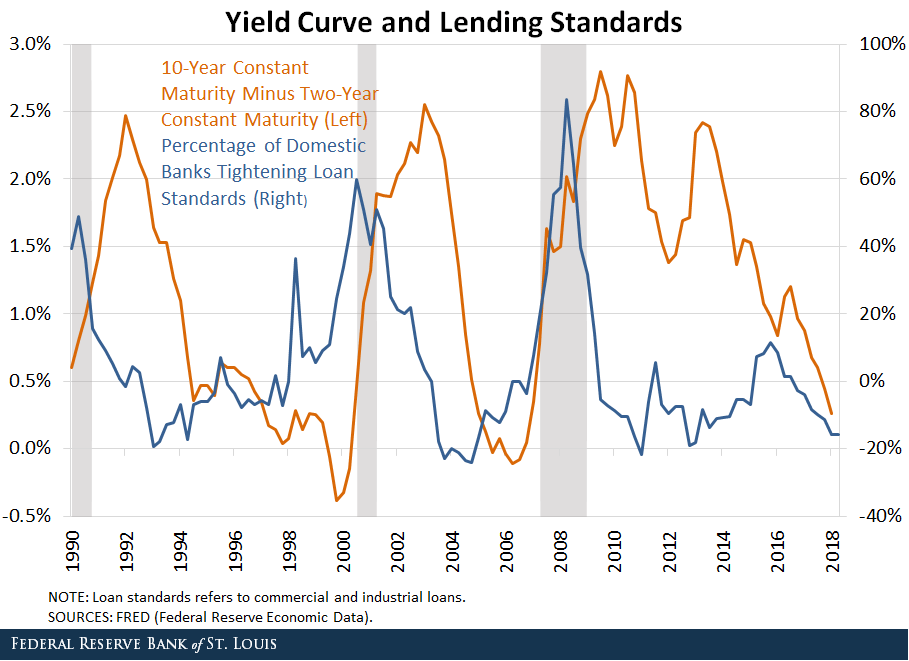

Monthly Macro Monitor – September

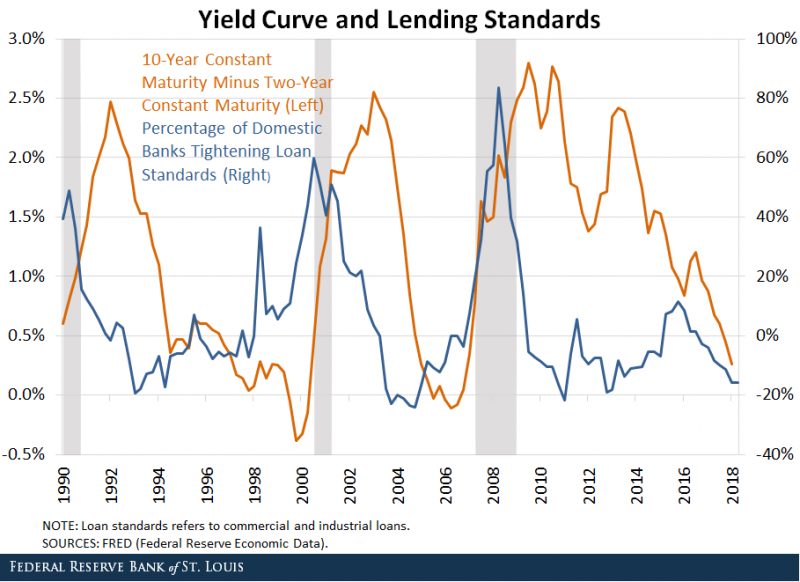

This has already been one of the longest economic expansions on record for the US and there is little in the data or markets to indicate that is about to come to an end. Current levels of the yield curve are comparable to late 2005 in the last cycle. It was almost two years later before we even had an inkling of a problem and even in the summer of 2008 – nearly three years later – there was still a robust debate about whether the US could avoid...

Read More »

Read More »

Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month.

Read More »

Read More »

Central Bank Investment Strategies

A survey of central banks and sovereign wealth funds by Invesco sheds light on their investment plans. The traditional separation of markets and the state may be helpful for ideological arguments, but the real situation is more complicated. Central banks and their investment vehicles (sovereign wealth funds) are market participants. In some activities, such as custodian, central banks compete with the private sector.

Read More »

Read More »

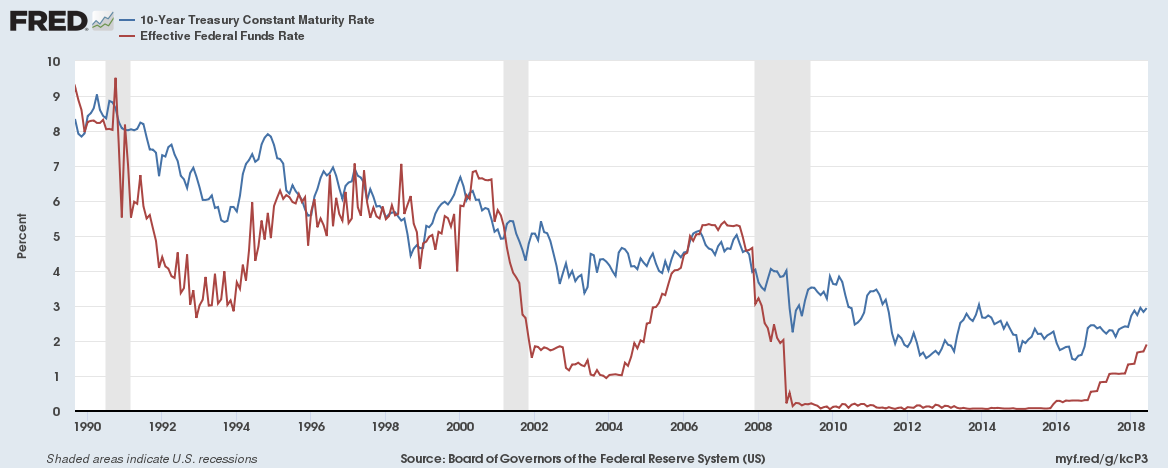

Bi-Weekly Economic Review

Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility.

There has been for some time now a large short position held by speculators in the futures market for Treasuries.

Read More »

Read More »

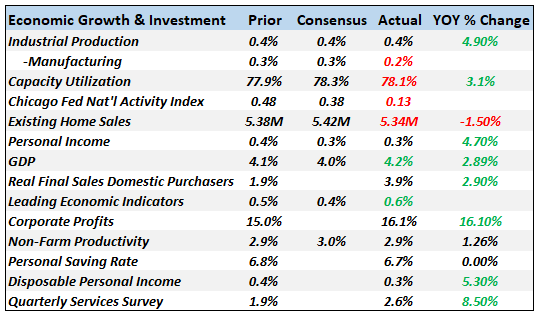

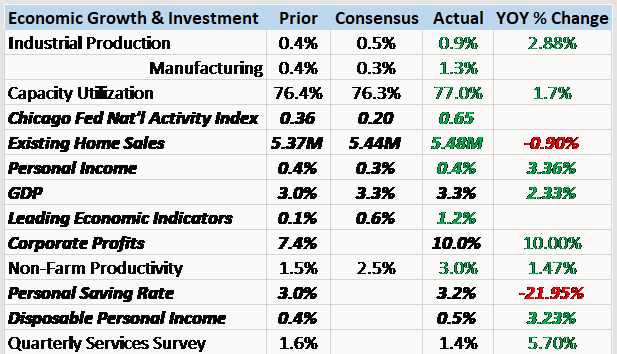

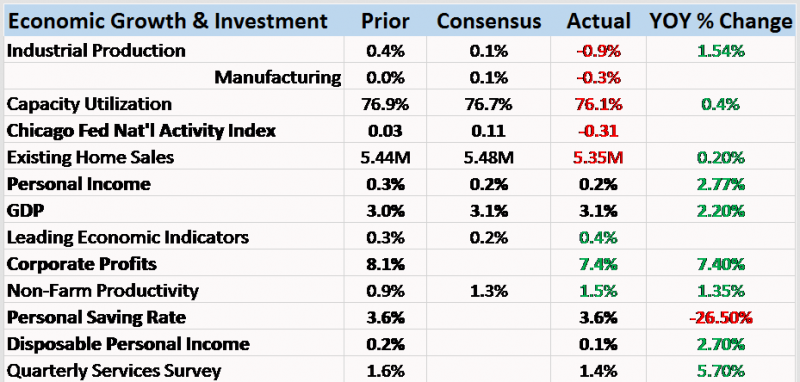

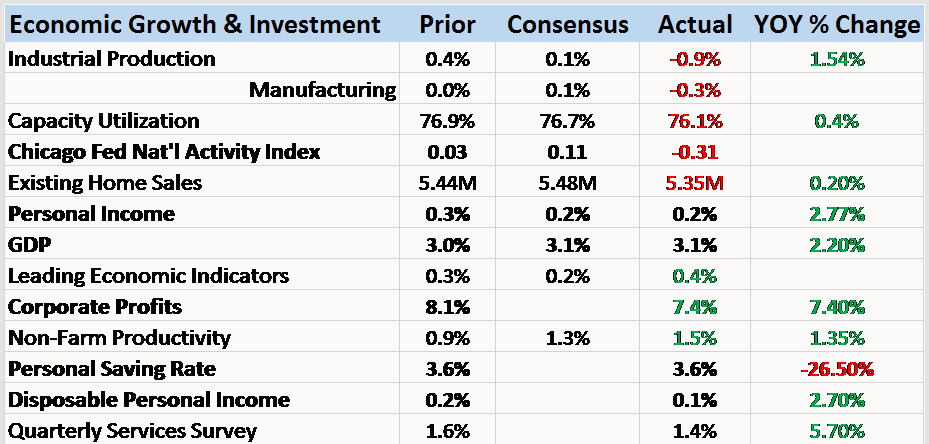

Bi-Weekly Economic Review: As Good As It Gets?

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not.

Read More »

Read More »

Bi-Weekly Economic Review: Who You Gonna Believe?

We’ve had a pretty good run of data recently and with the tax bill passing the Senate one would expect to see markets react positively, to reflect renewed optimism about economic growth. We have improving economic data on pretty much a global basis. It isn’t a boom by any stretch of the imagination but there is no doubt that the rate of change has recently been more positive.

Read More »

Read More »

Bi-Weekly Economic Review: Maximum Optimism?

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady stream of all time highs, bond...

Read More »

Read More »

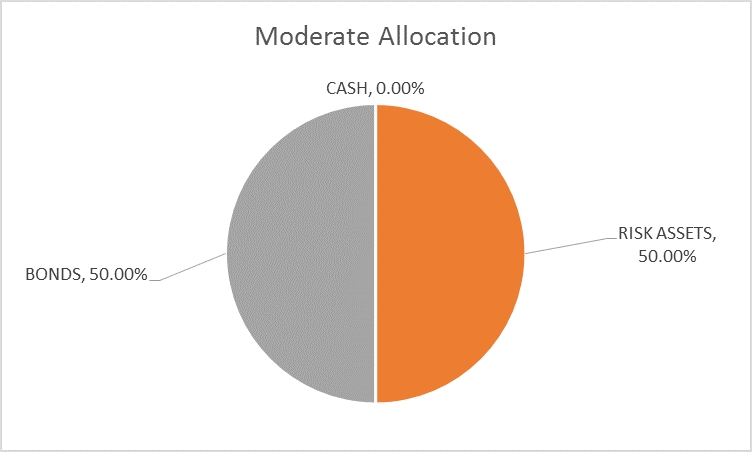

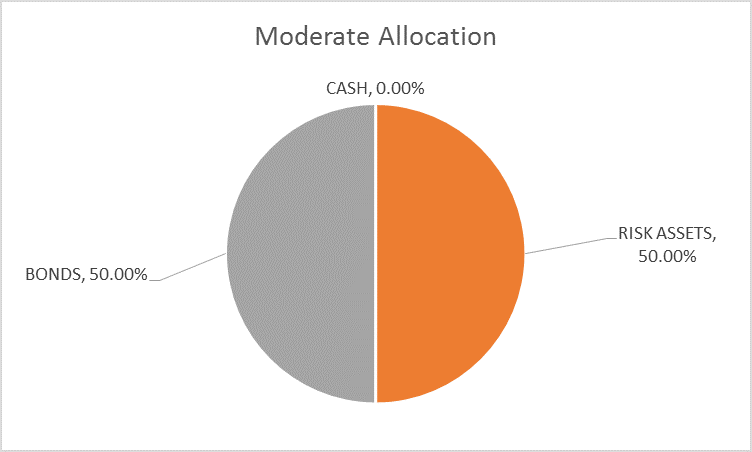

Global Asset Allocation Update: Step Away From The Portfolio

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a different hymnal.

Read More »

Read More »